Question: For the second question part (a), the first options are: x-bar or x.The second options are: law of large numbers, central limit theorem, or theory

For the second question part (a), the first options are: x-bar or x.The second options are: law of large numbers, central limit theorem, or theory of normality. The third options are: x-bar or x. For question (d), the first options are: increase, decrease, or stay the same. The second options are distribution, mean, average, or sample size.

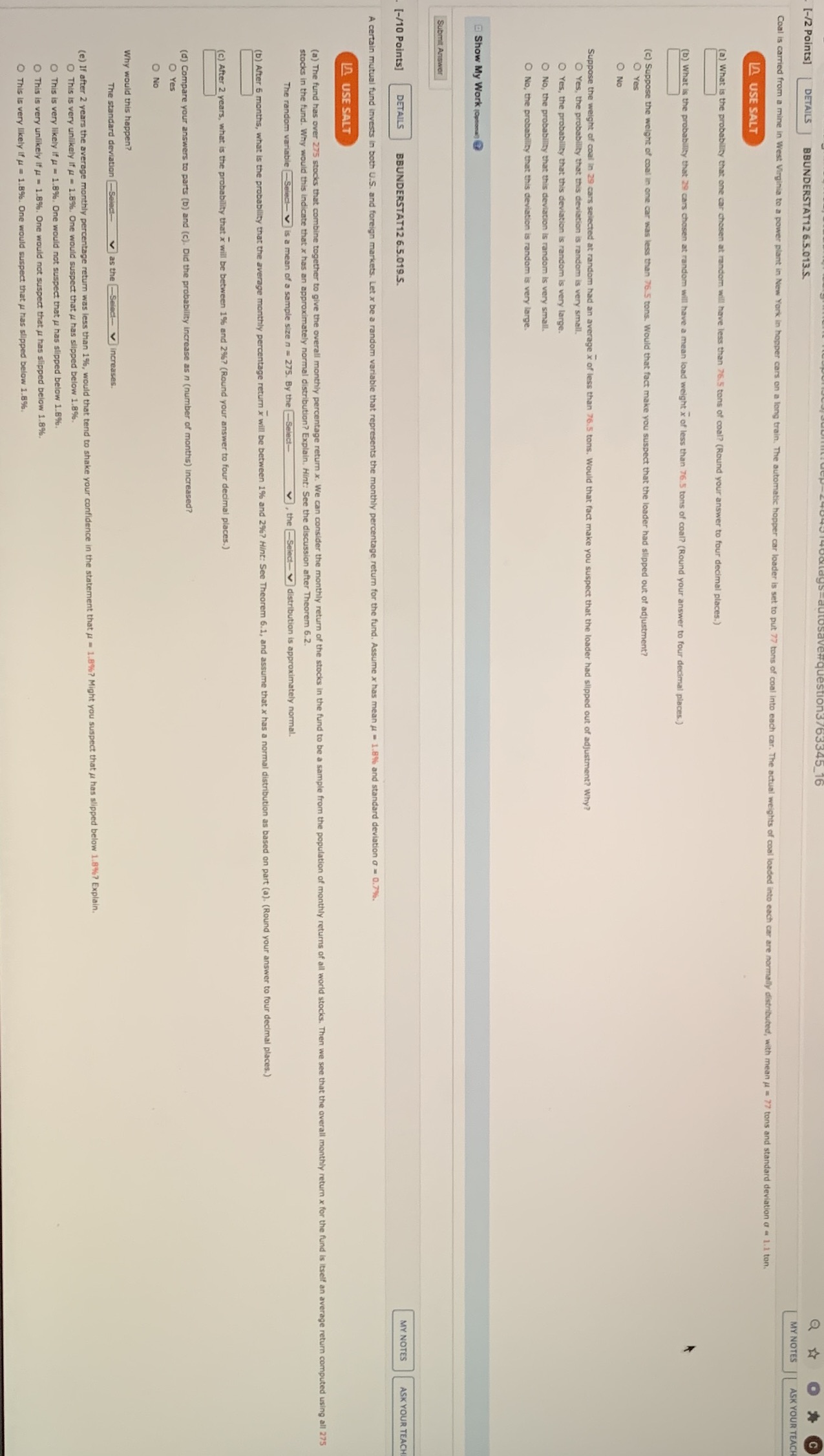

[-/2 Points] DETAILS BBUNDERSTAT12 6.5.013.5. a O C MY NOTES ASK YOUR TEAC Coal is carried from a mine in West Virginia to a po hopper car loader is set to put 77 tons of coal Into each LA USE SALT 77 tons and standard deviation a = 1.1 ton. (a) What is the pro lity that one car cho ess than 76.5 tons of coal? (Round your answer to four decimal places.) (b) What is the probability that 29 cars chosen load weight x of less than 76.5 tons of coal? (Round your answer to four decimal places.) c) Suppose the weight of coal in one car was less than 76.5 tons. Would that fact make you suspect that the loader had slipped out of adjustment? O Yes NO Suppose the weight of coal in 29 cars selected at random had an average x of less than 76.5 tons. Would that fact make you suspect that the loader had slipped out of adjustment? Why? O Yes, the probability that this deviation is random is very small. O Yes, the probability that this deviation is random is very large. O No, the probability that this deviation is random is very small. O No, the probability that this deviation is random is very large. Show My Work 10peony Submit Answer [-/10 Points] DETAILS BBUNDERSTAT12 6.5.019.5. MY NOTES ASK YOUR TEACH A certain mutual fund invests in both U.S. and foreign markets. Let x be a random variable entage return for the fund. Assume x has mean # - 1.8% and standard deviation o = 0.7%%. LO. USE SALT (a) The fund has over 275 stocks that combine together to give the overall monthly percentage return x. We can consider the monthly return of the stocks in the fund to be a sample from the population of monthly returns of all world stocks. Then we see that the overall monthly return x for the fund is itself an average return computed using all 275 stocks in the fund. Why would this indicate that x has an approximately normal distribution? Explain. Hint: See the discussion after Theorem 6.2. The random variat aleci- v is a mean of a sample size n = 275. By the -Sele v, the Select-v distribution is approximately normal. (b) After 6 months, what is the probability that the avera onthly percentage return x will be between 1% and 2%? Hint: See Theorem 6.1, and assume that x has a normal distribution as based on part (a). (Round your answer to four decimal places.) (c) After 2 years, what is the probability that x will be between 1% and 2%? (Round your answer to four decimal places.) d) Compare your answers to parts (b) and (c). Did the probability Increase as n (number of months) Increased? O Yes O No Why would this happen? The standard deviation -Select as the -Select- v increases. (e) If after 2 years the average monthly percentage return was less than 1%, would that tend to shake your confidence in the statement that 1.8%? Might you suspect that it has slipped below 1.8%? Explain. O This is very unlikely if # = 1.8%. One would suspect that / has slipped below 1.8%. O This is very likely if u = 1.8%. One would not suspect that / has slipped below 1.8%. O This is very unlikely if # = 1.8%. One would not suspect that u has slipped below 1.8%. This is very likely If ( = 1.8%. One w. spect that u has slipped below 1.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts