Question: For this assignment, you will need to refer to the following set of financial data: Creekside Community Hospital Data Utilize the following information: Hospital Characteristics

For this assignment, you will need to refer to the following set of financial data:

- Creekside Community Hospital Data

Utilize the following information:

- Hospital Characteristics (see attached financials)

-

- Competitive environment, declining market share to competitors

- Moderate to substantial debt

- Facility and equipment that is fairly current, but will have future investments in capital

- Partial electronic medical record system

- Mediocre quality and patient satisfaction scores

- Few employed physicians/ no hospitalist program

- Split payor mix between public and private

- Overall not profitable from operations in most recent fiscal year

- Local Physician Practices Characteristics

-

- Small primary care and specialty practices (mixture of solo and small groups)

- Independent ownership

- Loose affiliation with hospital

- Combination of office and hospital practice

Both Hospital and Physician organizations have contract-only relationships with payors and suppliers and are currently not working with either in any strategic way financially.

Your group is hired as a financial consultant to prepare a financial strategy (or strategies) to the hospital as they transition from the current environment to the future environment that will be impacted by health care reform due to governmental intervention, as well as changes from within the industry itself.

Specifically, your strategy should consider more than one alternative (outcome). When formulating your response, consider addressing the following topics at a minimum (feel free to add other financial topics as well). This Consultants Report should include about one page for each topic:

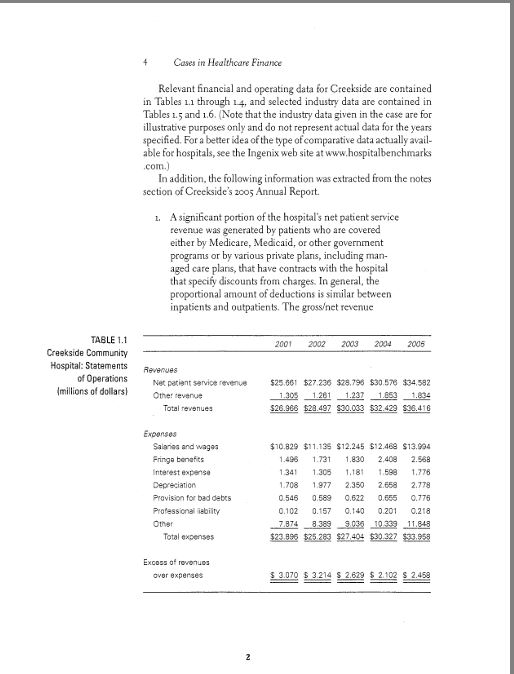

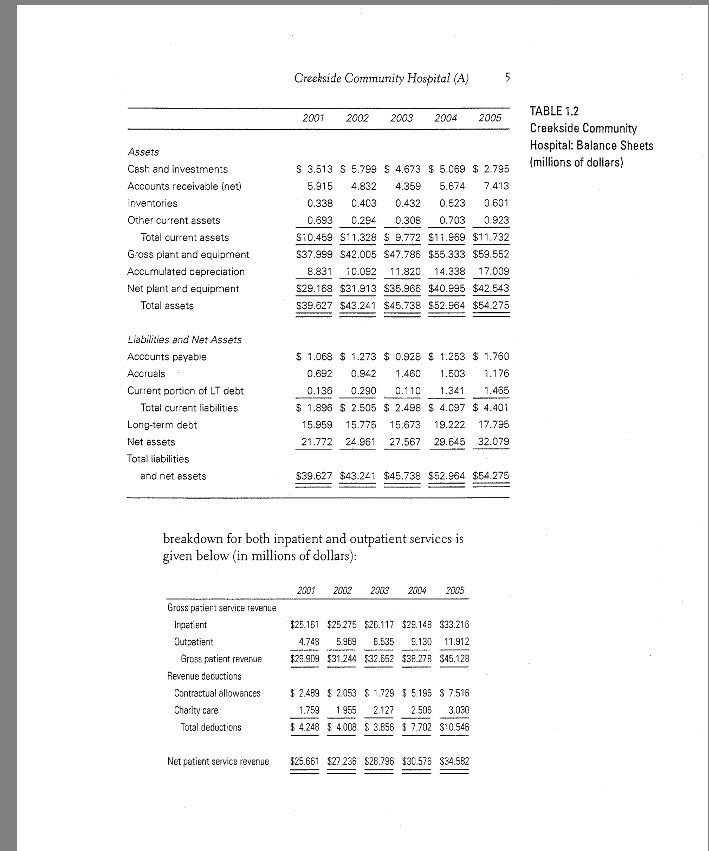

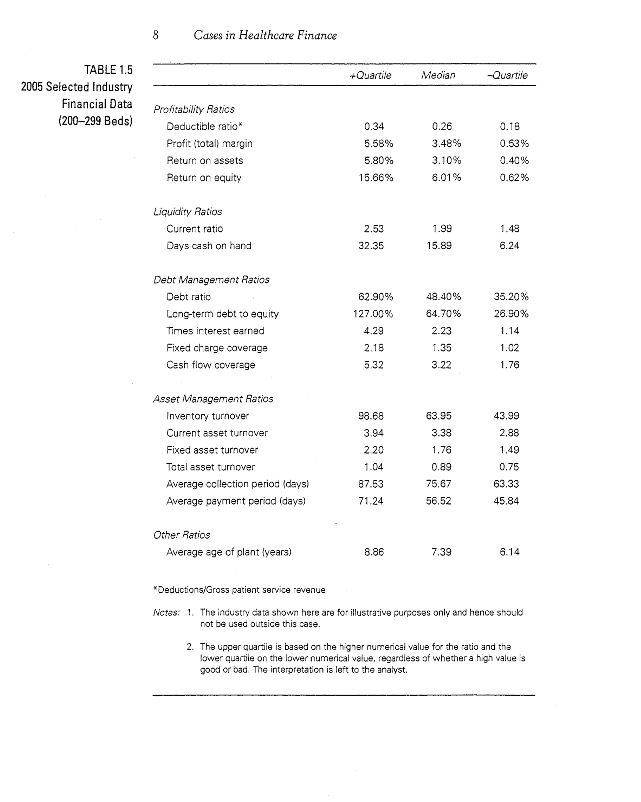

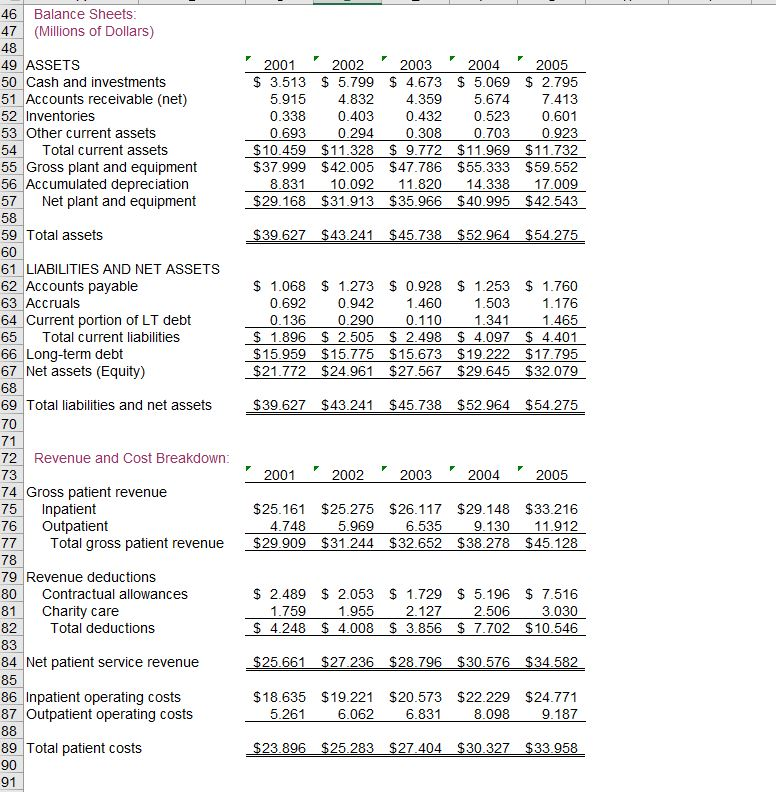

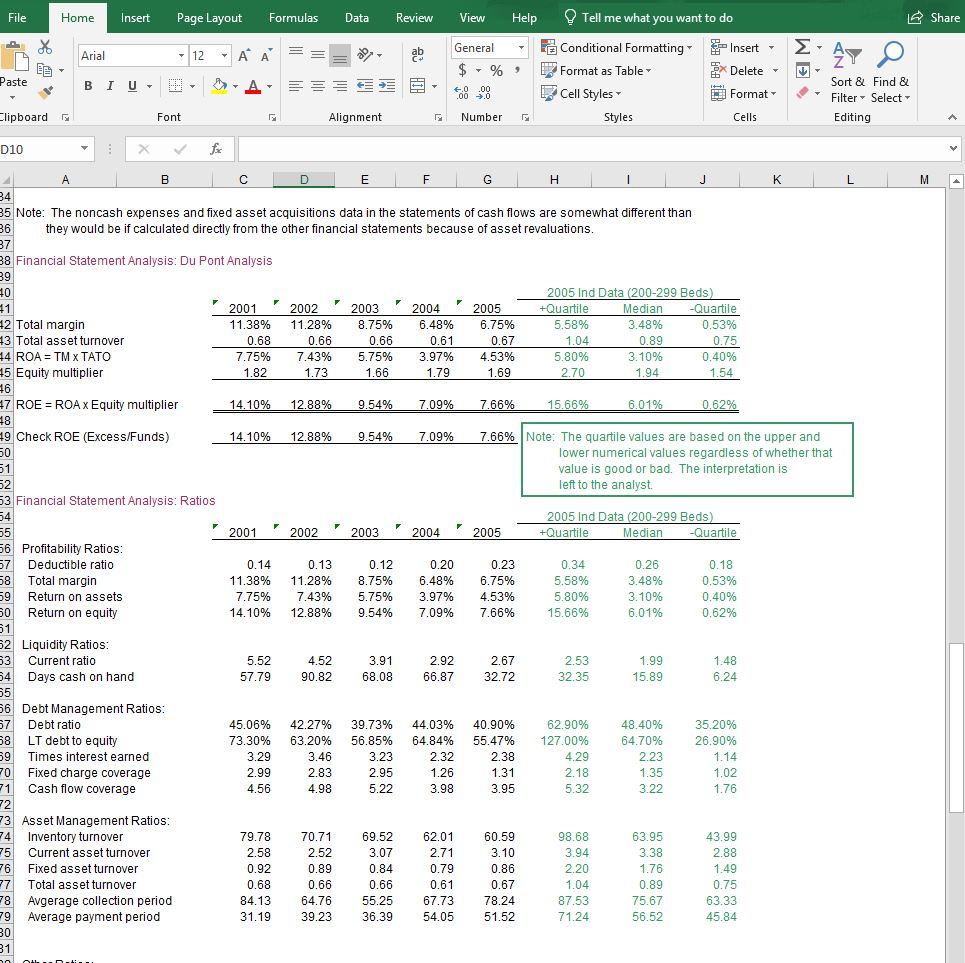

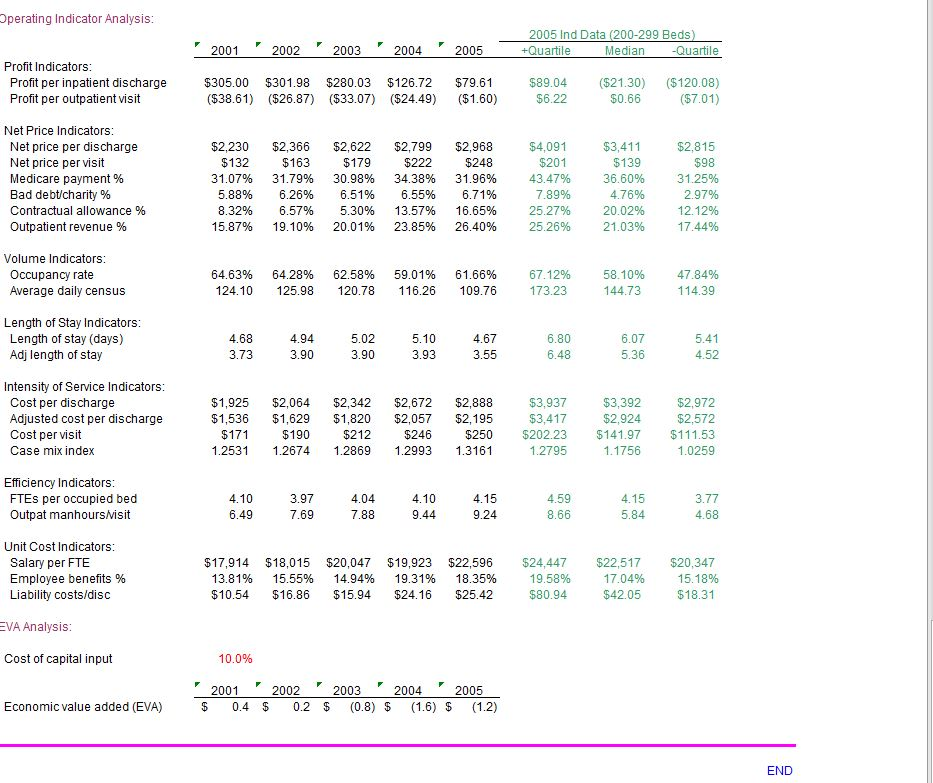

- Based upon the following financials attached, assess the current liquidity, profitability, and capital structure and what your recommendations would be for improving these for the future. Give 3-4 concrete financial recommendations based on this information.

- Address how a strong operating and capital budget process would assist achieving future financial goals (what tools might you employ?). Explain why accurate cost allocation is important. What would be the priorities for capital budgets (in general, not specifically)?

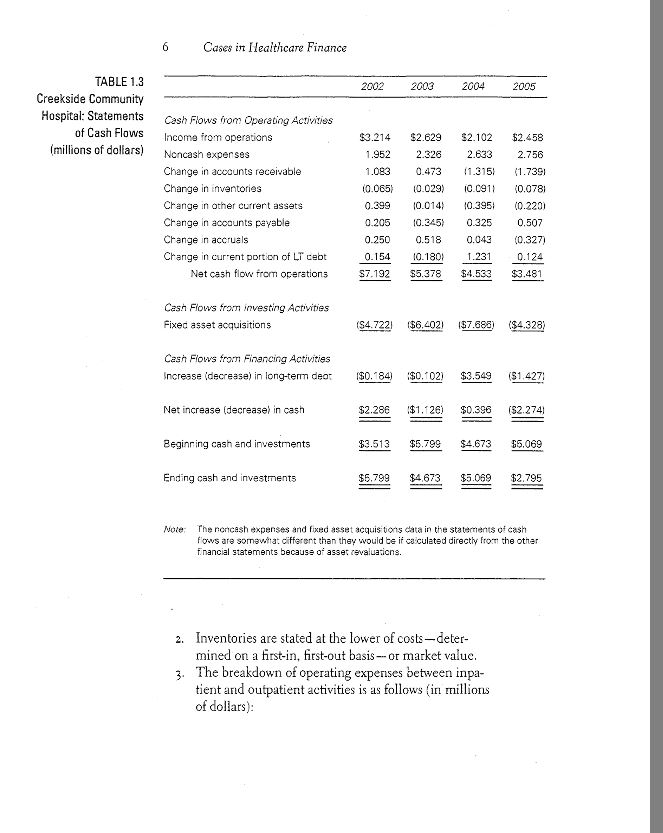

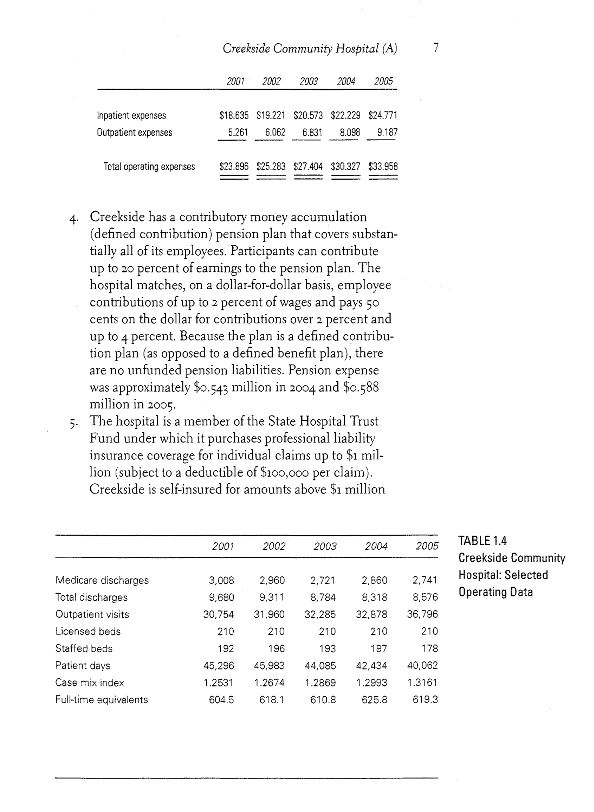

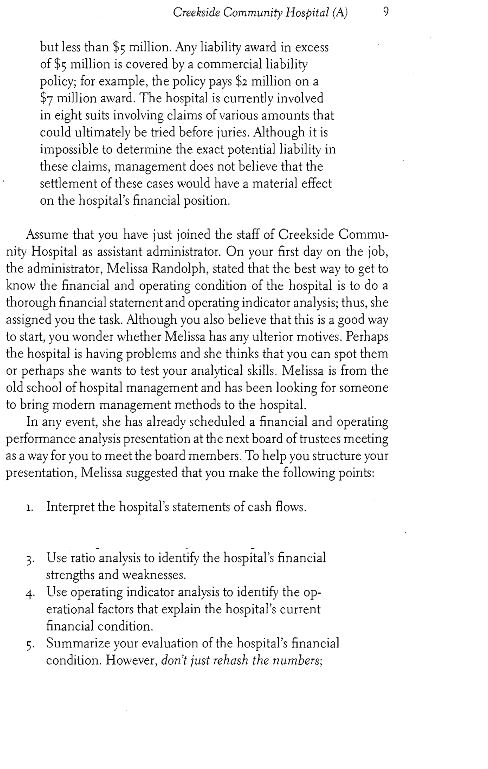

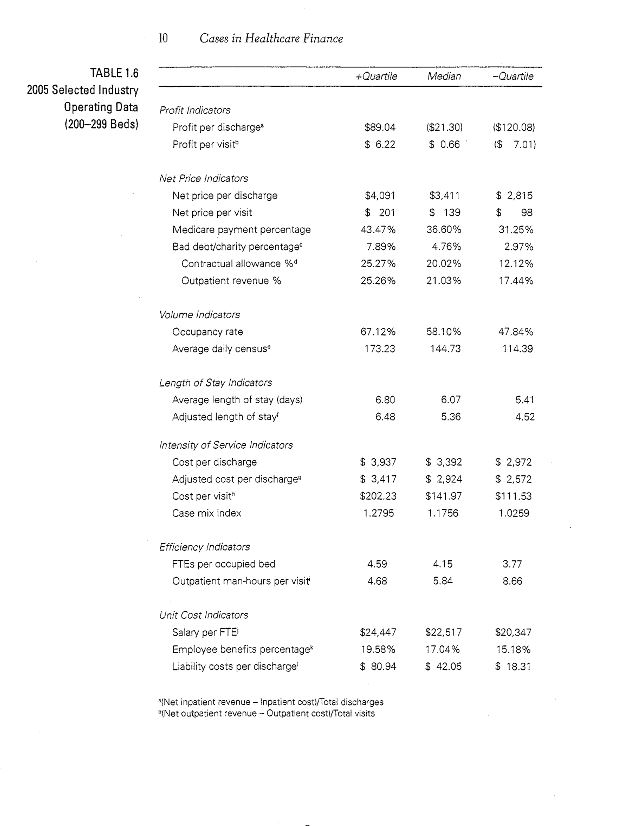

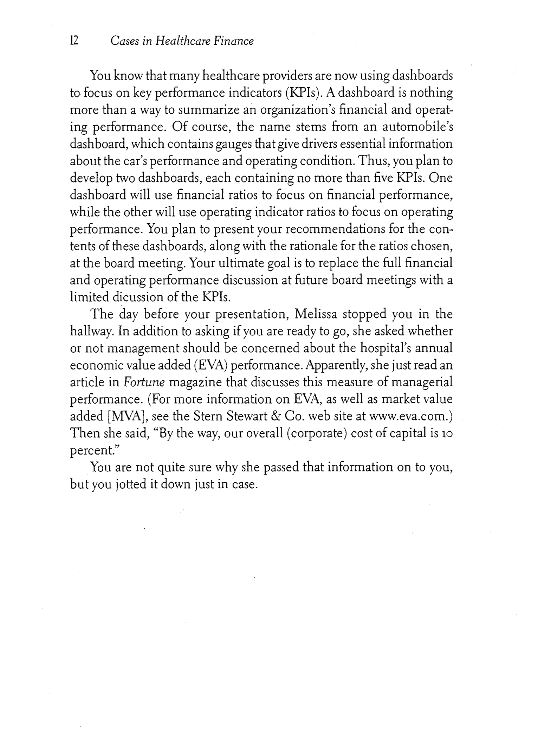

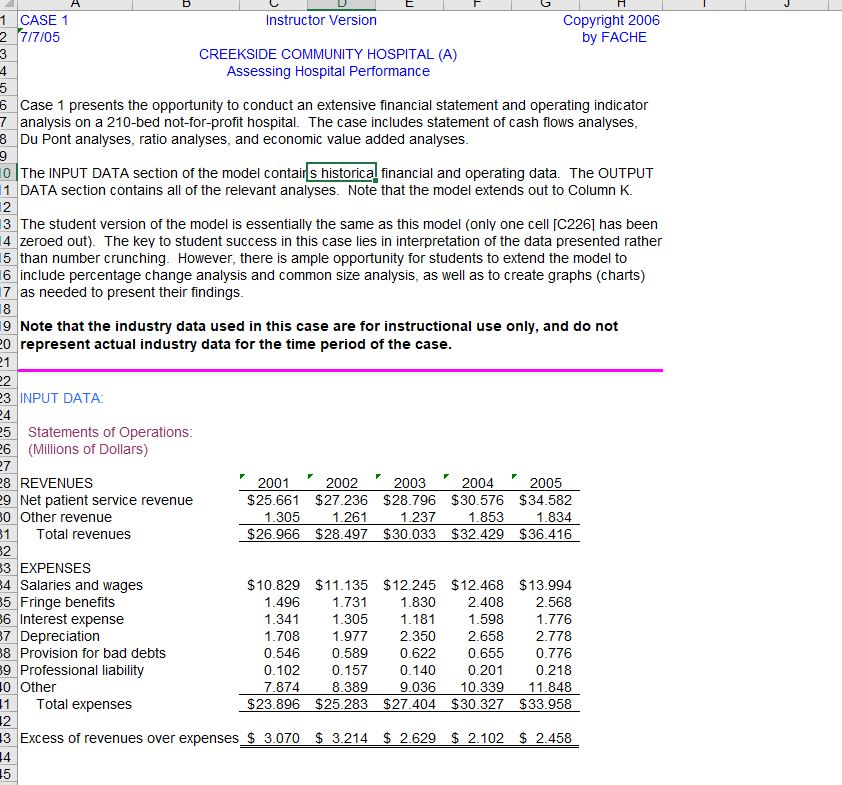

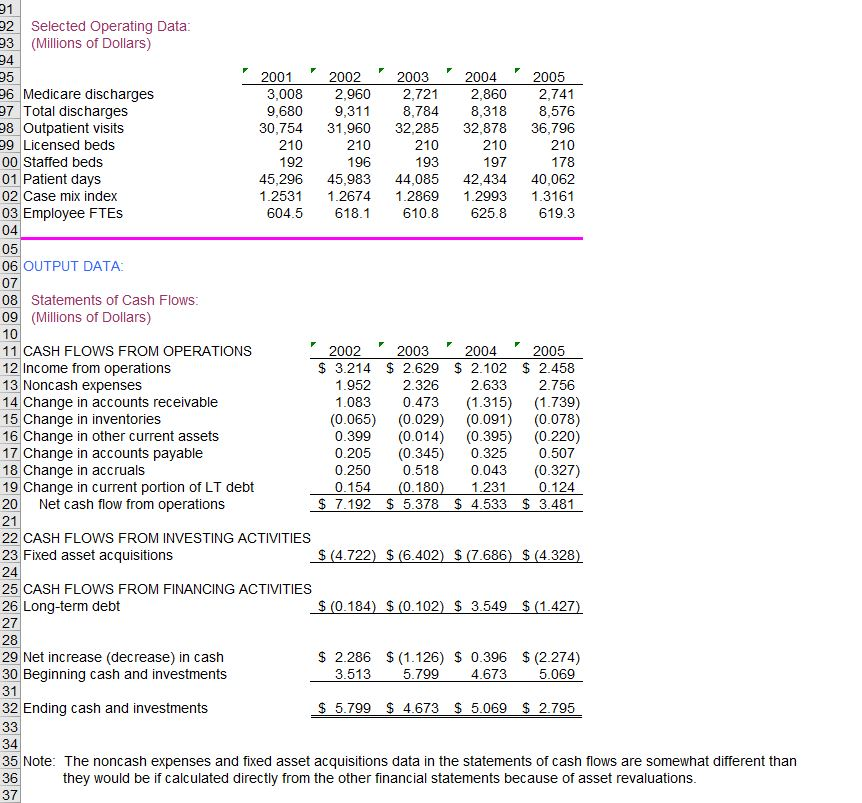

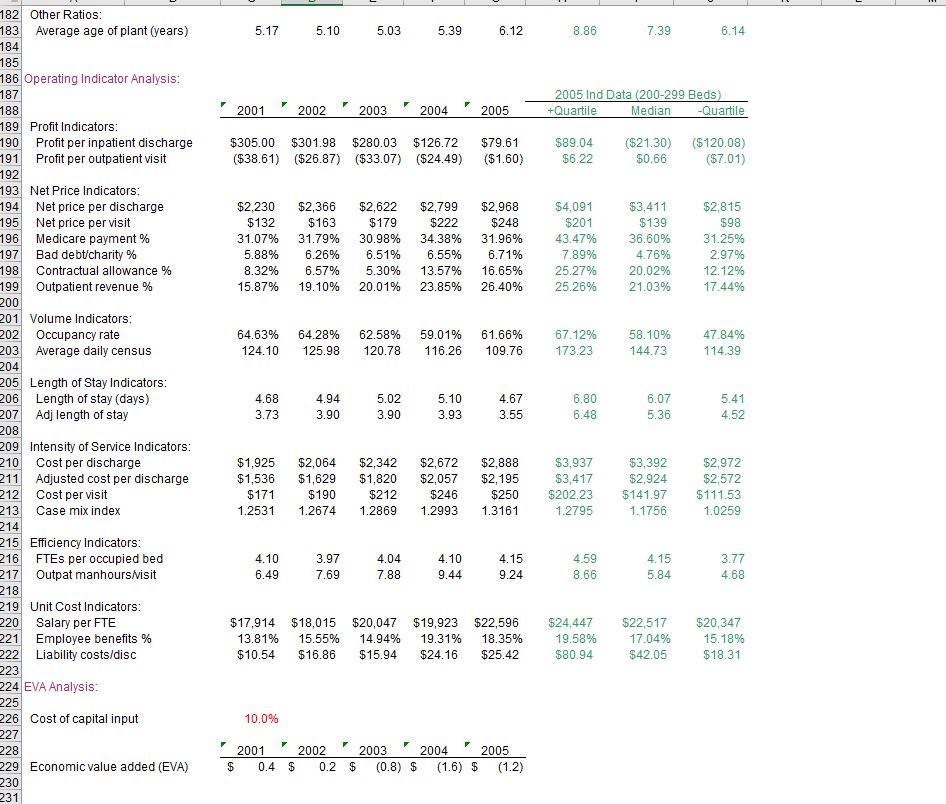

CREEKSIDE COMMUNITY HOSPITAL (A) ASSESSING HOSPITAL PERFORMANCE CREEKSIDE COMMUNITY HosPITAL is a ano-bed, not-for-profit, acute care hospital with a long-standing reputation for providing quality healthcare services to a growing service area Creekside competes with three other hospitals in its metropolitan statistical area (MSA)-two not-for-profit and one for-profit. It is the smallest of the four but has traditionally been ranked highest in patient satisfaction polls. Hospitals are accredited by the Joint Commission on Accreditation of Healthcare Organizations, an independent not-for-profit organiza- tion whose mission is to improve the safety and quality of healthcare provided to the public through accreditation and related services. (For more information on the Joint Commission, visit their web site at www.jcaho.org) Although acereditation is optional for hospitals, it is generally required to qualify for governmental (Medicare and Medic aid) reimbursement, and hence the vast majority of hospitals apply for accreditation. Creekside passed its latest Joint Commission accredita- tion with flying colors," receiving full accreditation, the highest of six accreditation categories. In recent years, competition among the four hospitals in Creeksides service area has been keen but friendly. However, a large for-proft chain recently purchased the for-profit hospital, which has resulted in some anxiety among the managers of the other three hospitals because of the chain's reputation for aggressively increasing market share in the markets they serve. 12 Cuses in Healthcare Finance You know that many healthcare providers are now using dashboards to focus on key performance indicators (KPIs). A dashboard is nothing more than a way to summarize an organization's financial and operat ing performance. Of course, the name stems from an automobile's dashboard, which contains gauges that give drivers essential information about the car's performance and operating condition. Thus, you plan to develop two dashboards, each containing no more than five KPIs. One dashboard will use financial ratios to focus on financial performance, while the other will use operating indicator ratios to focus on operating performance. You plan to present your recommendations for the con tents of these dashboards, along with the rationale for the ratios chosen, at the board meeting. Your ultimate goal is to replace the full financial and operating performance discussion at future board meetings with a limited dicussion of the KPIs. The day before your presentation, Melissa stopped you in the hallway. In addition to asking if you are ready to go, she asked whether or not management should be concerned about the hospital's annual economic value added (EVA) performance. Apparently, she just read an article in Fortune magazine that discusses this measure of managerial performance. (For more information on EVA, as well as market value added [MVA, see the Stern Stewart & Co. web site at www.eva.com.) Then she said, "By the way, our overall (corporate) cost of capital is 1o percent. You are not quite sure why she passed that information on to you, but you jotted it down just in case 10 Creekside Community Hospital (A 9 but less than $5on. Any liability award in excess of $5 million is covered by a commercial liability policy; for example, the policy pays $2 million on a $7 milion award. The hospital is currently involved in eight suits involving claims of various amounts that could ultimately be tried before juries. Although it is impossible to determine the exact potential liability in these claims, management does not believe that the settlement of these cases would have a material effect on the hospital's financial position. Assume that you have just joined the staff of Creekside Commu- nity Hospital as assistant administrator. On your first day on the job the administrator, Melissa Randolph, stated that the best way to get to know the financial and operating condition of the hospital is to do a thorough financial statementand opcrating indicator analysis; thus, she assigned you the task. Although you also believe that this is a good way lo start, you wonder whether Melissa has any ulterior motives. Perhaps the hospital is having problems and she thinks that you can spot them or perhaps she wants to test your analytical skills. Melissa is from the old school of hospital management and has been looking for someone to bring modern management methods to the hospital. In any event, she has already scheduled a financial and operating performancc analysis presentation at the next board of trustees meeting as a way for you to meet the board members. To help you structure your presentation, Melissa suggested that you make the following points: . Interpret the hospital's statements of cash flows. 3. Use ratio analysis to identify the hospital's financial 4. Use operating indicator analysis to identify the op- 5. Summarize your evaluation of the hospital's financial strengths and weaknesses. erational factors that explain the hospital's current inancial condition condiion. However, dont ust rehash the numbers; 82 Other Ratios 183 Average age of plant (years) 5.03 5.39 186 Operating Indicator Analysis 2005 Ind Data (200-299 Beds +Quartile 2001 2002 2003 2004 2005 Median 89 Profit Indicators 190 Profit per inpatient discharge 191Profit per outpatient visit 192 93 Net Price Indicators 194 Net price per discharge 195Net price per visit 1961 Medicare payment% 1971 Bad debt/charity % 1981 Contractual allowance % 199 outpatient revenue % 200 201 Volume Indicators 202 Occupancy rate 203 Average daily census $305.00 $301.98 $280.03 $126.72 $79.61 $89.04 ($21.30) ($120.08) ($7.01) ($38.61) ($26.87) (33.07) ($24.49) ($1.60) $6.22 $2,230 $2,366 $2,622 $2,799 $2,968 $4,091 $201 43.47% 7.89% 25.27% 25.26% $132 31.07% 5.88% 8.32% 15.87% 31.79% 6.26% 6.57% 19.10% $163$179 30.98% 6.51% 5.30% 20.01% $222 34.38% 6.55% 13.57% 23.85% $248 31.96% 6.71% 16.65% 26.40% $3,411 $139 36.60% 4.76% 20.02% 21.03% $2,815 $98 31.25% 2.97% 12.12% 17.44% 64.63% 67.12% 124.10 125.98 120.78 116.26 109.76 173.23 64.28% 62.58% 59.01% 61.66% 58.10% 144.73 47.84% 114.39 205 Length of Stay Indicators 206 Length of stay (days) 207 Adj length of stay 3.73 3.55 5.36 209 Intensity of Service Indicators 210 Cost per discharge 211 Adjusted cost per discharge 212Cost per visit 213 Case mix index $1,925 $2,064 $2,342 $2,672 $2,888 $3,937 $1,536 $1,629 $1,820 $2,057 $2,195 $3,417 $3,392 $2,972 $2,924 $2,572 $190 $212 $246 $250$202.23 $141.97 $111.53 1.0259 $171 1.2531 12674 1.2869 1.2993 1.3161 1.2795 1.1756 215 Efficiency Indicators 216 FTEs per occupied bed 217 Outpat manhoursMisit 4.04 4.68 219 Unit Cost Indicators 220 Salary per FTE 221 Employee benefits % 222 Liability costs/disc $17,914 $18,015 $20,047 $19,923 $22,596 $24,447 $22,517 $20,347 13.81% 15.55% 14.94% 19.31% 18.35% 19.58% 17.04% 15.18% $18.31 $10.54 $16.86 $15.94 $24.16 $25.42 $80.94 $42.05 224 EVA Analysis 226 Cost of capital input 227 10.0% 2003 $ 0.4 0.2 $ (0.8) (1.6) $ (1.2) 2001 2002 2004 2005 229 Economic value added (EVA) 230 231 CREEKSIDE COMMUNITY HOSPITAL (A) ASSESSING HOSPITAL PERFORMANCE CREEKSIDE COMMUNITY HosPITAL is a ano-bed, not-for-profit, acute care hospital with a long-standing reputation for providing quality healthcare services to a growing service area Creekside competes with three other hospitals in its metropolitan statistical area (MSA)-two not-for-profit and one for-profit. It is the smallest of the four but has traditionally been ranked highest in patient satisfaction polls. Hospitals are accredited by the Joint Commission on Accreditation of Healthcare Organizations, an independent not-for-profit organiza- tion whose mission is to improve the safety and quality of healthcare provided to the public through accreditation and related services. (For more information on the Joint Commission, visit their web site at www.jcaho.org) Although acereditation is optional for hospitals, it is generally required to qualify for governmental (Medicare and Medic aid) reimbursement, and hence the vast majority of hospitals apply for accreditation. Creekside passed its latest Joint Commission accredita- tion with flying colors," receiving full accreditation, the highest of six accreditation categories. In recent years, competition among the four hospitals in Creeksides service area has been keen but friendly. However, a large for-proft chain recently purchased the for-profit hospital, which has resulted in some anxiety among the managers of the other three hospitals because of the chain's reputation for aggressively increasing market share in the markets they serve. 12 Cuses in Healthcare Finance You know that many healthcare providers are now using dashboards to focus on key performance indicators (KPIs). A dashboard is nothing more than a way to summarize an organization's financial and operat ing performance. Of course, the name stems from an automobile's dashboard, which contains gauges that give drivers essential information about the car's performance and operating condition. Thus, you plan to develop two dashboards, each containing no more than five KPIs. One dashboard will use financial ratios to focus on financial performance, while the other will use operating indicator ratios to focus on operating performance. You plan to present your recommendations for the con tents of these dashboards, along with the rationale for the ratios chosen, at the board meeting. Your ultimate goal is to replace the full financial and operating performance discussion at future board meetings with a limited dicussion of the KPIs. The day before your presentation, Melissa stopped you in the hallway. In addition to asking if you are ready to go, she asked whether or not management should be concerned about the hospital's annual economic value added (EVA) performance. Apparently, she just read an article in Fortune magazine that discusses this measure of managerial performance. (For more information on EVA, as well as market value added [MVA, see the Stern Stewart & Co. web site at www.eva.com.) Then she said, "By the way, our overall (corporate) cost of capital is 1o percent. You are not quite sure why she passed that information on to you, but you jotted it down just in case 10 Creekside Community Hospital (A 9 but less than $5on. Any liability award in excess of $5 million is covered by a commercial liability policy; for example, the policy pays $2 million on a $7 milion award. The hospital is currently involved in eight suits involving claims of various amounts that could ultimately be tried before juries. Although it is impossible to determine the exact potential liability in these claims, management does not believe that the settlement of these cases would have a material effect on the hospital's financial position. Assume that you have just joined the staff of Creekside Commu- nity Hospital as assistant administrator. On your first day on the job the administrator, Melissa Randolph, stated that the best way to get to know the financial and operating condition of the hospital is to do a thorough financial statementand opcrating indicator analysis; thus, she assigned you the task. Although you also believe that this is a good way lo start, you wonder whether Melissa has any ulterior motives. Perhaps the hospital is having problems and she thinks that you can spot them or perhaps she wants to test your analytical skills. Melissa is from the old school of hospital management and has been looking for someone to bring modern management methods to the hospital. In any event, she has already scheduled a financial and operating performancc analysis presentation at the next board of trustees meeting as a way for you to meet the board members. To help you structure your presentation, Melissa suggested that you make the following points: . Interpret the hospital's statements of cash flows. 3. Use ratio analysis to identify the hospital's financial 4. Use operating indicator analysis to identify the op- 5. Summarize your evaluation of the hospital's financial strengths and weaknesses. erational factors that explain the hospital's current inancial condition condiion. However, dont ust rehash the numbers; 82 Other Ratios 183 Average age of plant (years) 5.03 5.39 186 Operating Indicator Analysis 2005 Ind Data (200-299 Beds +Quartile 2001 2002 2003 2004 2005 Median 89 Profit Indicators 190 Profit per inpatient discharge 191Profit per outpatient visit 192 93 Net Price Indicators 194 Net price per discharge 195Net price per visit 1961 Medicare payment% 1971 Bad debt/charity % 1981 Contractual allowance % 199 outpatient revenue % 200 201 Volume Indicators 202 Occupancy rate 203 Average daily census $305.00 $301.98 $280.03 $126.72 $79.61 $89.04 ($21.30) ($120.08) ($7.01) ($38.61) ($26.87) (33.07) ($24.49) ($1.60) $6.22 $2,230 $2,366 $2,622 $2,799 $2,968 $4,091 $201 43.47% 7.89% 25.27% 25.26% $132 31.07% 5.88% 8.32% 15.87% 31.79% 6.26% 6.57% 19.10% $163$179 30.98% 6.51% 5.30% 20.01% $222 34.38% 6.55% 13.57% 23.85% $248 31.96% 6.71% 16.65% 26.40% $3,411 $139 36.60% 4.76% 20.02% 21.03% $2,815 $98 31.25% 2.97% 12.12% 17.44% 64.63% 67.12% 124.10 125.98 120.78 116.26 109.76 173.23 64.28% 62.58% 59.01% 61.66% 58.10% 144.73 47.84% 114.39 205 Length of Stay Indicators 206 Length of stay (days) 207 Adj length of stay 3.73 3.55 5.36 209 Intensity of Service Indicators 210 Cost per discharge 211 Adjusted cost per discharge 212Cost per visit 213 Case mix index $1,925 $2,064 $2,342 $2,672 $2,888 $3,937 $1,536 $1,629 $1,820 $2,057 $2,195 $3,417 $3,392 $2,972 $2,924 $2,572 $190 $212 $246 $250$202.23 $141.97 $111.53 1.0259 $171 1.2531 12674 1.2869 1.2993 1.3161 1.2795 1.1756 215 Efficiency Indicators 216 FTEs per occupied bed 217 Outpat manhoursMisit 4.04 4.68 219 Unit Cost Indicators 220 Salary per FTE 221 Employee benefits % 222 Liability costs/disc $17,914 $18,015 $20,047 $19,923 $22,596 $24,447 $22,517 $20,347 13.81% 15.55% 14.94% 19.31% 18.35% 19.58% 17.04% 15.18% $18.31 $10.54 $16.86 $15.94 $24.16 $25.42 $80.94 $42.05 224 EVA Analysis 226 Cost of capital input 227 10.0% 2003 $ 0.4 0.2 $ (0.8) (1.6) $ (1.2) 2001 2002 2004 2005 229 Economic value added (EVA) 230 231

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts