Question: For this assignment, you will conduct research on the collapse of Silicon Valley Bank ( SVB ) and write a report that addresses the following

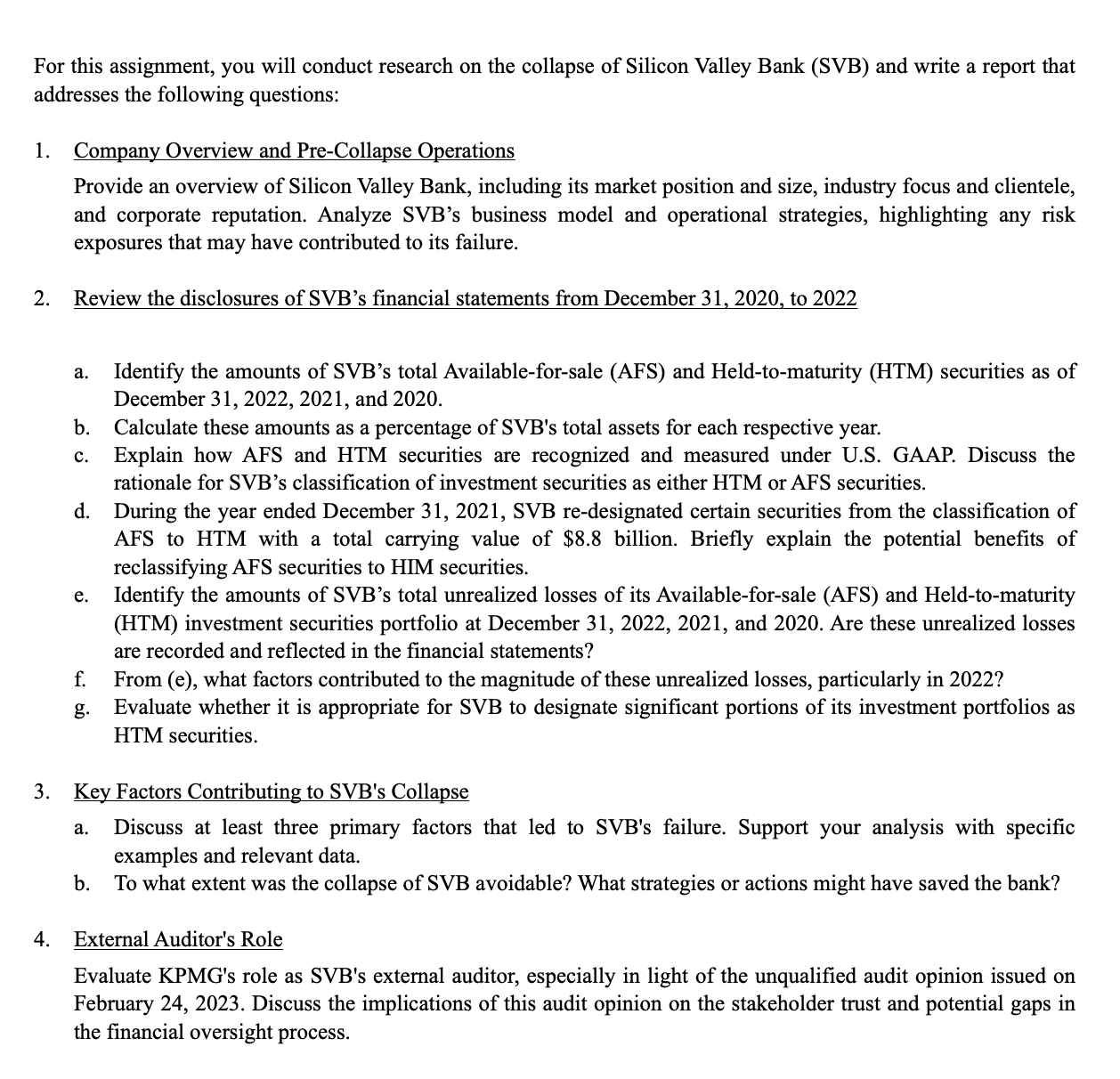

For this assignment, you will conduct research on the collapse of Silicon Valley Bank SVB and write a report that addresses the following questions: Company Overview and PreCollapse Operations Provide an overview of Silicon Valley Bank, including its market position and size, industry focus and clientele, and corporate reputation. Analyze SVBs business model and operational strategies, highlighting any risk exposures that may have contributed to its failure. Review the disclosures of SVBs financial statements from December to a Identify the amounts of SVBs total Availableforsale AFS and Heldtomaturity HTM securities as of December and b Calculate these amounts as a percentage of SVBs total assets for each respective year. c Explain how AFS and HTM securities are recognized and measured under US GAAP. Discuss the rationale for SVBs classification of investment securities as either HTM or AFS securities d During the year ended December SVB redesignated certain securities from the classification of AFS to HTM with a total carrying value of $ billion. Briefly explain the potential benefits of reclassifying AFS securities to HIM securities e Identify the amounts of SVBs total unrealized losses of its Availableforsale AFS and Heldtomaturity HTM investment securities portfolio at December and Are these unrealized losses are recorded and reflected in the financial statements? f From e what factors contributed to the magnitude of these unrealized losses, particularly in g Evaluate whether it is appropriate for SVB to designate significant portions of its investment portfolios as HTM securities Key Factors Contributing to SVBs Collapse a Discuss at least three primary factors that led to SVBs failure. Support your analysis with specific examples and relevant data. b To what extent was the collapse of SVB avoidable? What strategies or actions might have saved the bank? External Auditor's Role Evaluate KPMGs role as SVBs external auditor, especially in light of the unqualified audit opinion issued on February Discuss the implications of this audit opinion on the stakeholder trust and potential gaps in the financial oversight process.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock