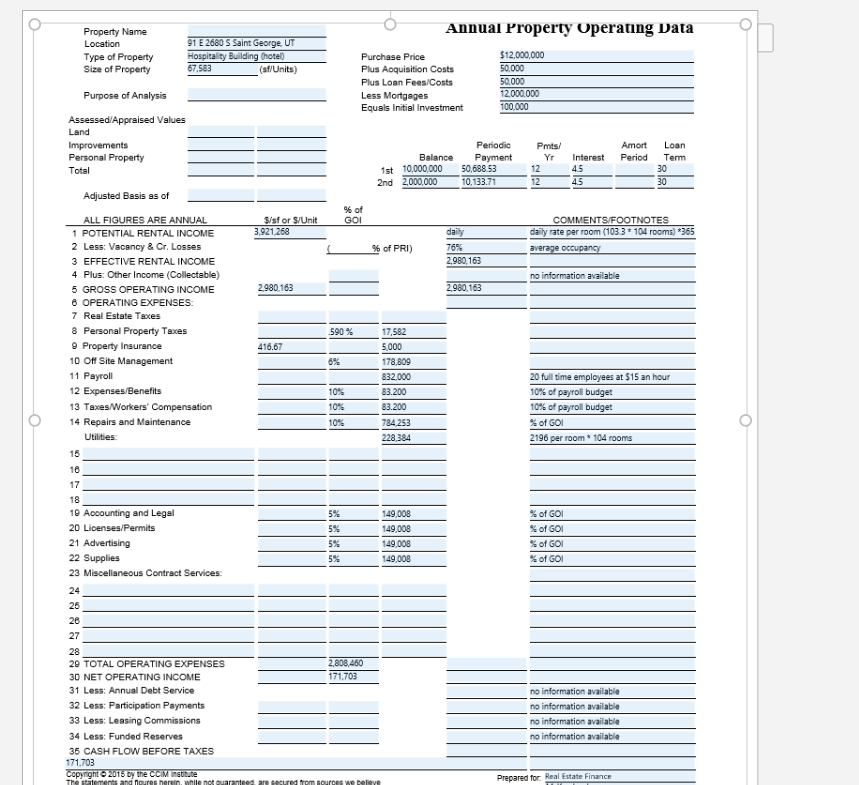

Question: For the property completed the APOD form (seen below), build a five year pro-forma with the following assumptions: Lease rates escalate 2% per year Operating

For the property completed the APOD form (seen below), build a five year pro-forma with the following assumptions:

- Lease rates escalate 2% per year

- Operating expenses increase 2% per year

- Vacancy rates are 7.5% per year

Annual Property Operating Data Property Name Location Type of Property Size of Property 91 E 2680 S Saint George UT Hospitality Building thotel 67,583 (sf/Units) Purchase Price Plus Acquisition Costs Plus Loan Fees/Costs Less Mortgages Equals Initial Investment $12,000,000 50,000 50.000 12.000.000 100,000 Purpose of Analysis Assessed/Appraised Values Land Improvements Personal Property Total Amort Period Pmts/ Yr 12 Balance 1st 10,000,000 2nd 2,000,000 Interest Periodic Payment 50,688.53 10,133.71 Loan Term 30 Adjusted Basis as of % of GOL $/sf or S/Unit 3,921,268 daily 76% COMMENTS/FOOTNOTES daily rate per room (1033* 104 rooms) *365 average occupancy % of PRI) 2980.163 no information available 2.980.163 2.980.163 ALL FIGURES ARE ANNUAL 1 POTENTIAL RENTAL INCOME 2 Less: Vacancy & Cr. Losses 3 EFFECTIVE RENTAL INCOME 4 Plus: Other Income (Collectable) 5 GROSS OPERATING INCOME 8 OPERATING EXPENSES 7 Real Estate Taxes 8 Personal Property Taxes 9 Property Insurance 10 Off Site Management 11 Payroll 12 Expenses/Benefits 13 Taxes/Workers' Compensation 14 Repairs and Maintenance Utilities: 17,582 5.000 178,809 832.000 83.200 83.200 784,253 228.384 10% 10% 20 full time emplovees at $15 an hour 10% of payroll budget 10% of payroll budget of GOI 2196 per room 104 rooms 19 Accounting and Legal 20 Licenses/Permits 21 Advertising 22 Supplies 23 Miscellaneous Contract Services: 149,008 149.008 149,008 149,008 % of GOI % of GOI of GOI of GOI 5% 2.808.460 29 TOTAL OPERATING EXPENSES 30 NET OPERATING INCOME 31 Less: Annual Debt Service 32 Less: Participation Payments 33 Less: Leasing Commissions 34 Less: Funded Reserves 36 CASH FLOW BEFORE TAXES 171.703 Copyright 2015 by the CCI nstitute The statements and roures herein, while not guaranteed are secured to no information available no information available no information available no information available ourne Prepared for Real Estate Finance Annual Property Operating Data Property Name Location Type of Property Size of Property 91 E 2680 S Saint George UT Hospitality Building thotel 67,583 (sf/Units) Purchase Price Plus Acquisition Costs Plus Loan Fees/Costs Less Mortgages Equals Initial Investment $12,000,000 50,000 50.000 12.000.000 100,000 Purpose of Analysis Assessed/Appraised Values Land Improvements Personal Property Total Amort Period Pmts/ Yr 12 Balance 1st 10,000,000 2nd 2,000,000 Interest Periodic Payment 50,688.53 10,133.71 Loan Term 30 Adjusted Basis as of % of GOL $/sf or S/Unit 3,921,268 daily 76% COMMENTS/FOOTNOTES daily rate per room (1033* 104 rooms) *365 average occupancy % of PRI) 2980.163 no information available 2.980.163 2.980.163 ALL FIGURES ARE ANNUAL 1 POTENTIAL RENTAL INCOME 2 Less: Vacancy & Cr. Losses 3 EFFECTIVE RENTAL INCOME 4 Plus: Other Income (Collectable) 5 GROSS OPERATING INCOME 8 OPERATING EXPENSES 7 Real Estate Taxes 8 Personal Property Taxes 9 Property Insurance 10 Off Site Management 11 Payroll 12 Expenses/Benefits 13 Taxes/Workers' Compensation 14 Repairs and Maintenance Utilities: 17,582 5.000 178,809 832.000 83.200 83.200 784,253 228.384 10% 10% 20 full time emplovees at $15 an hour 10% of payroll budget 10% of payroll budget of GOI 2196 per room 104 rooms 19 Accounting and Legal 20 Licenses/Permits 21 Advertising 22 Supplies 23 Miscellaneous Contract Services: 149,008 149.008 149,008 149,008 % of GOI % of GOI of GOI of GOI 5% 2.808.460 29 TOTAL OPERATING EXPENSES 30 NET OPERATING INCOME 31 Less: Annual Debt Service 32 Less: Participation Payments 33 Less: Leasing Commissions 34 Less: Funded Reserves 36 CASH FLOW BEFORE TAXES 171.703 Copyright 2015 by the CCI nstitute The statements and roures herein, while not guaranteed are secured to no information available no information available no information available no information available ourne Prepared for Real Estate Finance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts