Question: For the next 9 questions, please use the information below: Paul Gordon and his wife, Maxine, are in their mid-forties. They live in an upper

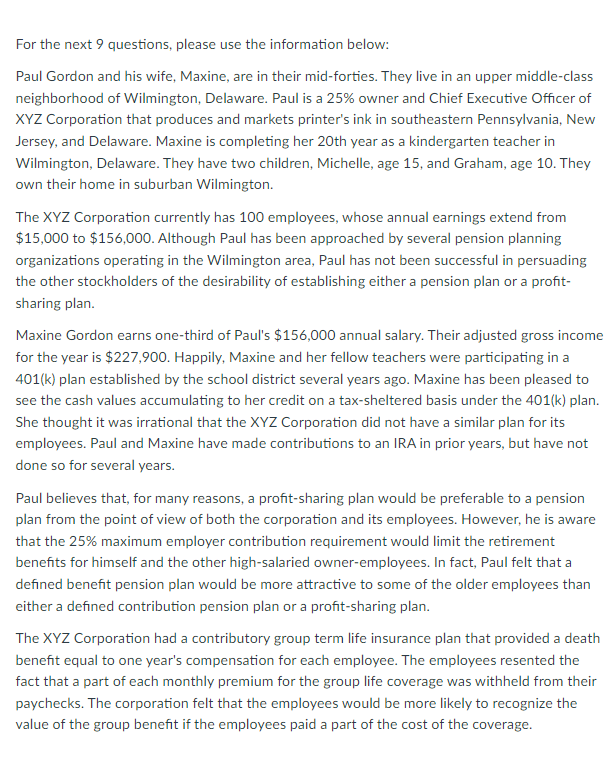

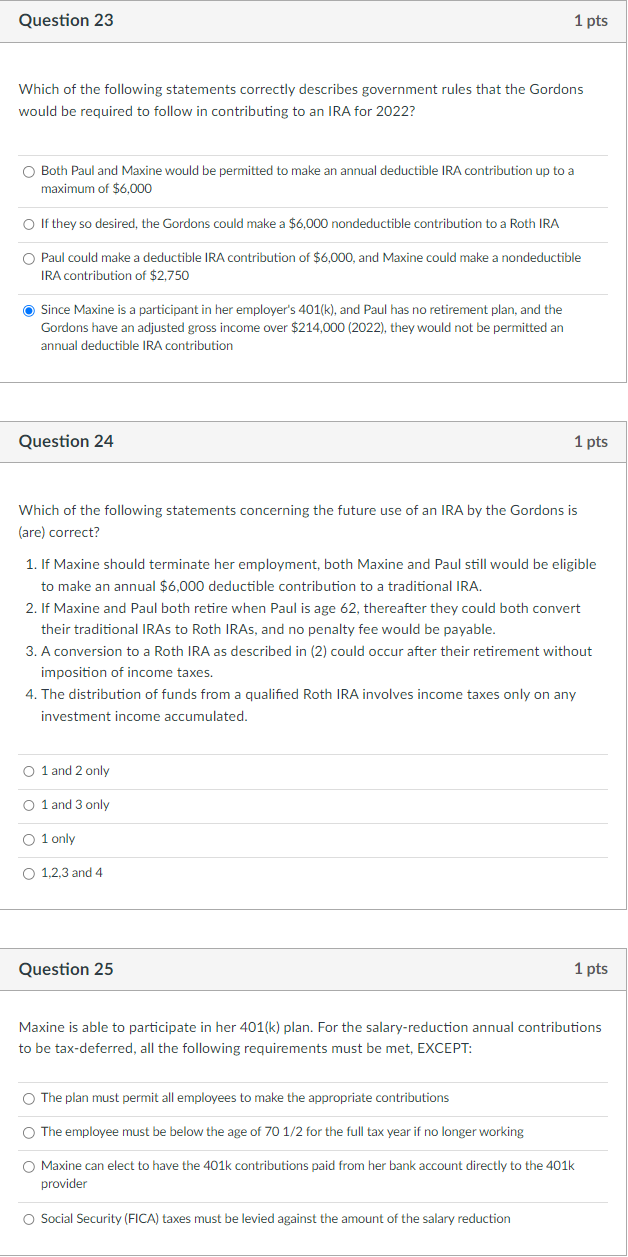

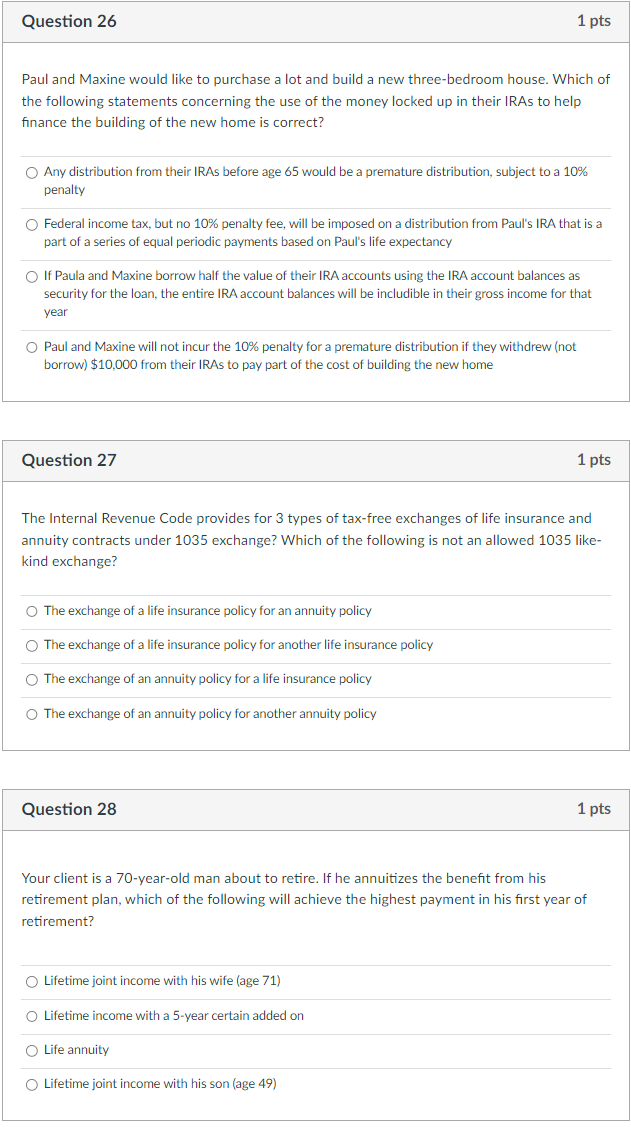

For the next 9 questions, please use the information below: Paul Gordon and his wife, Maxine, are in their mid-forties. They live in an upper middle-class neighborhood of Wilmington, Delaware. Paul is a 25% owner and Chief Executive Officer of XYZ Corporation that produces and markets printer's ink in southeastern Pennsylvania, New Jersey, and Delaware. Maxine is completing her 20th year as a kindergarten teacher in Wilmington, Delaware. They have two children, Michelle, age 15, and Graham, age 10. They own their home in suburban Wilmington. The XYZ Corporation currently has 100 employees, whose annual earnings extend from $15,000 to $156,000. Although Paul has been approached by several pension planning organizations operating in the Wilmington area, Paul has not been successful in persuading the other stockholders of the desirability of establishing either a pension plan or a profitsharing plan. Maxine Gordon earns one-third of Paul's $156,000 annual salary. Their adjusted gross income for the year is $227,900. Happily, Maxine and her fellow teachers were participating in a 401(k) plan established by the school district several years ago. Maxine has been pleased to see the cash values accumulating to her credit on a tax-sheltered basis under the 401(k) plan. She thought it was irrational that the XYZ Corporation did not have a similar plan for its employees. Paul and Maxine have made contributions to an IRA in prior years, but have not done so for several years. Paul believes that, for many reasons, a profit-sharing plan would be preferable to a pension plan from the point of view of both the corporation and its employees. However, he is aware that the 25% maximum employer contribution requirement would limit the retirement benefits for himself and the other high-salaried owner-employees. In fact, Paul felt that a defined benefit pension plan would be more attractive to some of the older employees than either a defined contribution pension plan or a profit-sharing plan. The XYZ Corporation had a contributory group term life insurance plan that provided a death benefit equal to one year's compensation for each employee. The employees resented the fact that a part of each monthly premium for the group life coverage was withheld from their paychecks. The corporation felt that the employees would be more likely to recognize the value of the group benefit if the employees paid a part of the cost of the coverage. Which of the following statements correctly describes government rules that the Gordons would be required to follow in contributing to an IRA for 2022 ? Both Paul and Maxine would be permitted to make an annual deductible IRA contribution up to a maximum of $6,000 If they so desired, the Gordons could make a $6,000 nondeductible contribution to a Roth IRA Paul could make a deductible IRA contribution of $6,000, and Maxine could make a nondeductible IRA contribution of $2,750 Since Maxine is a participant in her employer's 401(k), and Paul has no retirement plan, and the Gordons have an adjusted gross income over $214,000 (2022), they would not be permitted an annual deductible IRA contribution Question 24 1 pts Which of the following statements concerning the future use of an IRA by the Gordons is (are) correct? 1. If Maxine should terminate her employment, both Maxine and Paul still would be eligible to make an annual $6,000 deductible contribution to a traditional IRA. 2. If Maxine and Paul both retire when Paul is age 62 , thereafter they could both convert their traditional IRAs to Roth IRAs, and no penalty fee would be payable. 3. A conversion to a Roth IRA as described in (2) could occur after their retirement without imposition of income taxes. 4. The distribution of funds from a qualified Roth IRA involves income taxes only on any investment income accumulated. Question 25 1 pts Maxine is able to participate in her 401(k) plan. For the salary-reduction annual contributions to be tax-deferred, all the following requirements must be met, EXCEPT: The plan must permit all employees to make the appropriate contributions The employee must be below the age of 701/2 for the full tax year if no longer working Maxine can elect to have the 401k contributions paid from her bank account directly to the 401k provider Social Security (FICA) taxes must be levied against the amount of the salary reduction Paul and Maxine would like to purchase a lot and build a new three-bedroom house. Which of the following statements concerning the use of the money locked up in their IRAs to help finance the building of the new home is correct? Any distribution from their IRAs before age 65 would be a premature distribution, subject to a 10% penalty Federal income tax, but no 10% penalty fee, will be imposed on a distribution from Paul's IRA that is a part of a series of equal periodic payments based on Paul's life expectancy If Paula and Maxine borrow half the value of their IRA accounts using the IRA account balances as security for the loan, the entire IRA account balances will be includible in their gross income for that year Paul and Maxine will not incur the 10% penalty for a premature distribution if they withdrew (not borrow) $10,000 from their IRAs to pay part of the cost of building the new home Question 27 1pts The Internal Revenue Code provides for 3 types of tax-free exchanges of life insurance and annuity contracts under 1035 exchange? Which of the following is not an allowed 1035 likekind exchange? The exchange of a life insurance policy for an annuity policy The exchange of a life insurance policy for another life insurance policy The exchange of an annuity policy for a life insurance policy The exchange of an annuity policy for another annuity policy Question 28 1 pts Your client is a 70-year-old man about to retire. If he annuitizes the benefit from his retirement plan, which of the following will achieve the highest payment in his first year of retirement? Lifetime joint income with his wife (age 71) Lifetime income with a 5-year certain added on Life annuity Lifetime joint income with his son (age 49) For the next 9 questions, please use the information below: Paul Gordon and his wife, Maxine, are in their mid-forties. They live in an upper middle-class neighborhood of Wilmington, Delaware. Paul is a 25% owner and Chief Executive Officer of XYZ Corporation that produces and markets printer's ink in southeastern Pennsylvania, New Jersey, and Delaware. Maxine is completing her 20th year as a kindergarten teacher in Wilmington, Delaware. They have two children, Michelle, age 15, and Graham, age 10. They own their home in suburban Wilmington. The XYZ Corporation currently has 100 employees, whose annual earnings extend from $15,000 to $156,000. Although Paul has been approached by several pension planning organizations operating in the Wilmington area, Paul has not been successful in persuading the other stockholders of the desirability of establishing either a pension plan or a profitsharing plan. Maxine Gordon earns one-third of Paul's $156,000 annual salary. Their adjusted gross income for the year is $227,900. Happily, Maxine and her fellow teachers were participating in a 401(k) plan established by the school district several years ago. Maxine has been pleased to see the cash values accumulating to her credit on a tax-sheltered basis under the 401(k) plan. She thought it was irrational that the XYZ Corporation did not have a similar plan for its employees. Paul and Maxine have made contributions to an IRA in prior years, but have not done so for several years. Paul believes that, for many reasons, a profit-sharing plan would be preferable to a pension plan from the point of view of both the corporation and its employees. However, he is aware that the 25% maximum employer contribution requirement would limit the retirement benefits for himself and the other high-salaried owner-employees. In fact, Paul felt that a defined benefit pension plan would be more attractive to some of the older employees than either a defined contribution pension plan or a profit-sharing plan. The XYZ Corporation had a contributory group term life insurance plan that provided a death benefit equal to one year's compensation for each employee. The employees resented the fact that a part of each monthly premium for the group life coverage was withheld from their paychecks. The corporation felt that the employees would be more likely to recognize the value of the group benefit if the employees paid a part of the cost of the coverage. Which of the following statements correctly describes government rules that the Gordons would be required to follow in contributing to an IRA for 2022 ? Both Paul and Maxine would be permitted to make an annual deductible IRA contribution up to a maximum of $6,000 If they so desired, the Gordons could make a $6,000 nondeductible contribution to a Roth IRA Paul could make a deductible IRA contribution of $6,000, and Maxine could make a nondeductible IRA contribution of $2,750 Since Maxine is a participant in her employer's 401(k), and Paul has no retirement plan, and the Gordons have an adjusted gross income over $214,000 (2022), they would not be permitted an annual deductible IRA contribution Question 24 1 pts Which of the following statements concerning the future use of an IRA by the Gordons is (are) correct? 1. If Maxine should terminate her employment, both Maxine and Paul still would be eligible to make an annual $6,000 deductible contribution to a traditional IRA. 2. If Maxine and Paul both retire when Paul is age 62 , thereafter they could both convert their traditional IRAs to Roth IRAs, and no penalty fee would be payable. 3. A conversion to a Roth IRA as described in (2) could occur after their retirement without imposition of income taxes. 4. The distribution of funds from a qualified Roth IRA involves income taxes only on any investment income accumulated. Question 25 1 pts Maxine is able to participate in her 401(k) plan. For the salary-reduction annual contributions to be tax-deferred, all the following requirements must be met, EXCEPT: The plan must permit all employees to make the appropriate contributions The employee must be below the age of 701/2 for the full tax year if no longer working Maxine can elect to have the 401k contributions paid from her bank account directly to the 401k provider Social Security (FICA) taxes must be levied against the amount of the salary reduction Paul and Maxine would like to purchase a lot and build a new three-bedroom house. Which of the following statements concerning the use of the money locked up in their IRAs to help finance the building of the new home is correct? Any distribution from their IRAs before age 65 would be a premature distribution, subject to a 10% penalty Federal income tax, but no 10% penalty fee, will be imposed on a distribution from Paul's IRA that is a part of a series of equal periodic payments based on Paul's life expectancy If Paula and Maxine borrow half the value of their IRA accounts using the IRA account balances as security for the loan, the entire IRA account balances will be includible in their gross income for that year Paul and Maxine will not incur the 10% penalty for a premature distribution if they withdrew (not borrow) $10,000 from their IRAs to pay part of the cost of building the new home Question 27 1pts The Internal Revenue Code provides for 3 types of tax-free exchanges of life insurance and annuity contracts under 1035 exchange? Which of the following is not an allowed 1035 likekind exchange? The exchange of a life insurance policy for an annuity policy The exchange of a life insurance policy for another life insurance policy The exchange of an annuity policy for a life insurance policy The exchange of an annuity policy for another annuity policy Question 28 1 pts Your client is a 70-year-old man about to retire. If he annuitizes the benefit from his retirement plan, which of the following will achieve the highest payment in his first year of retirement? Lifetime joint income with his wife (age 71) Lifetime income with a 5-year certain added on Life annuity Lifetime joint income with his son (age 49)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts