Question: FOR THESE THREE PROBLEMS CAN YOU GIVE ME THE ANSWER USING ONLY THE FINANCIAL PROFESSIONAL CALCULATOR KEYS ONLY CLEARLY WRITTEN USING ONLY THE CALCULATOR PLEASE

FOR THESE THREE PROBLEMS CAN YOU GIVE ME THE ANSWER USING ONLY THE FINANCIAL PROFESSIONAL CALCULATOR KEYS ONLY CLEARLY WRITTEN USING ONLY THE CALCULATOR PLEASE AND THANK YOU VERY MUCH.

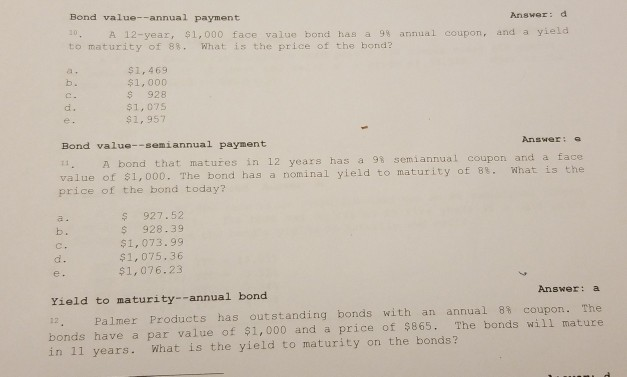

Bond value--annual payment 10, A 12-year, $1,000 face value bond has a 9% annual coupon, and a yield to maturity of 88. What is the price of the bond? Answer:d $1,469 $1,000 $ 928 $1, 075 $1, 957 b. d. Bond value--semiannual payment Answer:e Abond that matures in 12 years has a 98 semiannual coupon and a face value of $1,000. The bond has a nominal yield to maturity of 8%. What is the price of the bond today? 927.52 928.39 $1,073.99 $1,075.36 $1, 076.23 b. d. Yield to maturity--annual bond 12. Palmer Products has outstanding bonds with an annual 8% coupon. The bonds have a par value of $1,000 and a price of $865. The bonds will mature in 11 years. What is the yield to maturity on the bonds? Answer: a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts