Question: For the next two problems, please use the following information: Suppose New Era Caps is considering purchasing a machine to attach the brims at the

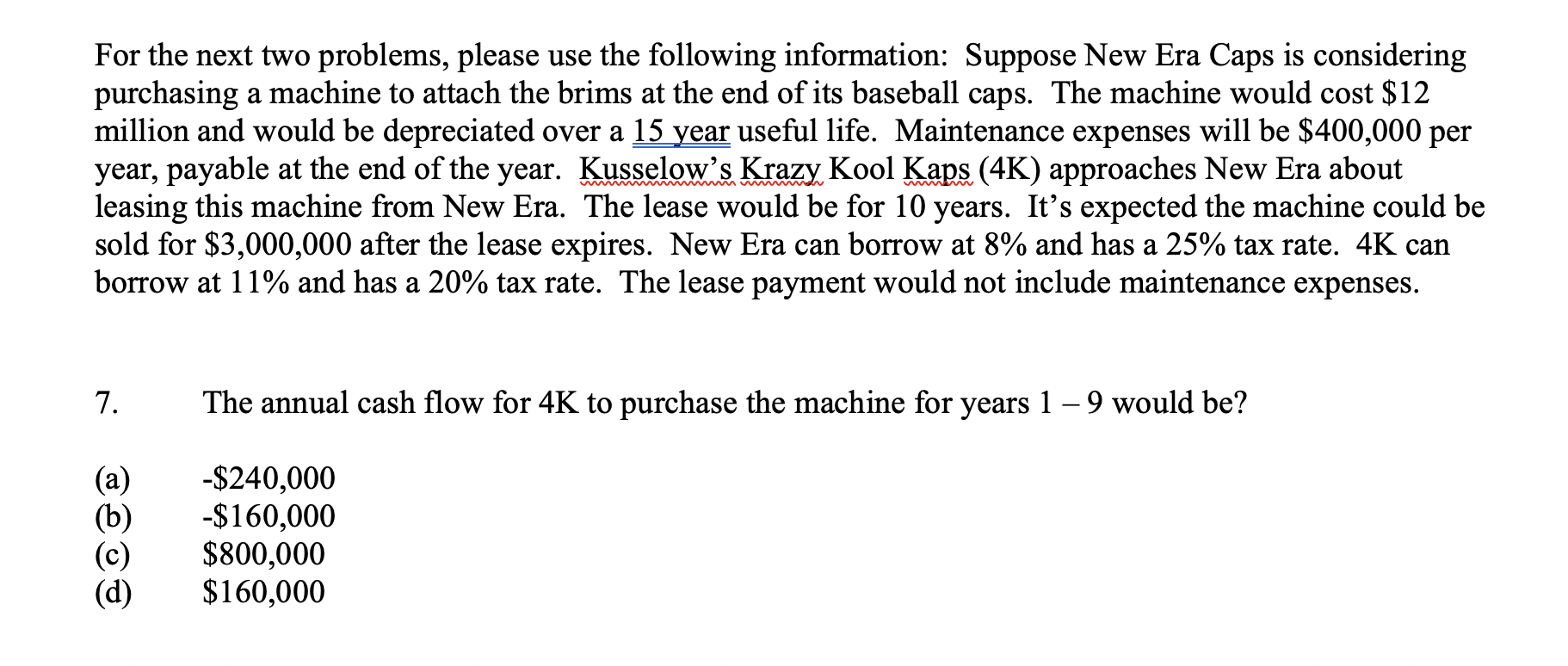

For the next two problems, please use the following information: Suppose New Era Caps is considering purchasing a machine to attach the brims at the end of its baseball caps. The machine would cost $12 million and would be depreciated over a 15 year useful life. Maintenance expenses will be $400,000 per year, payable at the end of the year. Kusselow's Krazy Kool Kaps (4K) approaches New Era about leasing this machine from New Era. The lease would be for 10 years. It's expected the machine could be sold for $3,000,000 after the lease expires. New Era can borrow at 8% and has a 25% tax rate. 4K can borrow at 11% and has a 20% tax rate. The lease payment would not include maintenance expenses. 7. The annual cash flow for 4K to purchase the machine for years 1 - 9 would be? (a) (b) (c) (d) -$240,000 -$160,000 $800,000 $160,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts