Question: For this assignment, you will answer the questions below and submit an Excel spreadsheet of your solutions. Each problem is worth 20 points; the total

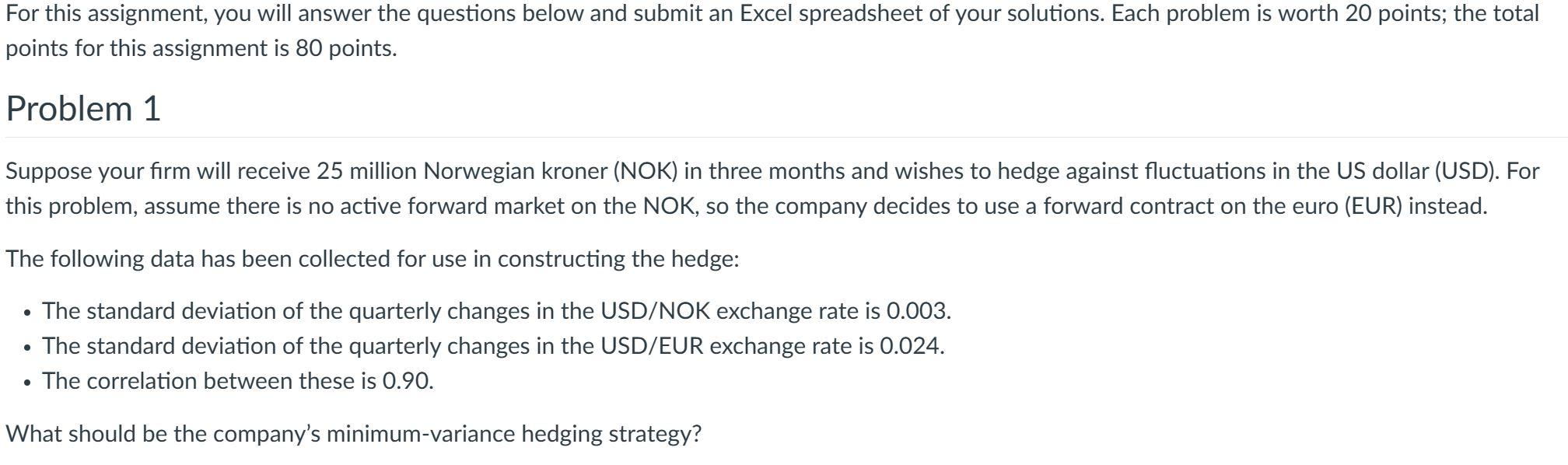

For this assignment, you will answer the questions below and submit an Excel spreadsheet of your solutions. Each problem is worth 20 points; the total points for this assignment is 80 points. Problem 1 Suppose your firm will receive 25 million Norwegian kroner (NOK) in three months and wishes to hedge against fluctuations in the US dollar (USD). For this problem, assume there is no active forward market on the NOK, so the company decides to use a forward contract on the euro (EUR) instead. The following data has been collected for use in constructing the hedge: - The standard deviation of the quarterly changes in the USD/NOK exchange rate is 0.003. - The standard deviation of the quarterly changes in the USD/EUR exchange rate is 0.024. - The correlation between these is 0.90. What should be the company's minimum-variance hedging strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts