Question: For the reservoir with 4 wells provided in Problem Set-1, two new field development plans for the next 10 years are considered, namely: Production

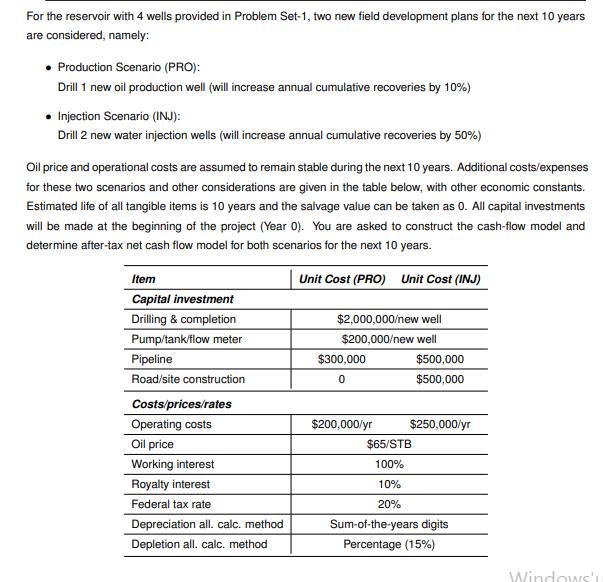

For the reservoir with 4 wells provided in Problem Set-1, two new field development plans for the next 10 years are considered, namely: Production Scenario (PRO): Drill 1 new oil production well (will increase annual cumulative recoveries by 10%) Injection Scenario (INJ): Drill 2 new water injection wells (will increase annual cumulative recoveries by 50%) Oil price and operational costs are assumed to remain stable during the next 10 years. Additional costs/expenses for these two scenarios and other considerations are given in the table below, with other economic constants. Estimated life of all tangible items is 10 years and the salvage value can be taken as 0. All capital investments will be made at the beginning of the project (Year 0). You are asked to construct the cash-flow model and determine after-tax net cash flow model for both scenarios for the next 10 years. Unit Cost (PRO) Unit Cost (INJ) Item Capital investment Drilling & completion Pump/tank/flow meter Pipeline Road/site construction Costs/prices/rates Operating costs Oil price Working interest Royalty interest Federal tax rate Depreciation all. calc. method Depletion all, calc. method $2,000,000/new well $200,000/new well $300,000 0 $200,000/yr $500,000 $500,000 $250,000/yr $65/STB 100% 10% 20% Sum-of-the-years digits Percentage (15%) Windows'

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Solution Let V N o2 From the lectures the mgf of the Gaussian random variable V is given ... View full answer

Get step-by-step solutions from verified subject matter experts