Question: For the spreadsheet that has been provided herein: 1. Calculate the Payback Period (2 Marks) 2. Calculate the Discounted Payback Period (5 Marks). For questions

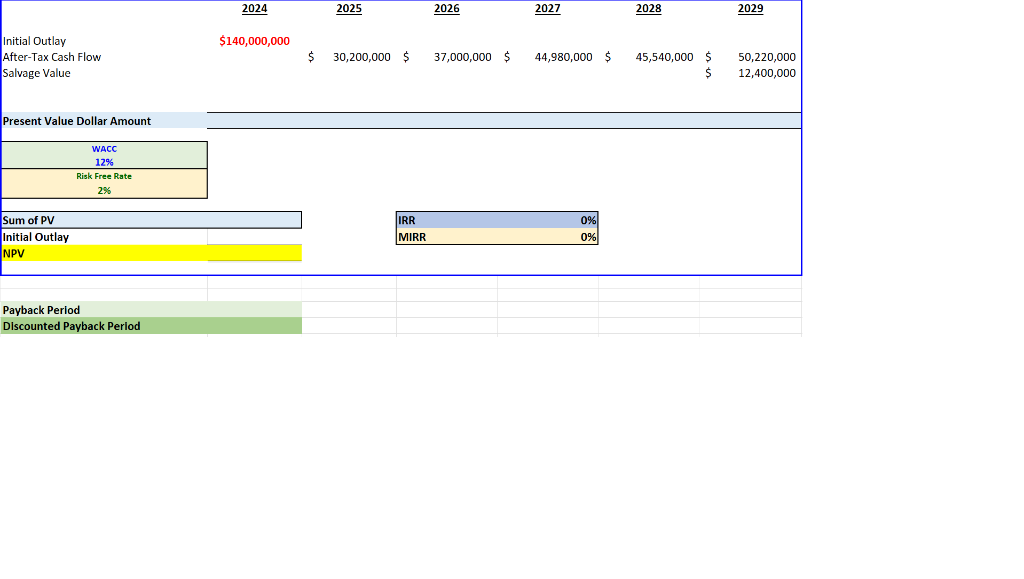

For the spreadsheet that has been provided herein:

1. Calculate the Payback Period (2 Marks)

2. Calculate the Discounted Payback Period (5 Marks).

For questions 1 and 2 identified above SHOW YOUR CALCULATIONS.

3. Calculate the NPV (10 Marks)

Once the NPV has been calculated the IRR and MIRR will be calculated automatically.

4. Identify and speak to why the IRR value will be GREATER than the WACC value (3 Marks).

2024 2025 2026 2027 2028 2029 $140,000,000 Initial Outlay After-Tax Cash Flow Salvage Value $ 30,200,000 $ 37,000,000 $ 44,980,000 $ 45,540,000 $ 50,220,000 12,400,000 Present Value Dollar Amount WACC 12% Risk Free Rate 2% 0% Sum of PV Initial Outlay NPV IRR IMIRR 096 Payback Period Discounted Payback Period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts