Question: StarCafe Corporation is reviewing the cost of equity and the WACC it uses to evaluate new investment projects. Management has collected the following information as

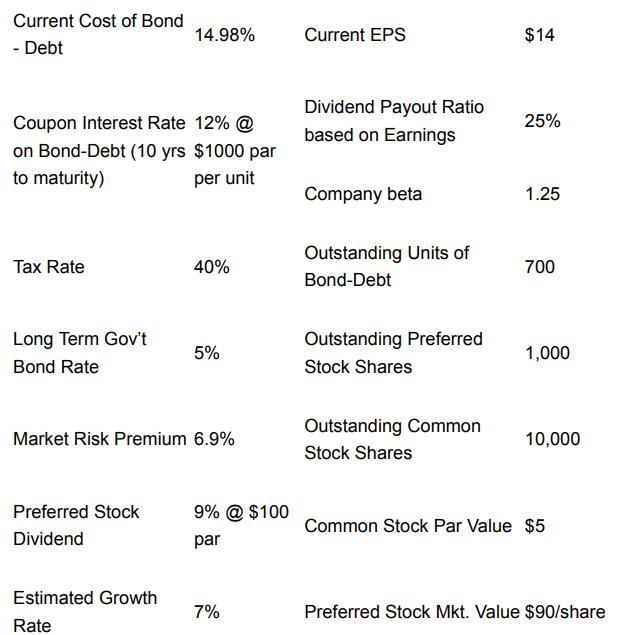

StarCafe Corporation is reviewing the cost of equity and the WACC it uses to evaluate new investment projects. Management has collected the following information as of September 30, 2001:

Assume that StarCafe is contemplating an investment for the enhancement of its stores: wireless Internet service within each café. In addition to charging for its use, management believes this enhancement will increase customer traffic and average amount spent per customer. The estimated cost of implementation is $27 million and the expected net increase in annual after-tax cash flow is $3 million in the first year, growing 3% a year in perpetuity. It is believed that this project has a similar risk to the other enhancement projects it carried out since the last 5 years. However if this new project is to be pushed through, additional 2,000 shares of common stock would have to be issued at the current market price.

What is the percentage cost of new common equity? (Use 3 decimal places)

What is the net present value of the proposed wireless internet service project? (Please type in the complete numerical figure: so 100000 for instance is correct but 100T will be marked wrong by canvas.)

What is the cost in percentage of common equity using dividend growth rate model? (Use 3 decimal places)

What is the company's WACC? (Use 3 decimal places)

What is the per unit market value in dollars of the company's outstanding bond-debt?

Current Cost of Bond - Debt Coupon Interest Rate 12% @ on Bond-Debt (10 yrs $1000 par to maturity) per unit Tax Rate Long Term Gov't Bond Rate 14.98% Preferred Stock Dividend Estimated Growth Rate 40% Market Risk Premium 6.9% 5% 9% @ $100 par 7% Current EPS Dividend Payout Ratio based on Earnings Company beta Outstanding Units of Bond-Debt Outstanding Preferred Stock Shares Outstanding Common Stock Shares $14 25% 1.25 700 1,000 10,000 Common Stock Par Value $5 Preferred Stock Mkt. Value $90/share

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Percentage cost of new common equity The percentage cost of new common equity is calculated by addin... View full answer

Get step-by-step solutions from verified subject matter experts