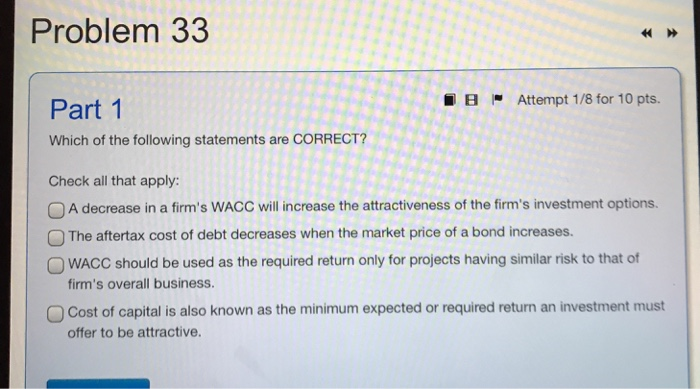

Question: For this -0.943 or 0.943 is not the answer Problem 33 Attempt 1/8 for 10 pts. Part 1 Which of the following stat are CORRECT?

For this -0.943 or 0.943 is not the answer

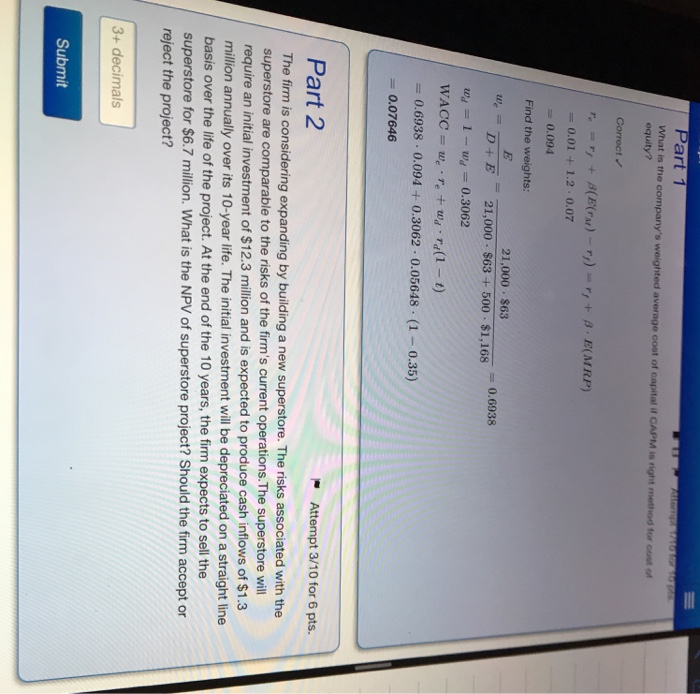

For this -0.943 or 0.943 is not the answer Problem 33 Attempt 1/8 for 10 pts. Part 1 Which of the following stat are CORRECT? Check all that apply: A decrease in a firm's WACC will increase the attractiveness of the firm's investment options. The aftertax cost of debt decreases when the market price of a bond increases. WACC should be used as the required return only for projects having similar risk to that of firm's overall business. Cost of capital is also known as the minimum expected or required return an investment must offer to be attractive. Part 1 What is the company's weighted average cost of capital CAPM IS equity? method to Correct TE " + ( E(TM) - ) = r;+ BE(MRP) = 0.01 + 1.2.0.07 = 0.094 Find the weights: 21,000 $63 D+E 21,000 $63 + 500 - $1,168 w; = 1 - w = 0.3062 WACC = were + ward(1-1) = 0.6938 0.094 +0.3062 -0.05648 . (1 -0.35) = 0.07646 Part 2 Attempt 3/10 for 6 pts. The firm is considering expanding by building a new superstore. The risks associated with the superstore are comparable to the risks of the firm's current operations. The superstore will require an initial investment of $12.3 million and is expected to produce cash inflows of $1.3 million annually over its 10-year life. The initial investment will be depreciated on a straight line basis over the life of the project. At the end of the 10 years, the firm expects to sell the superstore for $6.7 million. What is the NPV of superstore project? Should the firm accept or reject the project? 3+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts