Question: For this module week's assignment, use the spreadsheet you created in 6.4 Assignment: Taxes and Depreciation. Update the spreadsheet by adding the financing component (calculation

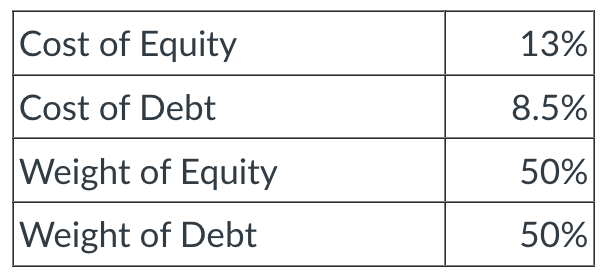

For this module week's assignment, use the spreadsheet you created in 6.4 Assignment: Taxes and Depreciation. Update the spreadsheet by adding the financing component (calculation of WACC) for the model. In other words, instead of the model simply having an input that is the value of "r," users should input information about the capital structure of the firm or project. The cost of debt, the cost of equity for the firm, the weight of each, and WACC should be calculated and used in the calculations of the model. Use the data to calculate the value of r. Use the calculated value of r and calculate the NPV. Be sure to include instructions for other users.

For your submission, the only additional data that will be needed to add to your model is:

Other data, such as the tax rate, has already been provided.

Tab 1 should be as described above. Tab 2 should be a ready-to-use generic version of the model that can be used for similar analysis. Make sure your model includes instructions and clearly identifies where users would provide inputs.

\begin{tabular}{|l|r|} \hline Cost of Equity & 13% \\ \hline Cost of Debt & 8.5% \\ \hline Weight of Equity & 50% \\ \hline Weight of Debt & 50% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts