Question: For this module, you have a commercial loan case study to analyze and report on. The balance sheet and income statement for Netflix (NFLX) from

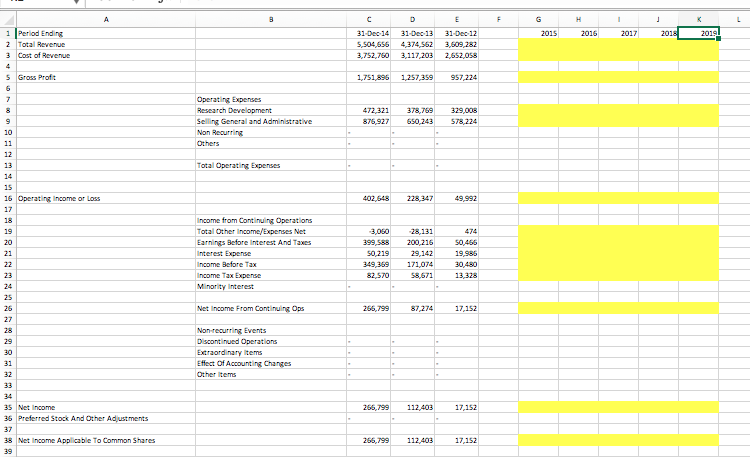

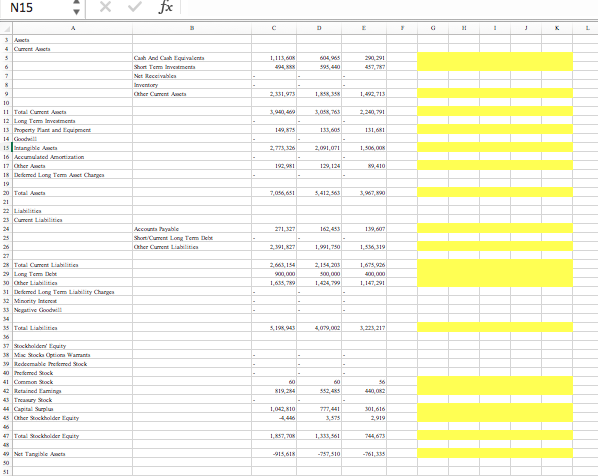

For this module, you have a commercial loan case study to analyze and report on. The balance sheet and income statement for Netflix (NFLX) from 2012-2014 are attached. There are multiple parts to the project:

- Complete pro forma statements for the years 2015-2019, assuming an 8% growth rate for all line items. The cells that need to be completed are shaded in yellow.

- The management of Netflix has approached your bank about borrowing $50,000,000 dollars in the form of a long-term bond. The bond would have a 30-year maturity and an 8% coupon rate. The first step is to calculate what the interest expense would be for this bond for Netflix on a monthly basis. Next, discuss what areas of the income statement and balance sheet would be impacted by this new debt and how. Finally, write a one page recommendation to your credit committee regarding the approval of this loan.

1 Period Ending 2 Total Revenue 3 Cost of Revenue 31-Dec 14 31-Deo 13 31-De 12 5,504,555 4,374,552 3,809,282 3,752,760 3,117,203 2,552,058 2017 Gross Proft 1,751,895 1,257,359957 224 Operating Expenses Research Development elnGeneral and Admi nistrative Non Recurring 72,31 378,759 329,008 876927 50,243578,224 16 Operatincoe or Loss 02,548228,347 49,992 ncome from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense ncome Before Tax Income Tax Expense 3,00 28,131 9,142 19.985 71,074 30,480 2,570 58,67113,328 349,391 Net Income From Continuing Ops 6,799 8727417,152 Non-recurring Events Extraordinary Items Effect Of Accountling Changes Other tems 35 Net Income 36 Preferred Stock And Other Adjustments 255,799112,40317,152 38 Net Inome Ap able To Common Share 255,799112,40317,152 N15 nventory 13 Phopcrty Hart and Equpmert 412 63 154 203 900 000 19%,943 1 Period Ending 2 Total Revenue 3 Cost of Revenue 31-Dec 14 31-Deo 13 31-De 12 5,504,555 4,374,552 3,809,282 3,752,760 3,117,203 2,552,058 2017 Gross Proft 1,751,895 1,257,359957 224 Operating Expenses Research Development elnGeneral and Admi nistrative Non Recurring 72,31 378,759 329,008 876927 50,243578,224 16 Operatincoe or Loss 02,548228,347 49,992 ncome from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense ncome Before Tax Income Tax Expense 3,00 28,131 9,142 19.985 71,074 30,480 2,570 58,67113,328 349,391 Net Income From Continuing Ops 6,799 8727417,152 Non-recurring Events Extraordinary Items Effect Of Accountling Changes Other tems 35 Net Income 36 Preferred Stock And Other Adjustments 255,799112,40317,152 38 Net Inome Ap able To Common Share 255,799112,40317,152 N15 nventory 13 Phopcrty Hart and Equpmert 412 63 154 203 900 000 19%,943

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts