Question: For the second question from Exercise 2, how does wf= (risk of s - .2940)/ risk of s turn into (.19-.075)/.19 ? How does .2940

For the second question from Exercise 2, how does wf= (risk of s - .2940)/ risk of s turn into (.19-.075)/.19 ? How does .2940 turn into .075?

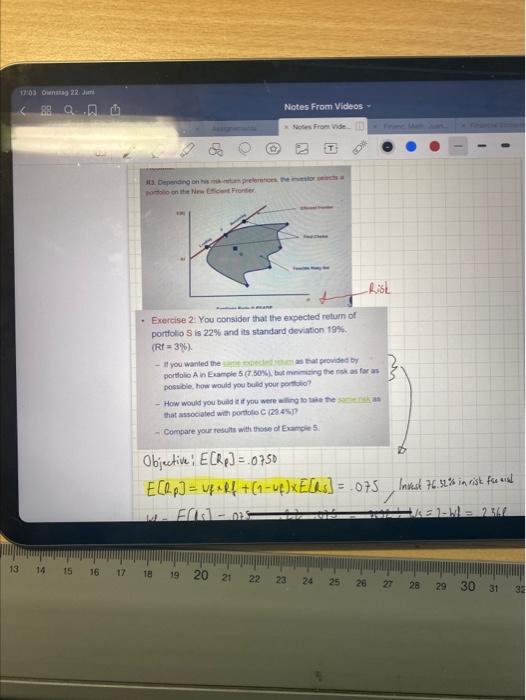

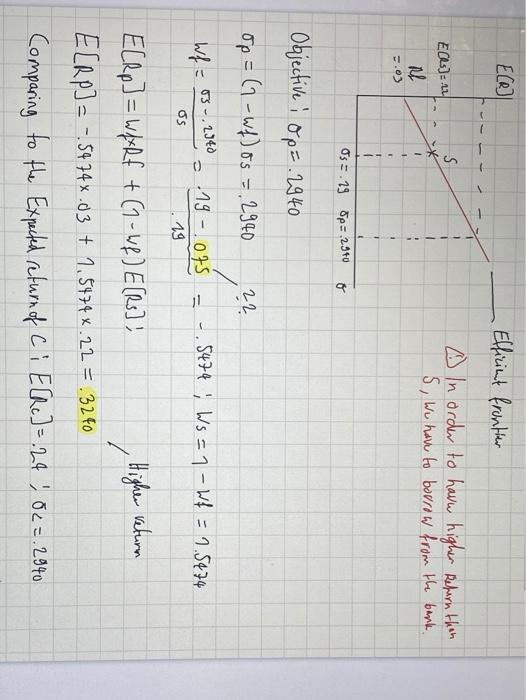

For the second question from Exercise 2, how does wf= (risk of s - .2940)/ risk of s turn into (.19-.075)/.19 ? How does .2940 turn into .075?17:03htag 22. Notes From Videos - 3. Depending a preto on the Frontier Rish - Exercise 2: You consider that the expected return of portfolio Sis 22% and its standard deviation 19% (Rf3%) - If you wanted the that provided by portfolio Ain Example 5(7.50%. but mang them as far as possible, how would you build your po? - How would you build it if you were wing to take the that associated with portfolio C (20.45 Compare your results with those of Examples Objective EDRp] =.0750 ECRp] = ufuff + (1-v)xECA.s] = .075 E- Inad 76.32% in rist fred W 2340 13 14 15 16 18 19 20 28 21 22 23 24 25 26 29 30 31 32 EC) - 1 Efficient fronter In order to have higher Refurn than 5, Wu have to borrow from the bank S E05)=22 -.03 Os = .19 Op=2970 a Objective i op=2940 Op = (1-wf) os = 2940 122 Wf = 85. 240 ..19.075 5474 ; Ws=1 - Wf = 1.5474 OS 19 Higher return ElRp] = wfxrf + (1 - Wp) E[Rs]) ELRP) = -5474x.03 + 1,5479x.22 = - 3240 Comparing to the Expected return of C i ER.] = 24 82=2940

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts