Question: For the problems 3 & 4 use the following steps a c to compute the gross-up amount: a. Compute tax rate: The tax rate on

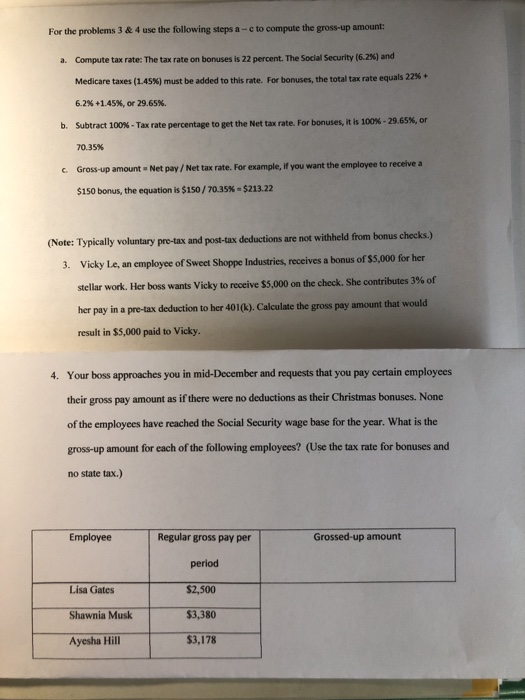

For the problems 3 & 4 use the following steps a c to compute the gross-up amount: a. Compute tax rate: The tax rate on bonuses is 22 percent. The Social Security (6.2%) and Medicare taxes (1.45%) must be added to this rate. For bonuses, the total tax rate equals 22% 6.2% +1.45%, or 29.65% b. Subtract 100% - Tax rate percentage to get the Net tax rate. For bonuses, it is 100% - 29.65%, or 70.35% Gross-up amount Net pay/Net tax rate. For example, if you want the employee to receive a $150 bonus, the equation is $150/70-35% - $213.22 (Note: Typically voluntary pre-tax and post-tax deductions are not withheld from bonus checks.) 3. Vicky Le, an employee of Sweet Shoppe Industries, receives a bonus of $5,000 for her stellar work. Her boss wants Vicky to receive 55,000 on the check. She contributes 3% of her pay in a pre-tax deduction to her 401(k). Calculate the gross pay amount that would result in $5,000 paid to Vicky. 4. Your boss approaches you in mid-December and requests that you pay certain employees their gross pay amount as if there were no deductions as their Christmas bonuses. None of the employees have reached the Social Security wage base for the year. What is the gross-up amount for each of the following employees? (Use the tax rate for bonuses and no state tax.) Employee Regular gross pay per Grossed-up amount period Lisa Gates $2,500 Shawnia Musk $3,380 Ayesha Hill $3,178

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts