Question: For this assignment, you must bake two dozen cookies from scratch and package them, calculate the unit cost, breakeven point, fixed/variable costs, and prepare reports

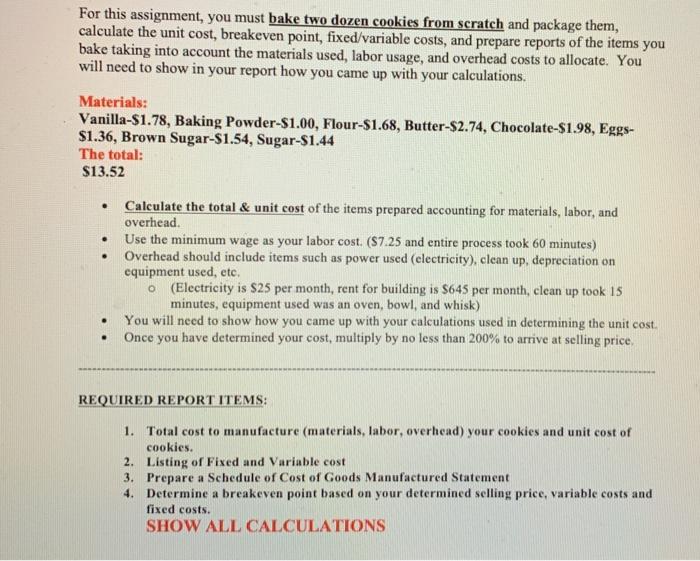

For this assignment, you must bake two dozen cookies from scratch and package them, calculate the unit cost, breakeven point, fixed/variable costs, and prepare reports of the items you bake taking into account the materials used, labor usage, and overhead costs to allocate. You will need to show in your report how you came up with your calculations. Materials: Vanilla-$1.78, Baking Powder-$1.00, Flour-$1.68, Butter-$2.74, Chocolate-$1.98, Eggs- $1.36, Brown Sugar-$1.54, Sugar $1.44 The total: $13.52 . . . Calculate the total & unit cost of the items prepared accounting for materials, labor, and overhead. Use the minimum wage as your labor cost. ($7.25 and entire process took 60 minutes) Overhead should include items such as power used (electricity), clean up, depreciation on equipment used, etc. o (Electricity is $25 per month, rent for building is $645 per month, clean up took 15 minutes, equipment used was an oven, bowl, and whisk) You will need to show how you came up with your calculations used in determining the unit cost. Once you have determined your cost, multiply by no less than 200% to arrive at selling price, REQUIRED REPORT ITEMS: 1. Total cost to manufacture (materials, labor, overhead) your cookies and unit cost of cookies. 2. Listing of Fixed and Variable cost 3. Prepare a Schedule of Cost of Goods Manufactured Statement 4. Determine a breakeven point based on your determined selling price, variable costs and fixed costs SHOW ALL CALCULATIONS For this assignment, you must bake two dozen cookies from scratch and package them, calculate the unit cost, breakeven point, fixed/variable costs, and prepare reports of the items you bake taking into account the materials used, labor usage, and overhead costs to allocate. You will need to show in your report how you came up with your calculations. Materials: Vanilla-$1.78, Baking Powder-$1.00, Flour-$1.68, Butter-$2.74, Chocolate-$1.98, Eggs- $1.36, Brown Sugar-$1.54, Sugar $1.44 The total: $13.52 . . . Calculate the total & unit cost of the items prepared accounting for materials, labor, and overhead. Use the minimum wage as your labor cost. ($7.25 and entire process took 60 minutes) Overhead should include items such as power used (electricity), clean up, depreciation on equipment used, etc. o (Electricity is $25 per month, rent for building is $645 per month, clean up took 15 minutes, equipment used was an oven, bowl, and whisk) You will need to show how you came up with your calculations used in determining the unit cost. Once you have determined your cost, multiply by no less than 200% to arrive at selling price, REQUIRED REPORT ITEMS: 1. Total cost to manufacture (materials, labor, overhead) your cookies and unit cost of cookies. 2. Listing of Fixed and Variable cost 3. Prepare a Schedule of Cost of Goods Manufactured Statement 4. Determine a breakeven point based on your determined selling price, variable costs and fixed costs SHOW ALL CALCULATIONS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts