Question: For the second part of the Exam, develop an Excel spreadsheet with clearly marked sections to answer each of the following questions using the

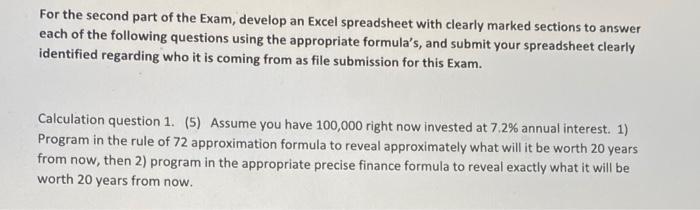

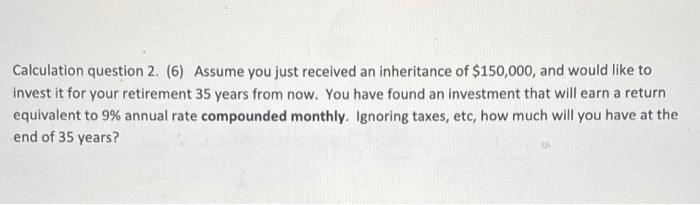

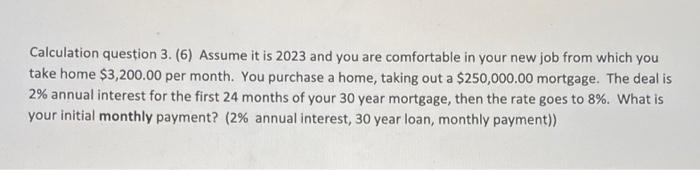

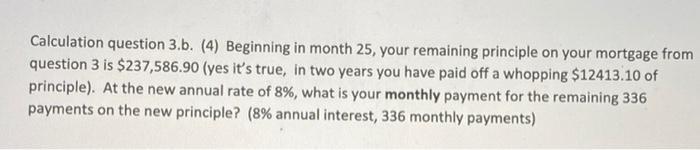

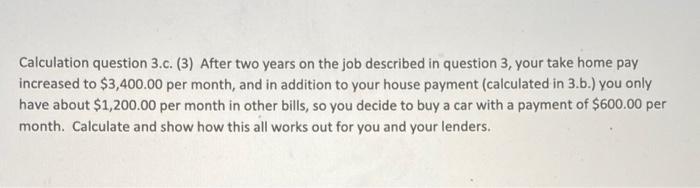

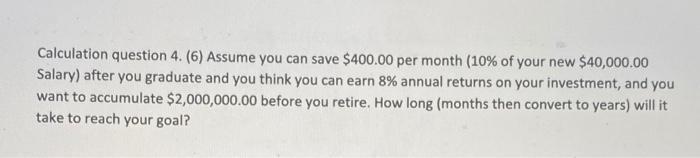

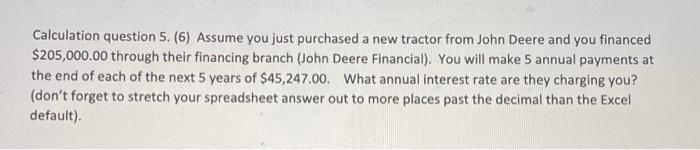

For the second part of the Exam, develop an Excel spreadsheet with clearly marked sections to answer each of the following questions using the appropriate formula's, and submit your spreadsheet clearly identified regarding who it is coming from as file submission for this Exam. Calculation question 1. (5) Assume you have 100,000 right now invested at 7.2% annual interest. 1) Program in the rule of 72 approximation formula to reveal approximately what will it be worth 20 years from now, then 2) program in the appropriate precise finance formula to reveal exactly what it will be worth 20 years from now. Calculation question 2. (6) Assume you just received an inheritance of $150,000, and would like to invest it for your retirement 35 years from now. You have found an investment that will earn a return equivalent to 9% annual rate compounded monthly. Ignoring taxes, etc, how much will you have at the end of 35 years? Calculation question 3. (6) Assume it is 2023 and you are comfortable in your new job from which you take home $3,200.00 per month. You purchase a home, taking out a $250,000.00 mortgage. The deal is 2% annual interest for the first 24 months of your 30 year mortgage, then the rate goes to 8%. What is your initial monthly payment? (2% annual interest, 30 year loan, monthly payment)) Calculation question 3.b. (4) Beginning in month 25, your remaining principle on your mortgage from question 3 is $237,586.90 (yes it's true, in two years you have paid off a whopping $12413.10 of principle). At the new annual rate of 8%, what is your monthly payment for the remaining 336 payments on the new principle? (8% annual interest, 336 monthly payments) Calculation question 3.c. (3) After two years on the job described in question 3, your take home pay increased to $3,400.00 per month, and in addition to your house payment (calculated in 3.b.) you only have about $1,200.00 per month in other bills, so you decide to buy a car with a payment of $600.00 per month. Calculate and show how this all works out for you and your lenders. Calculation question 4. (6) Assume you can save $400.00 per month (10 % of your new $40,000.00 Salary) after you graduate and you think you can earn 8% annual returns on your investment, and you want to accumulate $2,000,000.00 before you retire. How long (months then convert to years) will it take to reach your goal? Calculation question 5. (6) Assume you just purchased a new tractor from John Deere and you financed $205,000.00 through their financing branch (John Deere Financial). You will make 5 annual payments at the end of each of the next 5 years of $45,247.00. What annual interest rate are they charging you? (don't forget to stretch your spreadsheet answer out to more places past the decimal than the Excel default). For the second part of the Exam, develop an Excel spreadsheet with clearly marked sections to answer each of the following questions using the appropriate formula's, and submit your spreadsheet clearly identified regarding who it is coming from as file submission for this Exam. Calculation question 1. (5) Assume you have 100,000 right now invested at 7.2% annual interest. 1) Program in the rule of 72 approximation formula to reveal approximately what will it be worth 20 years from now, then 2) program in the appropriate precise finance formula to reveal exactly what it will be worth 20 years from now. Calculation question 2. (6) Assume you just received an inheritance of $150,000, and would like to invest it for your retirement 35 years from now. You have found an investment that will earn a return equivalent to 9% annual rate compounded monthly. Ignoring taxes, etc, how much will you have at the end of 35 years? Calculation question 3. (6) Assume it is 2023 and you are comfortable in your new job from which you take home $3,200.00 per month. You purchase a home, taking out a $250,000.00 mortgage. The deal is 2% annual interest for the first 24 months of your 30 year mortgage, then the rate goes to 8%. What is your initial monthly payment? (2% annual interest, 30 year loan, monthly payment)) Calculation question 3.b. (4) Beginning in month 25, your remaining principle on your mortgage from question 3 is $237,586.90 (yes it's true, in two years you have paid off a whopping $12413.10 of principle). At the new annual rate of 8%, what is your monthly payment for the remaining 336 payments on the new principle? (8% annual interest, 336 monthly payments) Calculation question 3.c. (3) After two years on the job described in question 3, your take home pay increased to $3,400.00 per month, and in addition to your house payment (calculated in 3.b.) you only have about $1,200.00 per month in other bills, so you decide to buy a car with a payment of $600.00 per month. Calculate and show how this all works out for you and your lenders. Calculation question 4. (6) Assume you can save $400.00 per month (10 % of your new $40,000.00 Salary) after you graduate and you think you can earn 8% annual returns on your investment, and you want to accumulate $2,000,000.00 before you retire. How long (months then convert to years) will it take to reach your goal? Calculation question 5. (6) Assume you just purchased a new tractor from John Deere and you financed $205,000.00 through their financing branch (John Deere Financial). You will make 5 annual payments at the end of each of the next 5 years of $45,247.00. What annual interest rate are they charging you? (don't forget to stretch your spreadsheet answer out to more places past the decimal than the Excel default). For the second part of the Exam, develop an Excel spreadsheet with clearly marked sections to answer each of the following questions using the appropriate formula's, and submit your spreadsheet clearly identified regarding who it is coming from as file submission for this Exam. Calculation question 1. (5) Assume you have 100,000 right now invested at 7.2% annual interest. 1) Program in the rule of 72 approximation formula to reveal approximately what will it be worth 20 years from now, then 2) program in the appropriate precise finance formula to reveal exactly what it will be worth 20 years from now. Calculation question 2. (6) Assume you just received an inheritance of $150,000, and would like to invest it for your retirement 35 years from now. You have found an investment that will earn a return equivalent to 9% annual rate compounded monthly. Ignoring taxes, etc, how much will you have at the end of 35 years? Calculation question 3. (6) Assume it is 2023 and you are comfortable in your new job from which you take home $3,200.00 per month. You purchase a home, taking out a $250,000.00 mortgage. The deal is 2% annual interest for the first 24 months of your 30 year mortgage, then the rate goes to 8%. What is your initial monthly payment? (2% annual interest, 30 year loan, monthly payment)) Calculation question 3.b. (4) Beginning in month 25, your remaining principle on your mortgage from question 3 is $237,586.90 (yes it's true, in two years you have paid off a whopping $12413.10 of principle). At the new annual rate of 8%, what is your monthly payment for the remaining 336 payments on the new principle? (8% annual interest, 336 monthly payments) Calculation question 3.c. (3) After two years on the job described in question 3, your take home pay increased to $3,400.00 per month, and in addition to your house payment (calculated in 3.b.) you only have about $1,200.00 per month in other bills, so you decide to buy a car with a payment of $600.00 per month. Calculate and show how this all works out for you and your lenders. Calculation question 4. (6) Assume you can save $400.00 per month (10 % of your new $40,000.00 Salary) after you graduate and you think you can earn 8% annual returns on your investment, and you want to accumulate $2,000,000.00 before you retire. How long (months then convert to years) will it take to reach your goal? Calculation question 5. (6) Assume you just purchased a new tractor from John Deere and you financed $205,000.00 through their financing branch (John Deere Financial). You will make 5 annual payments at the end of each of the next 5 years of $45,247.00. What annual interest rate are they charging you? (don't forget to stretch your spreadsheet answer out to more places past the decimal than the Excel default). For the second part of the Exam, develop an Excel spreadsheet with clearly marked sections to answer each of the following questions using the appropriate formula's, and submit your spreadsheet clearly identified regarding who it is coming from as file submission for this Exam. Calculation question 1. (5) Assume you have 100,000 right now invested at 7.2% annual interest. 1) Program in the rule of 72 approximation formula to reveal approximately what will it be worth 20 years from now, then 2) program in the appropriate precise finance formula to reveal exactly what it will be worth 20 years from now. Calculation question 2. (6) Assume you just received an inheritance of $150,000, and would like to invest it for your retirement 35 years from now. You have found an investment that will earn a return equivalent to 9% annual rate compounded monthly. Ignoring taxes, etc, how much will you have at the end of 35 years? Calculation question 3. (6) Assume it is 2023 and you are comfortable in your new job from which you take home $3,200.00 per month. You purchase a home, taking out a $250,000.00 mortgage. The deal is 2% annual interest for the first 24 months of your 30 year mortgage, then the rate goes to 8%. What is your initial monthly payment? (2% annual interest, 30 year loan, monthly payment)) Calculation question 3.b. (4) Beginning in month 25, your remaining principle on your mortgage from question 3 is $237,586.90 (yes it's true, in two years you have paid off a whopping $12413.10 of principle). At the new annual rate of 8%, what is your monthly payment for the remaining 336 payments on the new principle? (8% annual interest, 336 monthly payments) Calculation question 3.c. (3) After two years on the job described in question 3, your take home pay increased to $3,400.00 per month, and in addition to your house payment (calculated in 3.b.) you only have about $1,200.00 per month in other bills, so you decide to buy a car with a payment of $600.00 per month. Calculate and show how this all works out for you and your lenders. Calculation question 4. (6) Assume you can save $400.00 per month (10 % of your new $40,000.00 Salary) after you graduate and you think you can earn 8% annual returns on your investment, and you want to accumulate $2,000,000.00 before you retire. How long (months then convert to years) will it take to reach your goal? Calculation question 5. (6) Assume you just purchased a new tractor from John Deere and you financed $205,000.00 through their financing branch (John Deere Financial). You will make 5 annual payments at the end of each of the next 5 years of $45,247.00. What annual interest rate are they charging you? (don't forget to stretch your spreadsheet answer out to more places past the decimal than the Excel default).

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

6243e9c57a556_march30.xlsx

300 KBs Excel File