Question: For the tables, people borrow $200, solves the problem if they borrow at $400 based on these tables. For your home-made leverage, assume that the

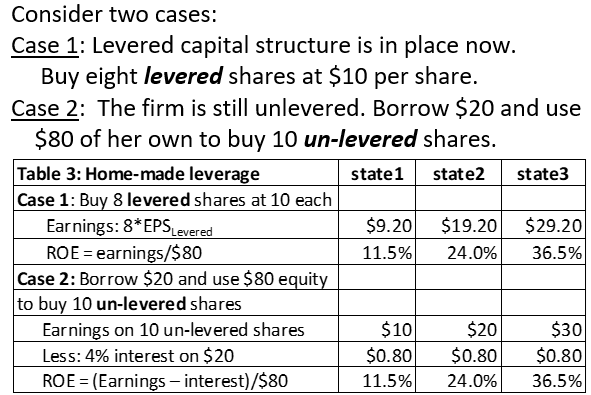

For the tables, people borrow $200, solves the problem if they borrow at $400 based on these tables. For your home-made leverage, assume that the total amount of your portfolio (which includes your investment in stocks and all other transactions) is $100. Show one decimal place for your answer. For your home-made leverage, how much do you need to borrow?

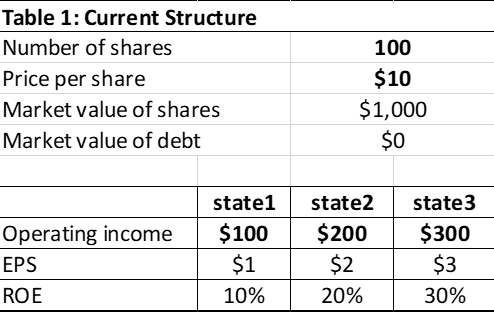

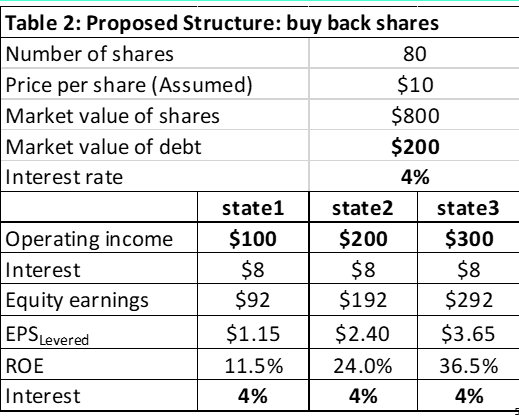

Table 1: Current Structure Number of shares Price per share Market value of shares Market value of debt 100 $10 $1,000 $0 Operating income EPS ROE state1 $100 $1 10% state2 $200 $2 20% state3 $300 $3 30% Table 2: Proposed Structure: buy back shares Number of shares 80 Price per share (Assumed) $10 Market value of shares $800 Market value of debt $200 Interest rate 4% state1 state2 state3 Operating income $100 $200 $300 Interest $8 $8 $8 Equity earnings $92 $192 $292 $1.15 $2.40 $3.65 ROE 11.5% 24.0% 36.5% Interest 4% 4% 4% EPS Levered Consider two cases: Case 1: Levered capital structure is in place now. Buy eight levered shares at $10 per share. Case 2: The firm is still unlevered. Borrow $20 and use $80 of her own to buy 10 un-levered shares. Table 3: Home-made leverage state1 state2 state3 Case 1: Buy 8 levered shares at 10 each Earnings: 8*EPSLevered $9.20 $19.20 $29.20 ROE = earnings/$80 11.5% 24.0% 36.5% Case 2: Borrow $20 and use $ 80 equity to buy 10 un-levered shares Earnings on 10 un-levered shares $10 $20 $30 Less: 4% interest on $20 $0.80 $0.80 $0.80 ROE = (Earnings - interest)/$80 11.5% 24.0% 36.5% Table 1: Current Structure Number of shares Price per share Market value of shares Market value of debt 100 $10 $1,000 $0 Operating income EPS ROE state1 $100 $1 10% state2 $200 $2 20% state3 $300 $3 30% Table 2: Proposed Structure: buy back shares Number of shares 80 Price per share (Assumed) $10 Market value of shares $800 Market value of debt $200 Interest rate 4% state1 state2 state3 Operating income $100 $200 $300 Interest $8 $8 $8 Equity earnings $92 $192 $292 $1.15 $2.40 $3.65 ROE 11.5% 24.0% 36.5% Interest 4% 4% 4% EPS Levered Consider two cases: Case 1: Levered capital structure is in place now. Buy eight levered shares at $10 per share. Case 2: The firm is still unlevered. Borrow $20 and use $80 of her own to buy 10 un-levered shares. Table 3: Home-made leverage state1 state2 state3 Case 1: Buy 8 levered shares at 10 each Earnings: 8*EPSLevered $9.20 $19.20 $29.20 ROE = earnings/$80 11.5% 24.0% 36.5% Case 2: Borrow $20 and use $ 80 equity to buy 10 un-levered shares Earnings on 10 un-levered shares $10 $20 $30 Less: 4% interest on $20 $0.80 $0.80 $0.80 ROE = (Earnings - interest)/$80 11.5% 24.0% 36.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts