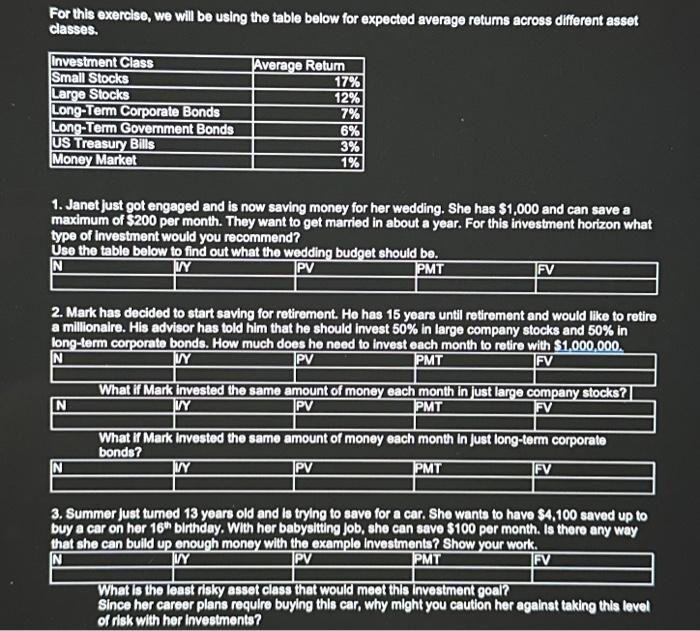

Question: For this exercise, we will be using the table below for expected average retums across different asset classes. 4. James is saving up for the

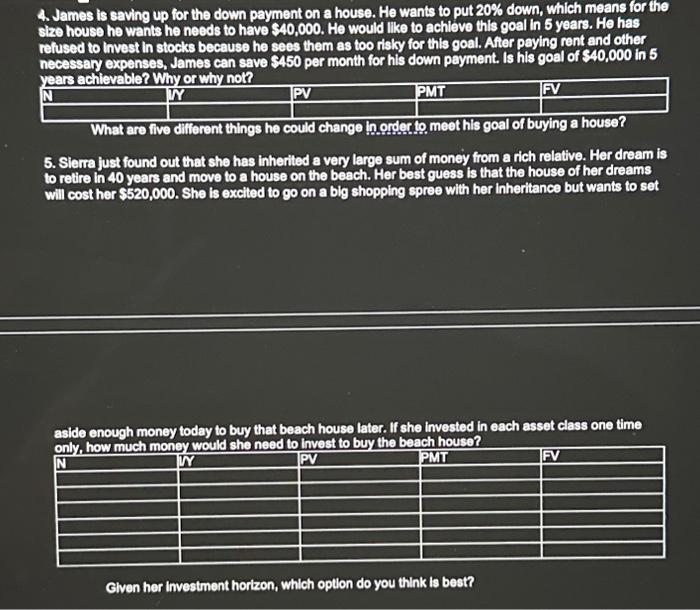

For this exercise, we will be using the table below for expected average retums across different asset classes. 4. James is saving up for the down payment on a house. He wants to put 20% down, which means for the sizo house he wants he needs to have $40,000. Ho would like to achleve this goal in 5 years. He has refused to invest in stocks because he sees them as too risky for this goal. After paying rent and other necessary expenses. James can save $450 per month for his down payment. Is his goal of $40,000 in 5 years achlevable? Why or why not? \begin{tabular}{|l|l|l|} \hline years achlevable? Why or why not? & TMT & FV \\ \hline \end{tabular} What are five difiorent things he could change ing order to meet his goal of buying a house? 5. Sierra just found out that she has inherited a very large sum of money from a rich relative. Her dream is to retire in 40 years and move to a house on the beach. Her best guess is that the house of her dreams will cost her $520,000. She is excited to go on a big shopping spree with her inheritance but wants to set aside enough money today to buy that beach house later. If she invested in each asset class one time Given her investment horkon, which option do you think is best

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts