Question: For this accounting question i only need help with the questions that have a red 'X' next to them. the rest is correct hope this

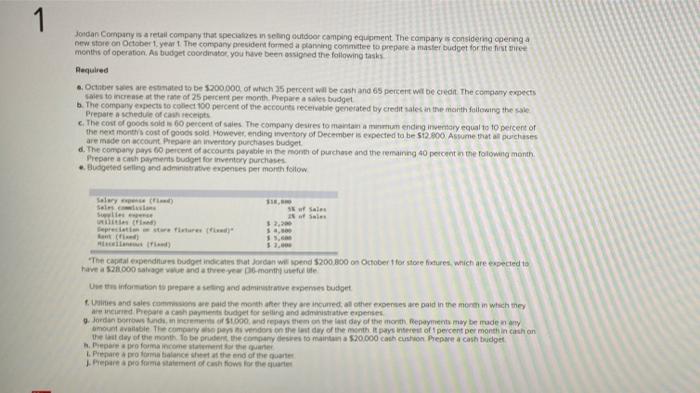

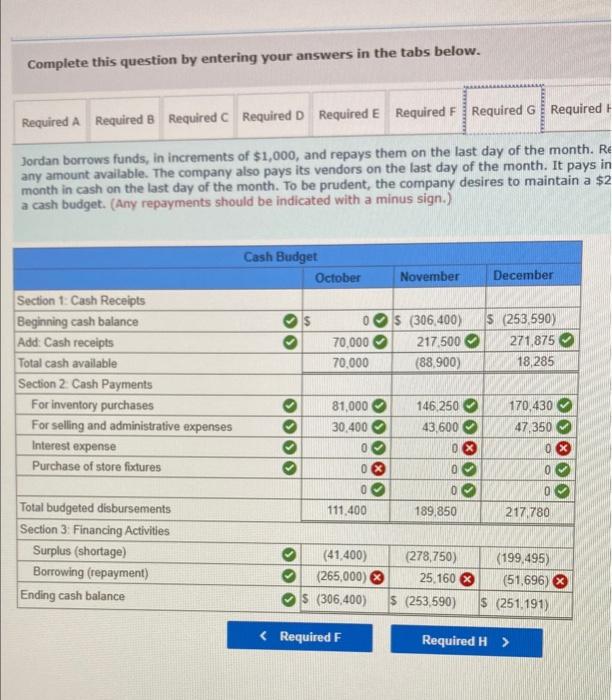

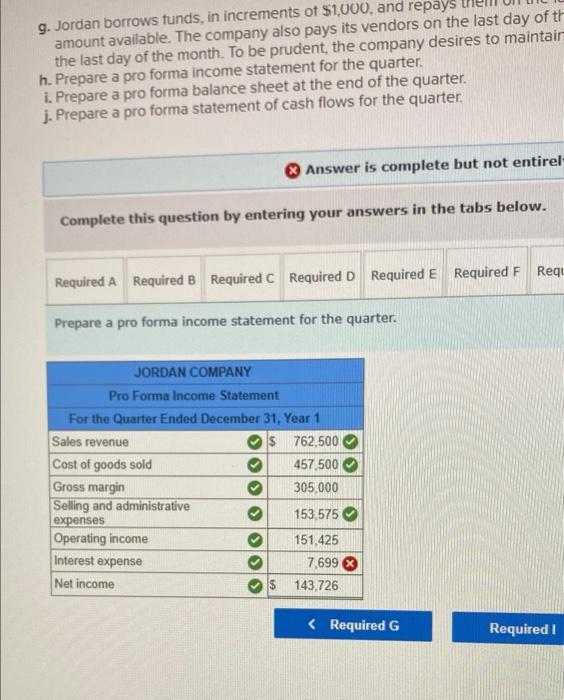

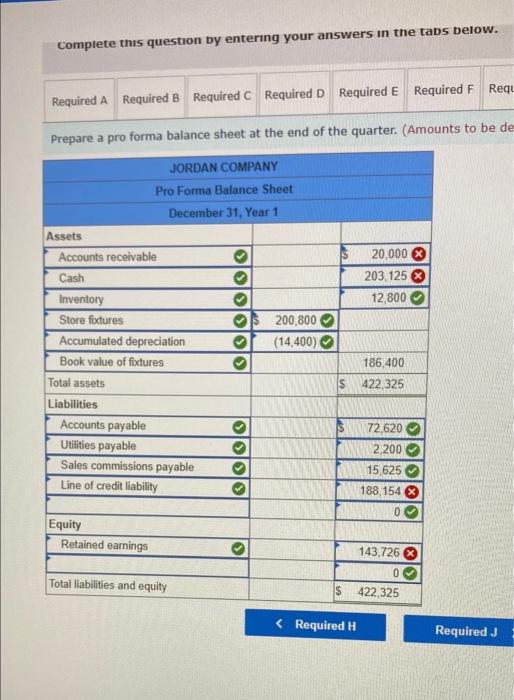

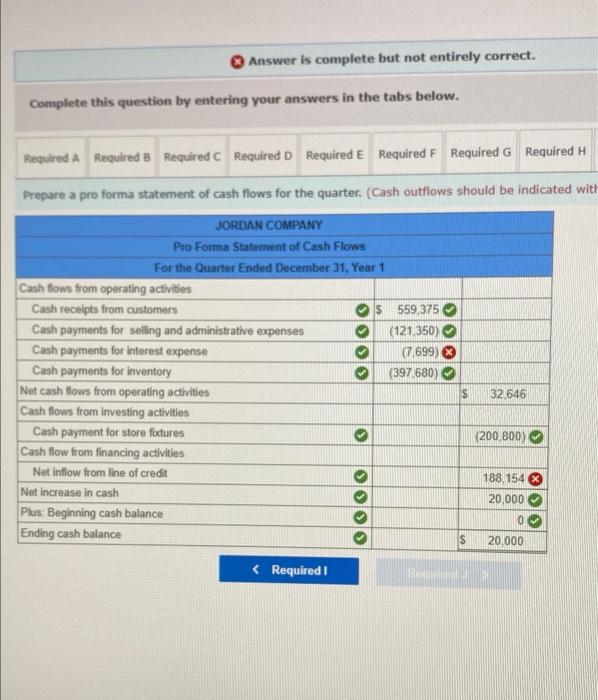

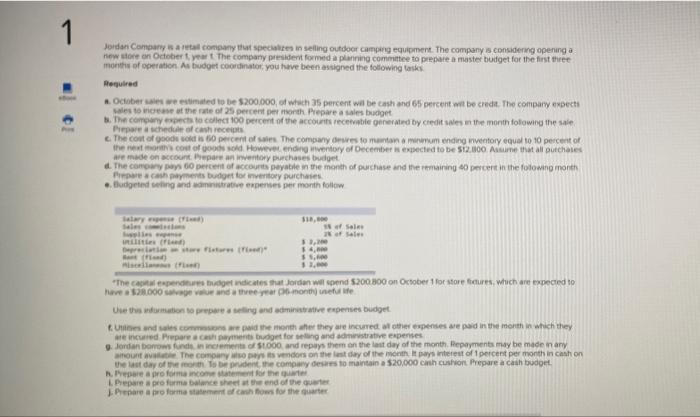

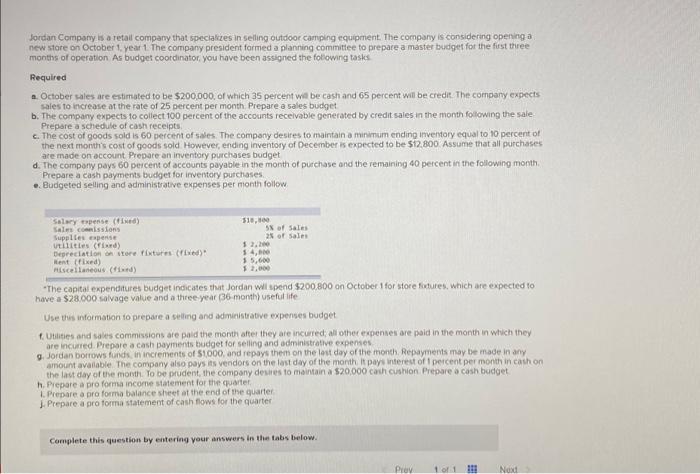

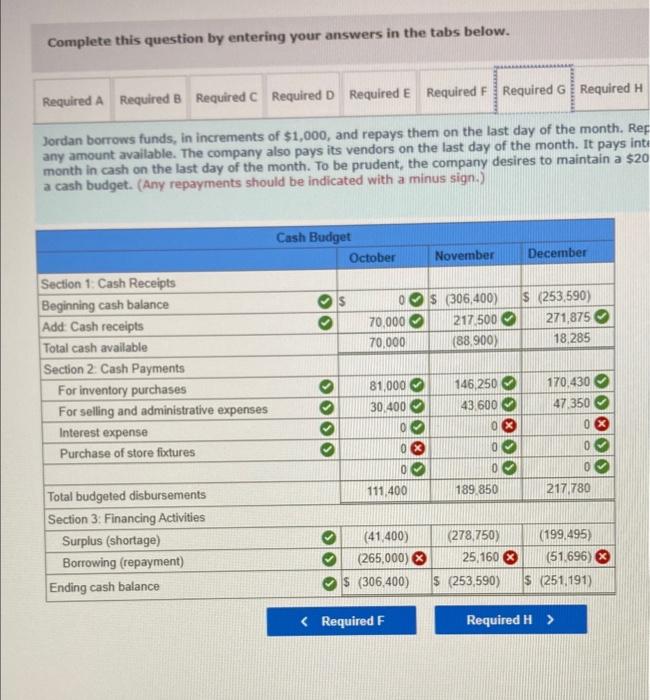

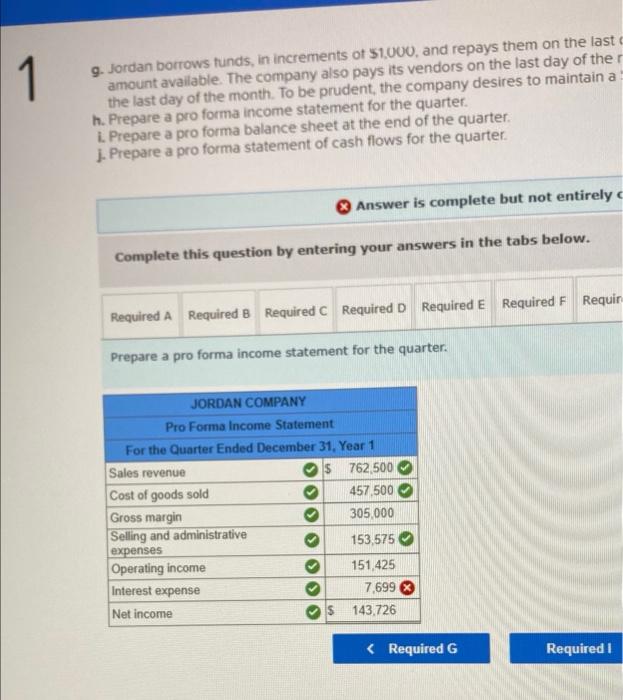

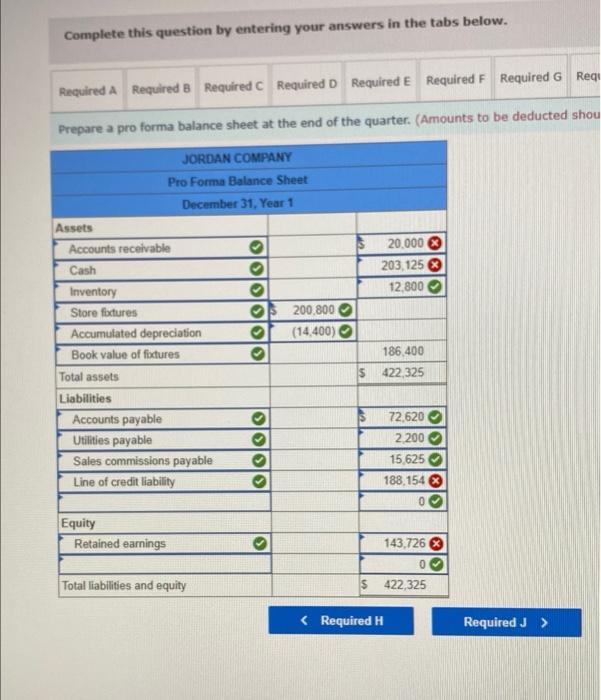

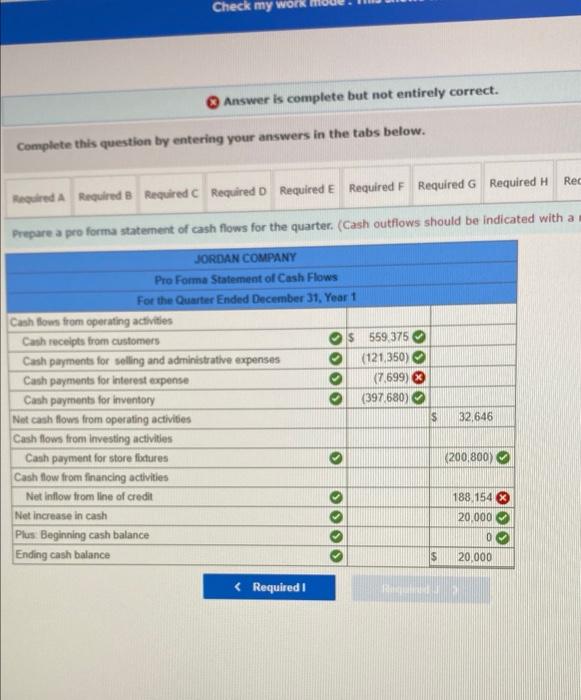

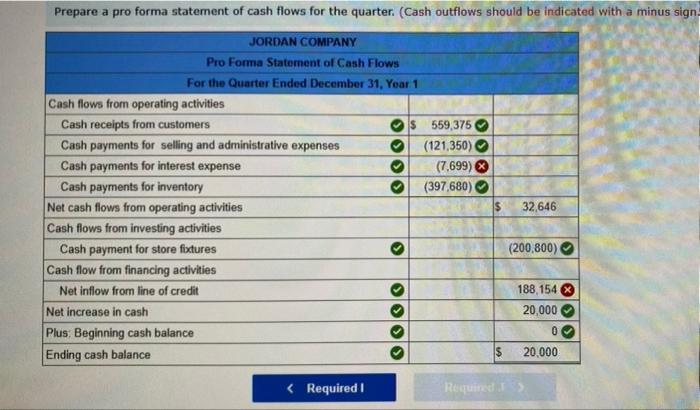

1 Jordan Company is a real company that specializes in seting outdoor camping equipment. The company is considering openinga new store on October 1 year? The company president formed a paving committee to prepare a master budget for the liste months of operation. As budget coordinator you have been assigned the following tasks Required Obers are estimated to be $200.000, of which 35 percent will be cash and 65 percent will be credit. The company expects sales to increase at the rate of 25 percent per month Prepare a sales budget . The company expect to collect 100 percent of the accounts receivable generated by credit sales and the month following the sale Prepare a schedule of carts The cost of goods sold 60 percent of sales. The company desires to mantan a un ending inventory equal to 10 percent of the next month cost of goods sold. However ending inventory of December is expected to be $12.800 Assume that purchases are made on account. Prepare an inventory purchases budget d. The comparar percent of accounts payable in the month of purchase and the remaining 40 percent as the following month. Prepare a cash payments budget for inventory burchases Budgeted setting and administrative expenses per month follow 118, Salary() Since Sow Deprecaterer w Sales Sale $ 3.20 sa, The capital expenditures budget indicates that Jordan wiped $200,000 on October for store stures which are expected to have a $2.000 avage and a three year 6 months Use the information to prepares and administrave pemes budget cities and sales como are paid the month after they are incurred at other crees are paid in the morm in which they incurred. Prepare a cash and budget for selling and administrative expenses Jordan browsind, in incremento and repays them on the last day of the morth Repayment may be made any amount available the company Desvendors on the last day of the month its interest of percent per month in cash on the day of the month to be prudent the company eses to maintama 20.000 coth cushion Prepare a cash budget Pero forma income tanto que L. Prepare a proformations the end of the quartet Prepare a reformat of cows for the Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F Required Grequired Jordan borrows funds, in increments of $1,000, and repays them on the last day of the month. Re any amount available. The company also pays its vendors on the last day of the month. It pays in month in cash on the last day of the month. To be prudent, the company desires to maintain a $2 a cash budget. (Any repayments should be indicated with a minus sign.) Cash Budget October November December 70.000 70.000 $ (306,400) 217500 (88,900) $ (253,590) 271,875 18,285 Section 1: Cash Receipts Beginning cash balance Add: Cash receipts Total cash available Section 2 Cash Payments For inventory purchases For selling and administrative expenses Interest expense Purchase of store factures 81,000 30,400 146,250 43,600 170,430 47,350 >>IX 0 0 O 0 O 0 0 0 0 111,400 189,850 2171780 Total budgeted disbursements Section 3: Financing Activities Surplus (shortage) Borrowing (repayment) Ending cash balance (41.400) (265,000) $ (306,400) (278,750) 25,160 % 5 (253,590) (199 495) (51,696) $ (251,191) g. Jordan borrows funds, in increments of $1,000, and repays amount available. The company also pays its vendors on the last day of th the last day of the month. To be prudent, the company desires to maintain h. Prepare a pro forma income statement for the quarter. 1. Prepare a pro forma balance sheet at the end of the quarter. j. Prepare a pro forma statement of cash flows for the quarter. Answer is complete but not entirel- Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F Requ Prepare a pro forma income statement for the quarter. JORDAN COMPANY Pro Forma Income Statement For the Quarter Ended December 31, Year 1 Sales revenue $ 762,500 Cost of goods sold 457.500 Gross margin 305,000 Selling and administrative 153,575 expenses Operating income 151.425 Interest expense 7,699 Net income $ 143,726 200 80 188,154 20,000 0 20,000 $ 1 9. Jordan borrows funds, in increments of $1.000, and repays them on the last amount available. The company also pays its vendors on the last day of the the last day of the month. To be prudent, the company desires to maintain a h. Prepare a pro forma income statement for the quarter. L. Prepare a pro forma balance sheet at the end of the quarter. J. Prepare a pro forma statement of cash flows for the quarter. Answer is complete but not entirely Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F. Requir Prepare a pro forma income statement for the quarter. JORDAN COMPANY Pro Forma Income Statement For the Quarter Ended December 31, Year 1 Sales revenue 762,500 Cost of goods sold 457,500 Gross margin 305,000 Selling and administrative 153,575 expenses Operating income 151,425 Interest expense 7,699 Net income 143.726 Check my work Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Rec Required A Required B Required C Required D Required E Required F Required G Required H Prepare a pro forma statement of cash flows for the quarter. (Cash outflows should be indicated with a JORDAN COMPANY Pro Forma Statement of Cash Flows For the Quarter Ended December 31, Year 1 Cash flow from operating activities Cash receipts from customers $ 559 375 Cash payments for selling and administrative expenses (121350) Cash payments for interest expense (7.699) Cash payments for inventory (397.680) Net cash flows from operating activities Cash flows from investing activities Cash payment for store fdures Cash flow from financing activities Net Inflow from line of credit Net Increase in cash Plus Beginning cash balance Ending cash balance $ 32 646 (200.800) 188 154 $ 20.000 0 S 20,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts