Question: For the year ended December 3 1 , 2 0 1 7 , Micah Company, had pretax financial income of $ 8 3 0 ,

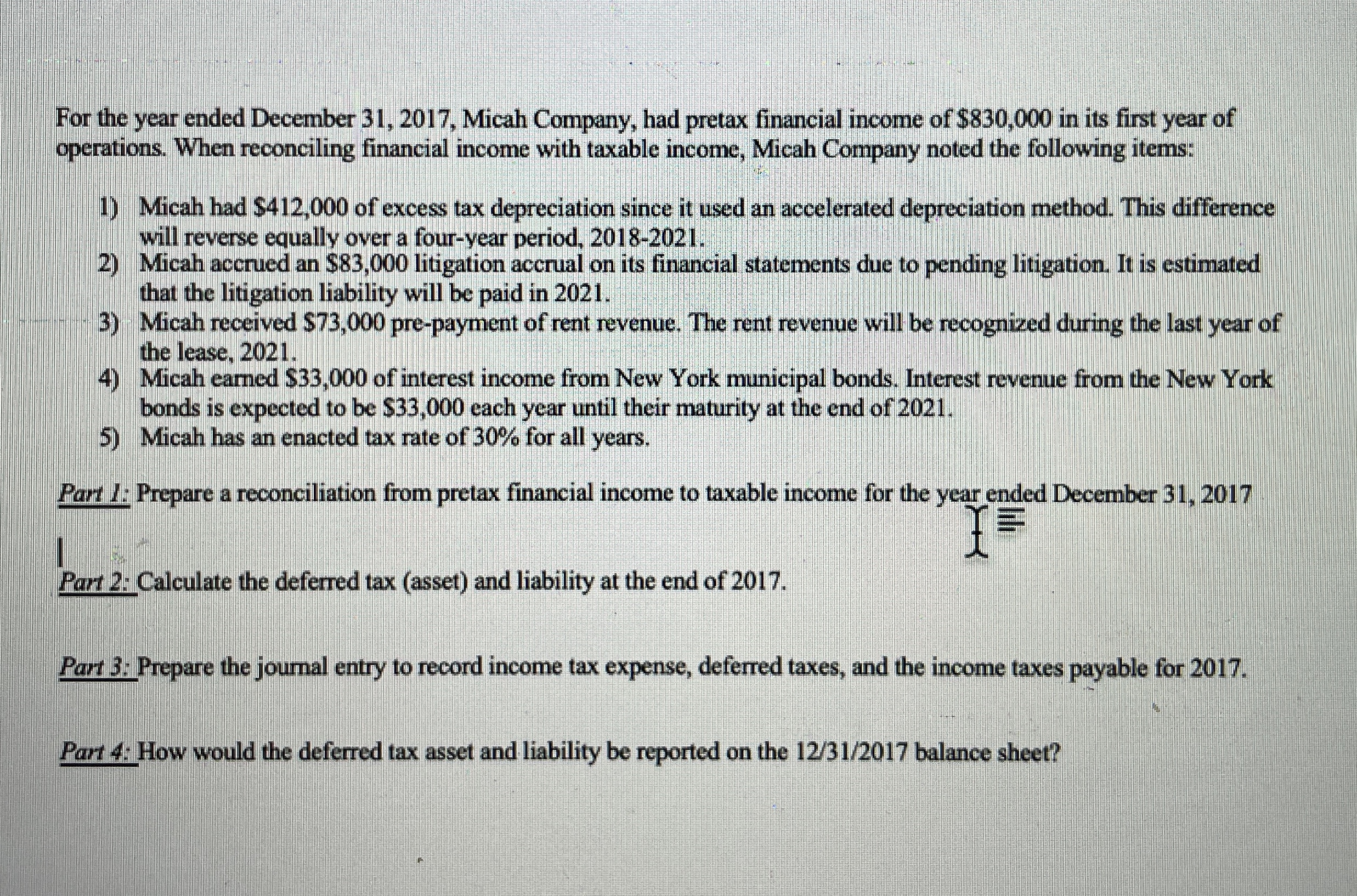

For the year ended December Micah Company, had pretax financial income of $ in its first year of operations. When reconciling financial income with taxable income, Micah Company noted the following items:

Micah had $ of excess tax depreciation since it used an accelerated depreciation method. This difference will reverse equally over a fouryear period,

Micah accrued an $ litigation accrual on its financial statements due to pending litigation. It is estimated that the litigation liability will be paid in

Micah received $ prepayment of rent revenue. The rent revenue will be recognized during the last year of the lease,

Micah earned $ of interest income from New York municipal bonds. Interest revenue from the New York bonds is expected to be $ each year until their maturity at the end of

Micah has an enacted tax rate of for all years.

Part : Prepare a reconciliation from pretax financial income to taxable income for the year ended December

Part : Calculate the deferred tax asset and liability at the end of

Part ; Prepare the journal entry to record income tax expense, deferred taxes, and the income taxes payable for

Part : How would the deferred tax asset and liability be reported on the balance sheet?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock