Question: for the multiple choice, please show all the works Indicate whether each statement is true or false. An individual's status as an investor is generally

for the multiple choice, please show all the works

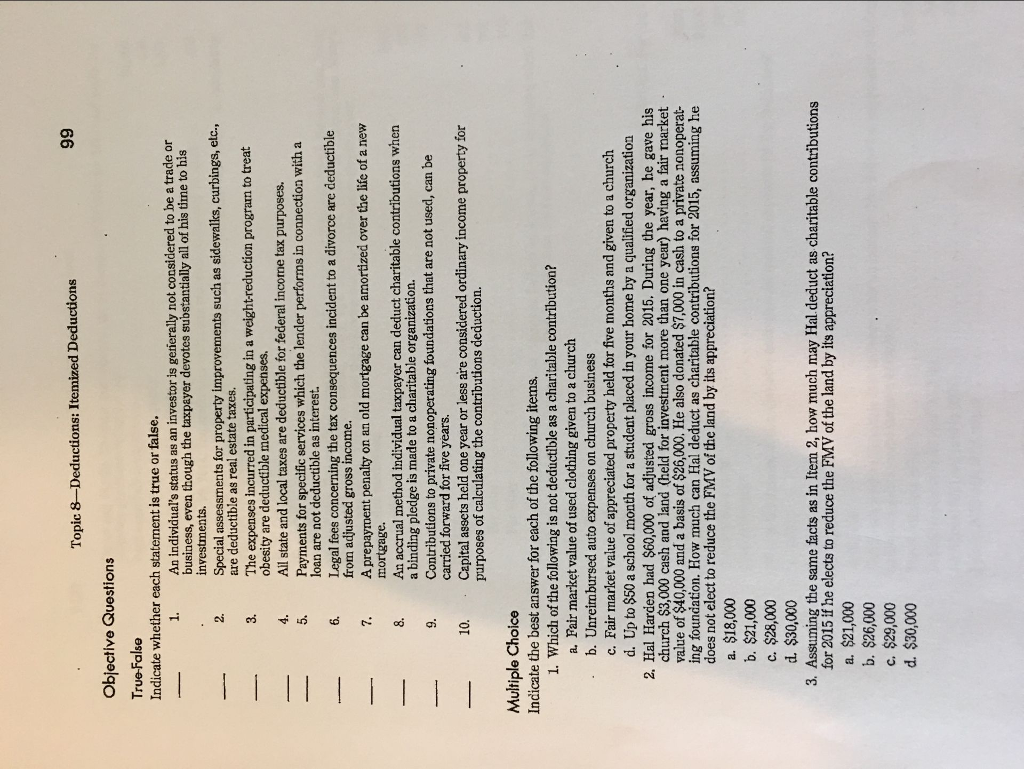

Indicate whether each statement is true or false. An individual's status as an investor is generally not considered to be a trade or business, even though the taxpayer devotes substantially all of his time to his investments. Special assessments for property improvements such as sidewalks, curbings, elc., are deductible as real estate taxes. The expenses Incurred in participating in a weight-reduction program to treat obesity are deductible medical expenses. All state and local taxes are deductible for federal income tax purposes. Payments for specific services which the lender performs in connection with a loan are not deductible as interest. Legal fees concerning the tax consequences incident to a divorce are deductible from adjusted gross income. A prepayment penalty on an old mortgage can be amortized over the life of a new mortgage. An accrual method individual taxpayer can deduct charitable contributions when a binding pledge is made to a charitable organization. Contributions to private nonoperating? foundations that are not used, can be carried forward for five years. Capital assets held one year or less are considered ordinary income property for purposes of calculating the contributions deduction. Indicate the best answer for each of the following items. Which of the following is not deductible as a charitable contribution? a. Fair market value of used clothing given to a church b. Unreimbursed auto expenses on church business c. Fair market value of appreciated property held for five months and given to a church d. Up to $50 a school month for a student placed in your home by a qualified organization Hal Harden had $60,000 of adjusted gross income for 2015. During the year, he gave his church $3,000 cash and land (held for investment more than one year) having a fair market middot value of $40,000 and a basis of $26,000. He also donated $7,000 in cash to a private nonoperating foundation. How much can Hal deduct as charitable contributions for 2015, assuming he does not elect to reduce the FMV of the land by its appreciation? a. $18,000 b. $21,000 c. $28,000 d. $30,000 Assuming the same facts as in Item 2, how much may Hal deduct as charitable contributions for 2015 if he elects to reduce the FMV of the land by its appreciation? a. $21,000 b. $26,000 c. $29,000 d. $30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts