Question: For this case, we will analyze the available computers that can provide the server function necessary to make this interlinking available and successful. The first

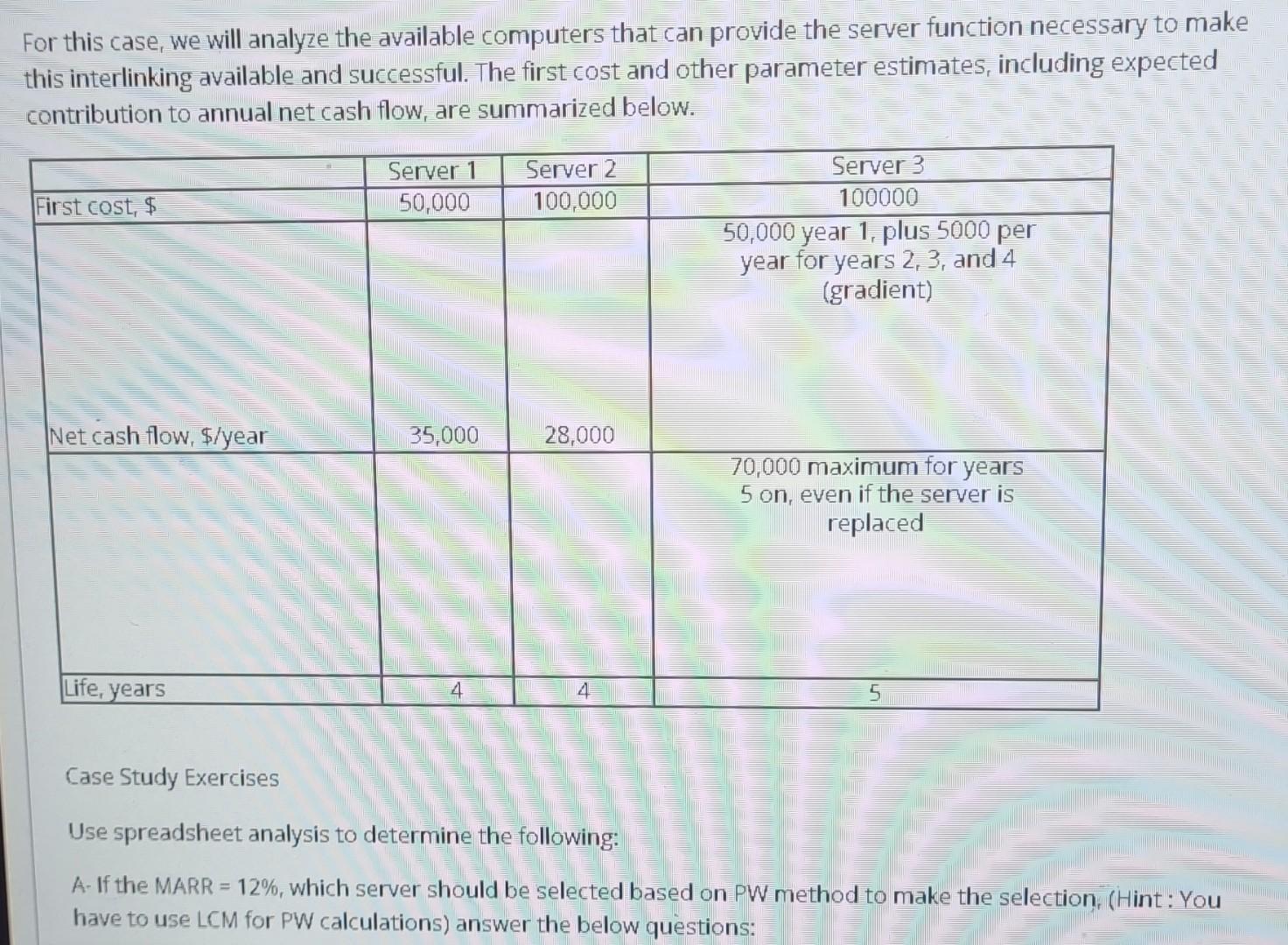

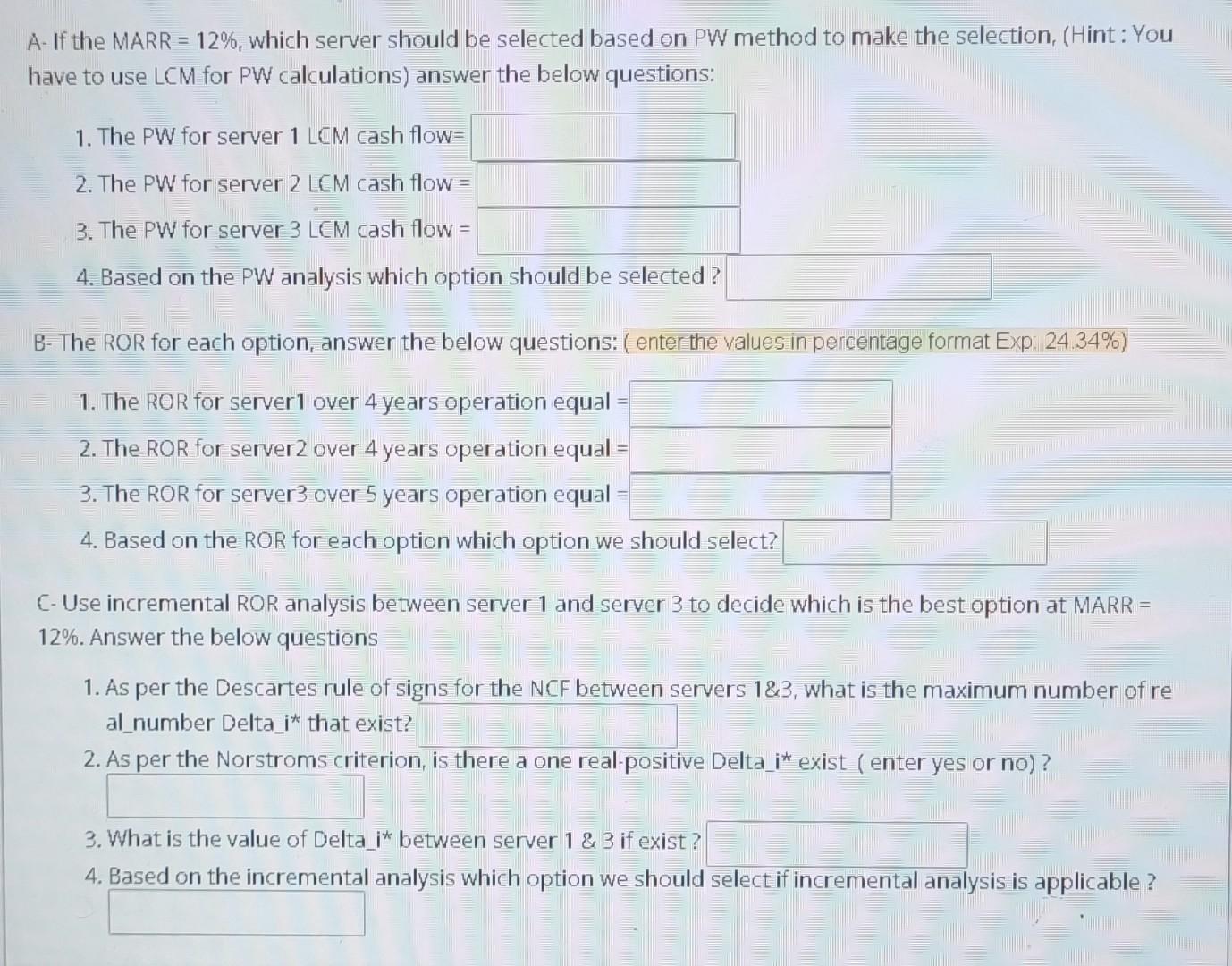

For this case, we will analyze the available computers that can provide the server function necessary to make this interlinking available and successful. The first cost and other parameter estimates, including expected contribution to annual net cash flow, are summarized below. Case Study Exercises Use spreadsheet analysis to determine the following: A. If the MARR =12%, which server should be selected based on PW method to make the selection, (Hint: You have to use LCM for PW calculations) answer the below questions: A- If the MARR =12%, which server should be selected based on PW method to make the selection, (Hint: You have to use LCM for PW calculations) answer the below questions: 1. The PW for server 1LCM cash flow= 2. The PW for server 2LCM cash flow = 3. The PW for server 3LCM cash flow = 4. Based on the PW analysis which option should be selected? B- The ROR for each option, answer the below questions: ( enter the values in percentage format Exp: 24.34\%) 1. The ROR for server 1 over 4 years operation equal = 2. The ROR for server2 over 4 years operation equal = 3. The ROR for server 3 over 5 years operation equal = 4. Based on the ROR for each option which option we should select? C- Use incremental ROR analysis between server 1 and server 3 to decide which is the best option at MARR = 12%. Answer the below questions 1. As per the Descartes rule of signs for the NCF between servers 1&3, what is the maximum number of re al_number Delta_i* that exist? 2. As per the Norstroms criterion, is there a one real-positive Delta_i* exist (enter yes or no)? 3. What is the value of Delta i between server 1&3 if exist ? 4. Based on the incremental analysis which option we should select if incremental analysis is applicable? For this case, we will analyze the available computers that can provide the server function necessary to make this interlinking available and successful. The first cost and other parameter estimates, including expected contribution to annual net cash flow, are summarized below. Case Study Exercises Use spreadsheet analysis to determine the following: A. If the MARR =12%, which server should be selected based on PW method to make the selection, (Hint: You have to use LCM for PW calculations) answer the below questions: A- If the MARR =12%, which server should be selected based on PW method to make the selection, (Hint: You have to use LCM for PW calculations) answer the below questions: 1. The PW for server 1LCM cash flow= 2. The PW for server 2LCM cash flow = 3. The PW for server 3LCM cash flow = 4. Based on the PW analysis which option should be selected? B- The ROR for each option, answer the below questions: ( enter the values in percentage format Exp: 24.34\%) 1. The ROR for server 1 over 4 years operation equal = 2. The ROR for server2 over 4 years operation equal = 3. The ROR for server 3 over 5 years operation equal = 4. Based on the ROR for each option which option we should select? C- Use incremental ROR analysis between server 1 and server 3 to decide which is the best option at MARR = 12%. Answer the below questions 1. As per the Descartes rule of signs for the NCF between servers 1&3, what is the maximum number of re al_number Delta_i* that exist? 2. As per the Norstroms criterion, is there a one real-positive Delta_i* exist (enter yes or no)? 3. What is the value of Delta i between server 1&3 if exist ? 4. Based on the incremental analysis which option we should select if incremental analysis is applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts