Question: For this assignment I need to analyze this excel sheet with the Cash Flow and Balance Sheet and answer questions relating to it below but

For this assignment I need to analyze this excel sheet with the Cash Flow and Balance Sheet and answer questions relating to it below but not sure if it's right, Please read and analyze thoroughly and answer the questions, that are marked green including the table.

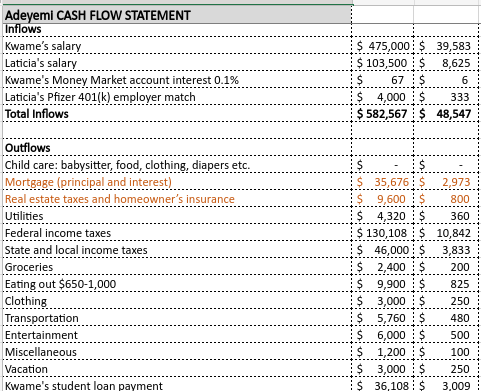

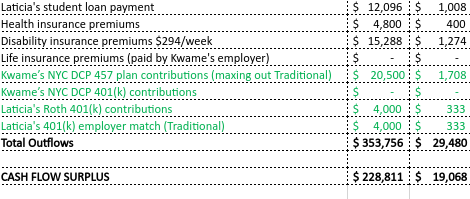

For the Cash flow Statement, there are two columns, the left one is Annual, and the right is Monthly.

The above is the Cash Flow Statement

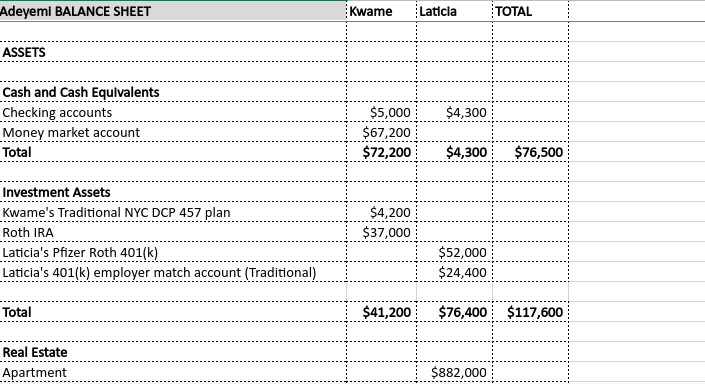

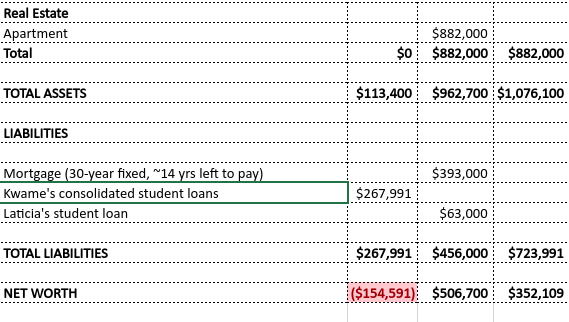

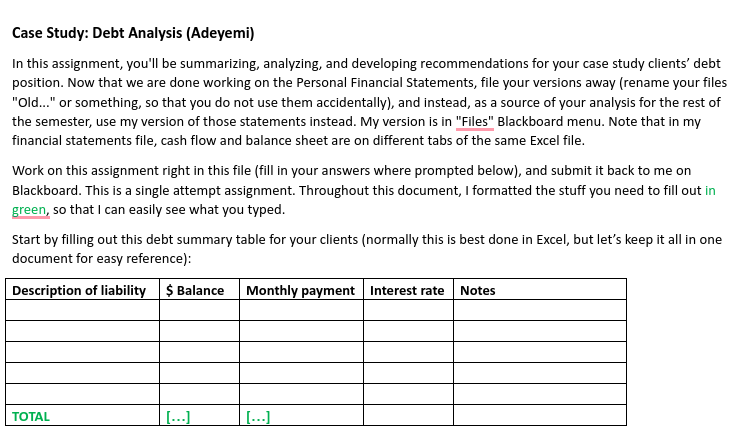

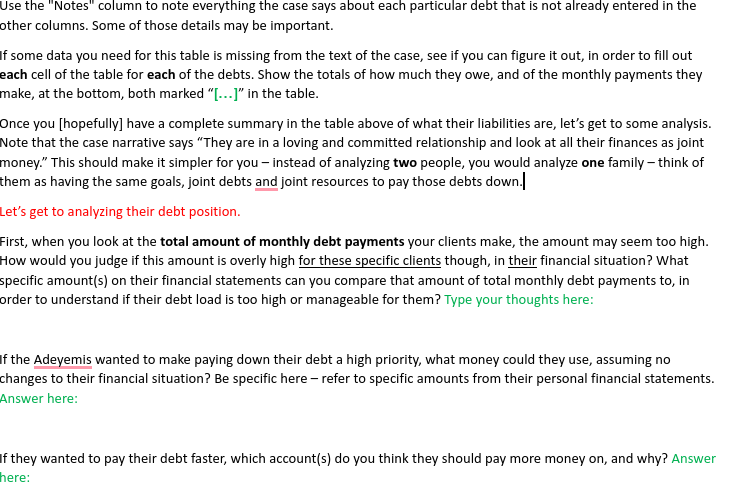

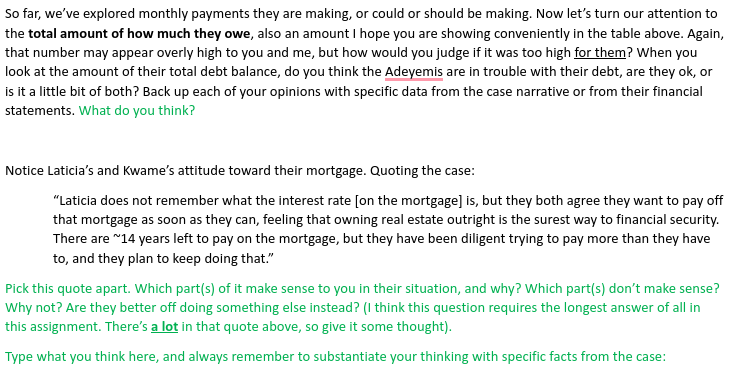

Adeyemi CASH FLOW STATEMENT Inflows Kwame's salary Laticia's salary Kwame's Money Market account interest 0.1% Laticia's Pfizer 401(k) employer match Total Inflows $ 475,000 $ 39,583 $ 103,500 $ 8,625 67 : $ 6 $ 4,000 $ 333 $ 582,567 : $ 48,547 Outflows Child care: babysitter, food, clothing, diapers etc. Mortgage (principal and interest) Real estate taxes and homeowner's insurance Utilities Federal income taxes State and local income taxes Groceries Eating out $650-1,000 Clothing Transportation Entertainment Miscellaneous Vacation Kwame's student loan payment $ $ 35,676 $ 2,973 $ 9,600 $ 800 $ 4,320 360 $ 130,108 $ 10,842 $ 46,000 3,833 $ 2,400 $ 200 $ 9,900 $ 825 $ 3,000 $ 250 $ 5,760 $ 480 $ 6,000 $ $ 1,200 $ 100 $ 3,000 $ 250 : $ 36,108 : $ 3,009 500 Laticia's student loan payment Health insurance premiums Disability insurance premiums $294/week Life insurance premiums (paid by Kwame's employer) Kwame's NYC DCP 457 plan contributions (maxing out Traditional) Kwame's NYC DCP 401(k) contributions Laticia's Roth 401(k) contributions ) Laticia's 401(k) employer match (Traditional) Total Outflows $ 12,096 $ 1,008 $ 4,800 $ 400 $ 15,288 $ 1,274 : $ : $ $ 20,500 $ 1,708 $ $ $ 4,000 $ 333 $ 4,000 $ 333 $ 353,756 $ 29,480 $ : CASH FLOW SURPLUS $ 228,811 : $ 19,068 Adeyemi BALANCE SHEET Kwame Laticla TOTAL ASSETS $4,300 Cash and Cash Equivalents Checking accounts Money market account Total $5,000 $67,200 $72,200 $4,300 $76,500 Investment Assets Kwame's Traditional NYC DCP 457 plan Roth IRA Laticia's Pfizer Roth 401(k) Laticia's 401(k) employer match account (Traditional) $4,200 $37,000 $ 52,000 $24,400 Total $41,200 $76,400 $117,600 Real Estate Apartment $882,000 Real Estate Apartment Total $882,000 $882,000 $882,000 $0 TOTAL ASSETS $113,400 $962,700 $1,076,100 LIABILITIES $393,000 Mortgage (30-year fixed, 14 yrs left to pay) Kwame's consolidated student loans Laticia's student loan $267,991 $63,000 TOTAL LIABILITIES $267,991 $456,000 $723,991 NET WORTH ($154,591) $506,700 $352,109 Case Study: Debt Analysis (Adeyemi) In this assignment, you'll be summarizing, analyzing, and developing recommendations for your case study clients' debt position. Now that we are done working on the Personal Financial Statements, file your versions away (rename your files "Old..." or something, so that you do not use them accidentally), and instead, as a source of your analysis for the rest of the semester, use my version of those statements instead. My version is in "Files" Blackboard menu. Note that in my financial statements file, cash flow and balance sheet are on different tabs of the same Excel file. Work on this assignment right in this file (fill in your answers where prompted below), and submit it back to me on Blackboard. This is a single attempt assignment. Throughout this document, I formatted the stuff you need to fill out in green, so that I can easily see what you typed. Start by filling out this debt summary table for your clients (normally this is best done in Excel, but let's keep it all in one document for easy reference): Description of liability $ Balance Monthly payment Interest rate Notes TOTAL [...] [...] Use the "Notes" column to note everything the case says about each particular debt that is not already entered in the other columns. Some of those details may be important. If some data you need for this table is missing from the text of the case, see if you can figure it out, in order to fill out each cell of the table for each of the debts. Show the totals of how much they owe, and of the monthly payments they make, at the bottom, both marked "[...) in the table. Once you [hopefully] have a complete summary in the table above of what their liabilities are, let's get to some analysis. Note that the case narrative says "They are in a loving and committed relationship and look at all their finances as joint money." This should make it simpler for you - instead of analyzing two people, you would analyze one family - think of them as having the same goals, joint debts and joint resources to pay those debts down./ Let's get to analyzing their debt position. First, when you look at the total amount of monthly debt payments your clients make, the amount may seem too high. How would you judge if this amount is overly high for these specific clients though, in their financial situation? What specific amount(s) on their financial statements can you compare that amount of total monthly debt payments to, in order to understand if their debt load is too high or manageable for them? Type your thoughts here: If the Adeyemis wanted to make paying down their debt a high priority, what money could they use, assuming no changes to their financial situation? Be specific here - refer to specific amounts from their personal financial statements. Answer here: if they wanted to pay their debt faster, which account(s) do you think they should pay more money on, and why? Answer here: So far, we've explored monthly payments they are making, or could or should be making. Now let's turn our attention to the total amount of how much they owe, also an amount I hope you are showing conveniently in the table above. Again, that number may appear overly high to you and me, but how would you judge if it was too high for them? When you look at the amount of their total debt balance, do you think the Adeyemis are in trouble with their debt, are they ok, or is it a little bit of both? Back up each of your opinions with specific data from the case narrative or from their financial statements. What do you think? Notice Laticia's and Kwame's attitude toward their mortgage. Quoting the case: "Laticia does not remember what the interest rate [on the mortgage] is, but they both agree they want to pay off that mortgage as soon as they can, feeling that owning real estate outright is the surest way to financial security. There are 14 years left to pay on the mortgage, but they have been diligent trying to pay more than they have to, and they plan to keep doing that." Pick this quote apart. Which part(s) of it make sense to you in their situation, and why? Which part(s) don't make sense? Why not? Are they better off doing something else instead? (I think this question requires the longest answer of all in this assignment. There's a lot in that quote above, so give it some thought). Type what you think here, and always remember to substantiate your thinking with specific facts from the case: Adeyemi CASH FLOW STATEMENT Inflows Kwame's salary Laticia's salary Kwame's Money Market account interest 0.1% Laticia's Pfizer 401(k) employer match Total Inflows $ 475,000 $ 39,583 $ 103,500 $ 8,625 67 : $ 6 $ 4,000 $ 333 $ 582,567 : $ 48,547 Outflows Child care: babysitter, food, clothing, diapers etc. Mortgage (principal and interest) Real estate taxes and homeowner's insurance Utilities Federal income taxes State and local income taxes Groceries Eating out $650-1,000 Clothing Transportation Entertainment Miscellaneous Vacation Kwame's student loan payment $ $ 35,676 $ 2,973 $ 9,600 $ 800 $ 4,320 360 $ 130,108 $ 10,842 $ 46,000 3,833 $ 2,400 $ 200 $ 9,900 $ 825 $ 3,000 $ 250 $ 5,760 $ 480 $ 6,000 $ $ 1,200 $ 100 $ 3,000 $ 250 : $ 36,108 : $ 3,009 500 Laticia's student loan payment Health insurance premiums Disability insurance premiums $294/week Life insurance premiums (paid by Kwame's employer) Kwame's NYC DCP 457 plan contributions (maxing out Traditional) Kwame's NYC DCP 401(k) contributions Laticia's Roth 401(k) contributions ) Laticia's 401(k) employer match (Traditional) Total Outflows $ 12,096 $ 1,008 $ 4,800 $ 400 $ 15,288 $ 1,274 : $ : $ $ 20,500 $ 1,708 $ $ $ 4,000 $ 333 $ 4,000 $ 333 $ 353,756 $ 29,480 $ : CASH FLOW SURPLUS $ 228,811 : $ 19,068 Adeyemi BALANCE SHEET Kwame Laticla TOTAL ASSETS $4,300 Cash and Cash Equivalents Checking accounts Money market account Total $5,000 $67,200 $72,200 $4,300 $76,500 Investment Assets Kwame's Traditional NYC DCP 457 plan Roth IRA Laticia's Pfizer Roth 401(k) Laticia's 401(k) employer match account (Traditional) $4,200 $37,000 $ 52,000 $24,400 Total $41,200 $76,400 $117,600 Real Estate Apartment $882,000 Real Estate Apartment Total $882,000 $882,000 $882,000 $0 TOTAL ASSETS $113,400 $962,700 $1,076,100 LIABILITIES $393,000 Mortgage (30-year fixed, 14 yrs left to pay) Kwame's consolidated student loans Laticia's student loan $267,991 $63,000 TOTAL LIABILITIES $267,991 $456,000 $723,991 NET WORTH ($154,591) $506,700 $352,109 Case Study: Debt Analysis (Adeyemi) In this assignment, you'll be summarizing, analyzing, and developing recommendations for your case study clients' debt position. Now that we are done working on the Personal Financial Statements, file your versions away (rename your files "Old..." or something, so that you do not use them accidentally), and instead, as a source of your analysis for the rest of the semester, use my version of those statements instead. My version is in "Files" Blackboard menu. Note that in my financial statements file, cash flow and balance sheet are on different tabs of the same Excel file. Work on this assignment right in this file (fill in your answers where prompted below), and submit it back to me on Blackboard. This is a single attempt assignment. Throughout this document, I formatted the stuff you need to fill out in green, so that I can easily see what you typed. Start by filling out this debt summary table for your clients (normally this is best done in Excel, but let's keep it all in one document for easy reference): Description of liability $ Balance Monthly payment Interest rate Notes TOTAL [...] [...] Use the "Notes" column to note everything the case says about each particular debt that is not already entered in the other columns. Some of those details may be important. If some data you need for this table is missing from the text of the case, see if you can figure it out, in order to fill out each cell of the table for each of the debts. Show the totals of how much they owe, and of the monthly payments they make, at the bottom, both marked "[...) in the table. Once you [hopefully] have a complete summary in the table above of what their liabilities are, let's get to some analysis. Note that the case narrative says "They are in a loving and committed relationship and look at all their finances as joint money." This should make it simpler for you - instead of analyzing two people, you would analyze one family - think of them as having the same goals, joint debts and joint resources to pay those debts down./ Let's get to analyzing their debt position. First, when you look at the total amount of monthly debt payments your clients make, the amount may seem too high. How would you judge if this amount is overly high for these specific clients though, in their financial situation? What specific amount(s) on their financial statements can you compare that amount of total monthly debt payments to, in order to understand if their debt load is too high or manageable for them? Type your thoughts here: If the Adeyemis wanted to make paying down their debt a high priority, what money could they use, assuming no changes to their financial situation? Be specific here - refer to specific amounts from their personal financial statements. Answer here: if they wanted to pay their debt faster, which account(s) do you think they should pay more money on, and why? Answer here: So far, we've explored monthly payments they are making, or could or should be making. Now let's turn our attention to the total amount of how much they owe, also an amount I hope you are showing conveniently in the table above. Again, that number may appear overly high to you and me, but how would you judge if it was too high for them? When you look at the amount of their total debt balance, do you think the Adeyemis are in trouble with their debt, are they ok, or is it a little bit of both? Back up each of your opinions with specific data from the case narrative or from their financial statements. What do you think? Notice Laticia's and Kwame's attitude toward their mortgage. Quoting the case: "Laticia does not remember what the interest rate [on the mortgage] is, but they both agree they want to pay off that mortgage as soon as they can, feeling that owning real estate outright is the surest way to financial security. There are 14 years left to pay on the mortgage, but they have been diligent trying to pay more than they have to, and they plan to keep doing that." Pick this quote apart. Which part(s) of it make sense to you in their situation, and why? Which part(s) don't make sense? Why not? Are they better off doing something else instead? (I think this question requires the longest answer of all in this assignment. There's a lot in that quote above, so give it some thought). Type what you think here, and always remember to substantiate your thinking with specific facts from the case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts