Question: For this part, use first and second set, i.e. total of 12 Treasuries 4. a)Using regression methods, extract zero coupon bonds. (Note: Force the intercept

For this part, use first and second set, i.e. total of 12 Treasuries 4.

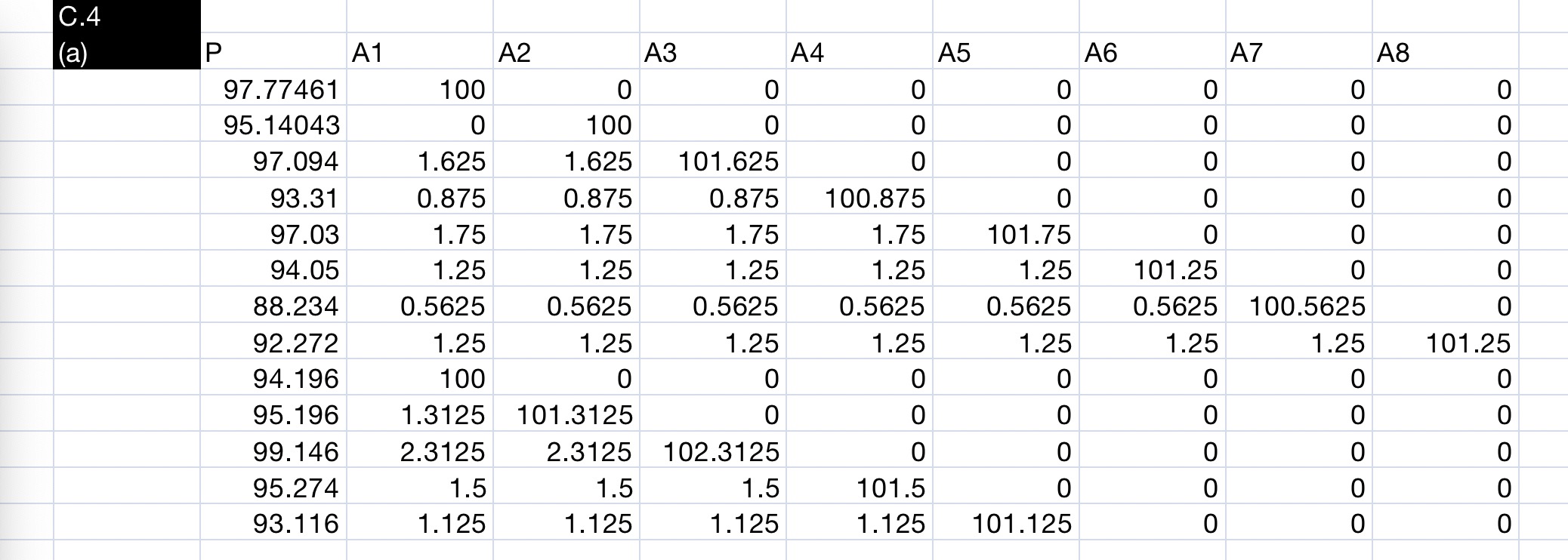

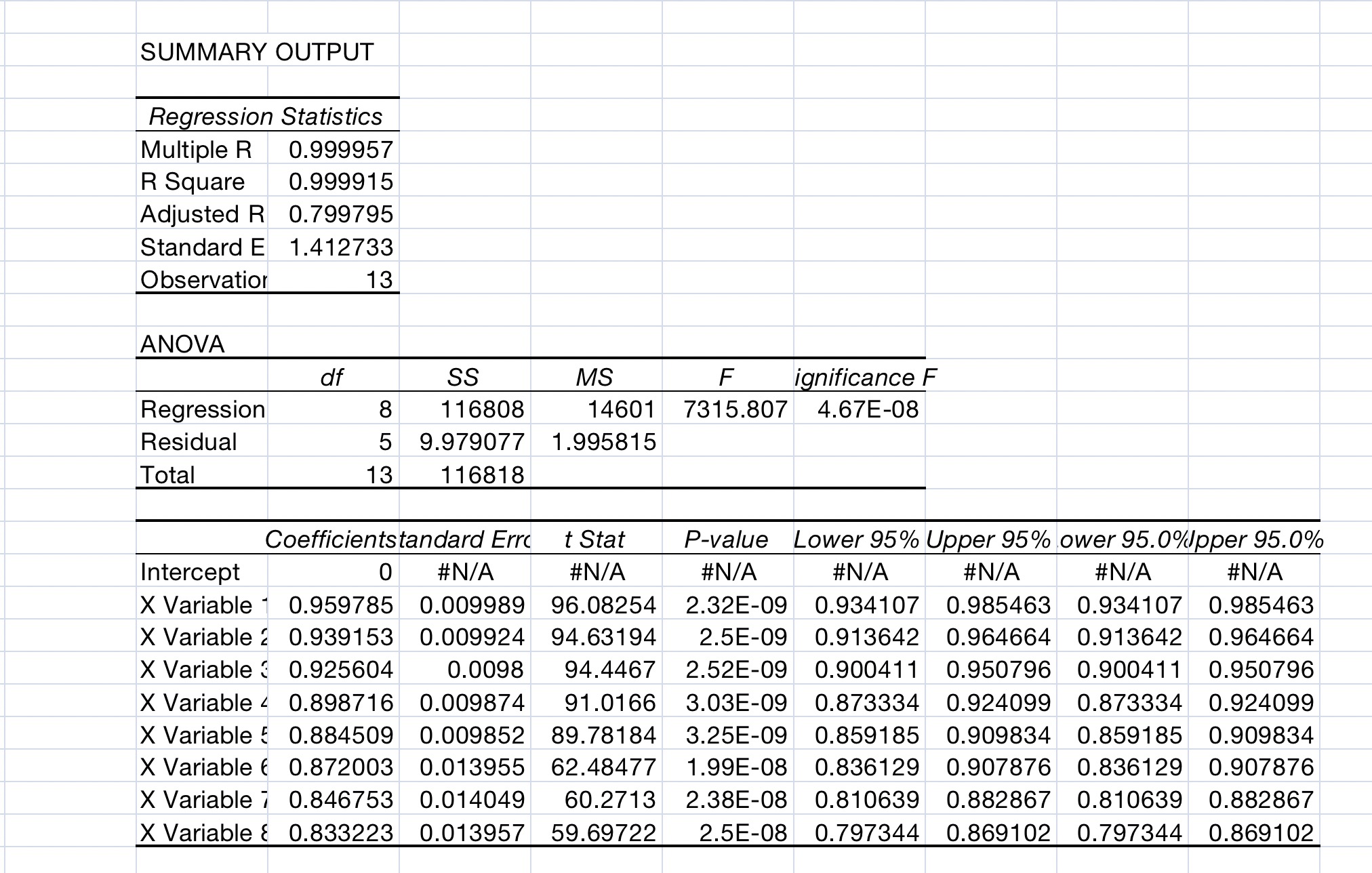

a)Using regression methods, extract zero coupon bonds. (Note: Force the intercept to zero in the regression).

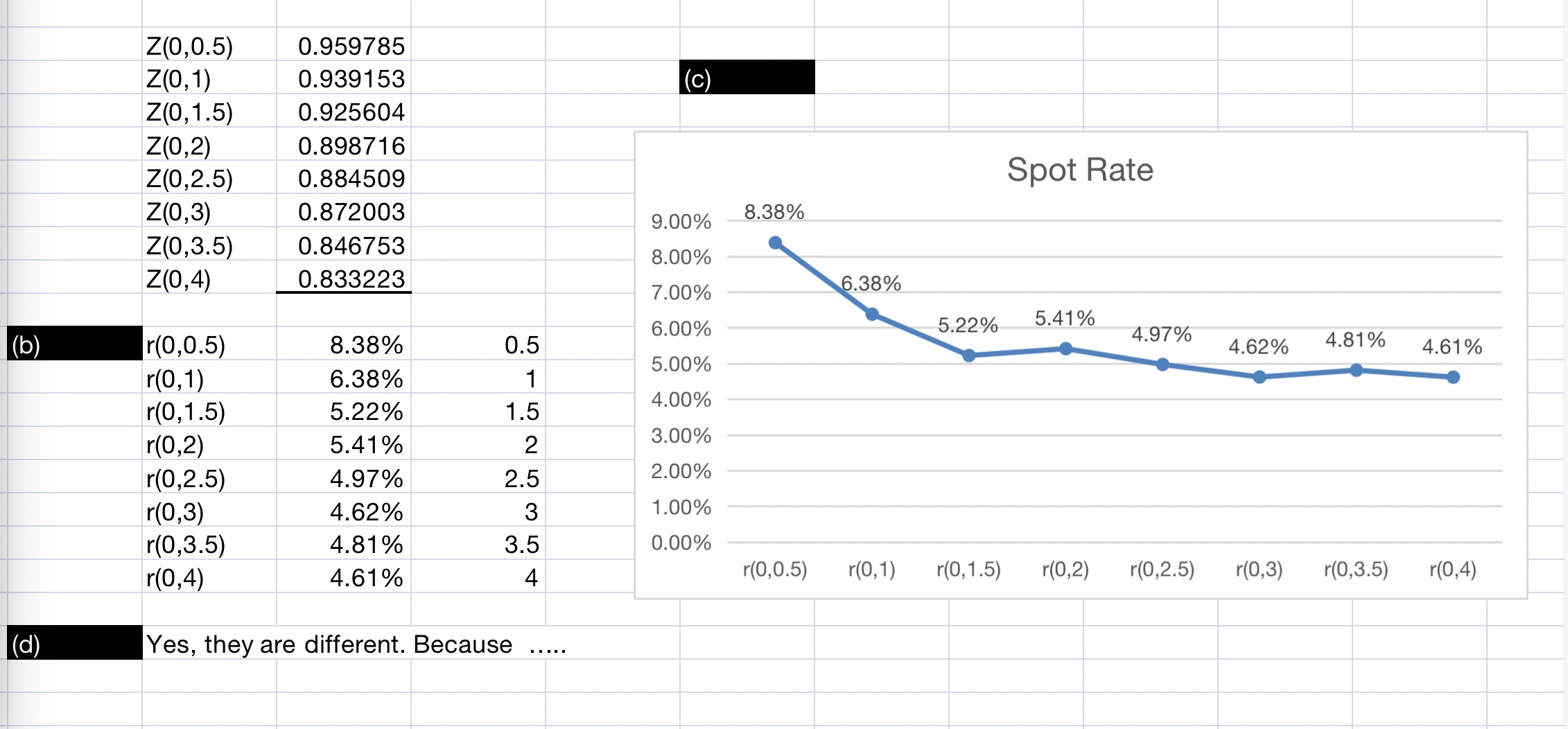

b) Calculate 6 month spot rates

c) Plot the spot rate curve

All the above steps have been completed. See attachedimagesl for details

My question:

d) Compare the spot rates with the ones you found by bootstrapping. Are they different? Why? Why not?

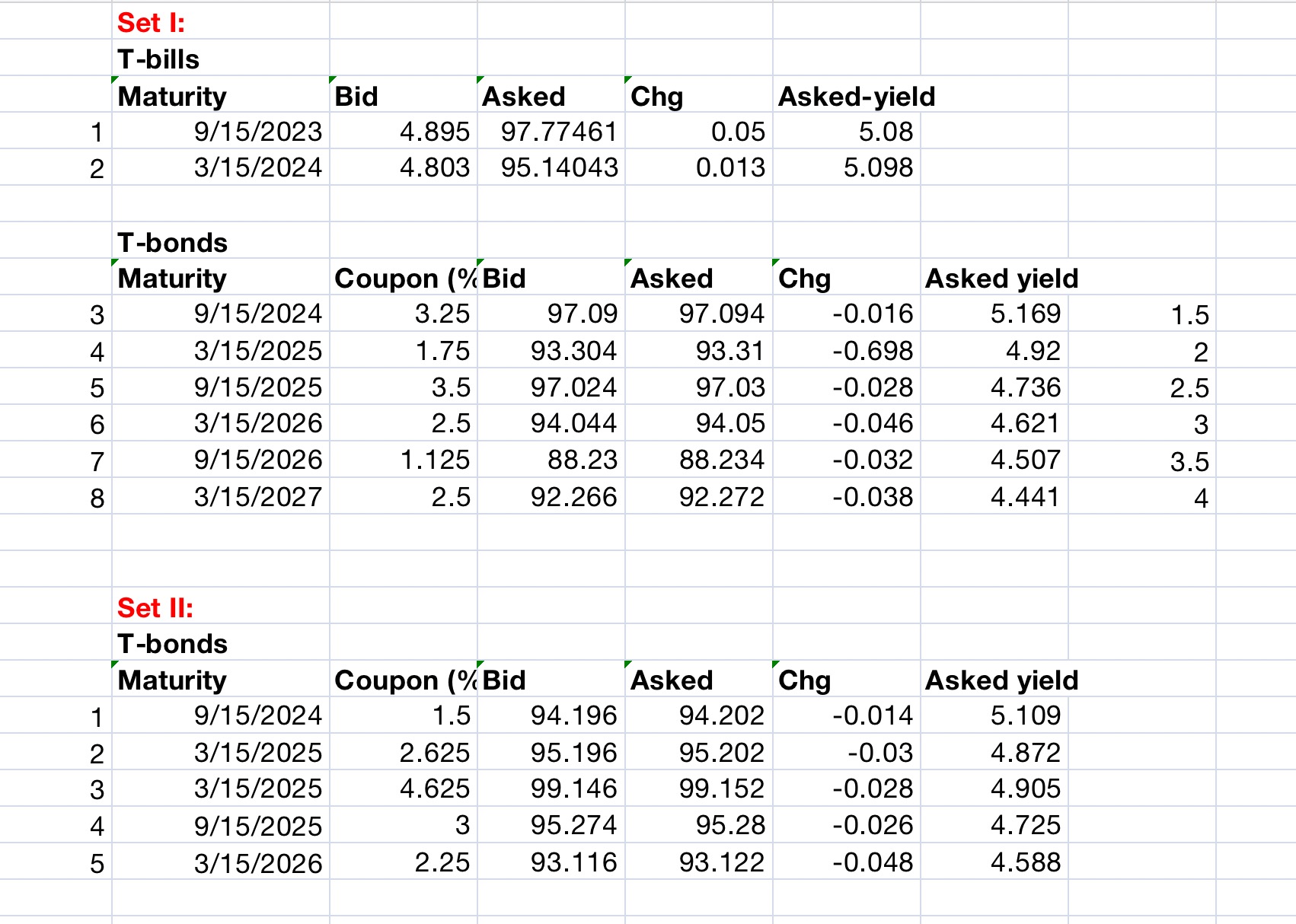

Set I: T-bills Maturity Bid Asked Chg Asked-yield 9/15/2023 4.895 97.77461 0.05 5.08 2 3/15/2024 4.803 95. 14043 0.013 5.098 T-bonds Maturity Coupon (% Bid Asked Chg Asked yield 3 9/15/2024 3.25 97.09 97.094 -0.016 5.169 1.5 4 3/15/2025 1.75 93.304 93.31 -0.698 4.92 2 5 9/15/2025 3.5 97.024 97.03 -0.028 4.736 2.5 6 3/15/2026 2.5 94.044 94.05 -0.046 4.621 3 7 9/15/2026 1.125 88.23 88.234 -0.032 4.507 3.5 8 3/15/2027 2.5 92.266 92.272 -0.038 4.441 4 Set II: T-bonds Maturity Coupon (/ Bid Asked Chg Asked yield 9/15/2024 1.5 94. 196 94.202 -0.014 5.109 3/15/2025 2.625 95. 196 95.202 -0.03 4.872 3 3/15/2025 4.625 99.146 99.152 -0.028 4.905 4 9/15/2025 3 95.274 95.28 -0.026 4.725 5 3/15/2026 2.25 93.116 93.122 -0.048 4.588\fSUMMARY OUTPUT Regression Statistics Multiple R 0.999957 R Square 0.999915 Adjusted R 0.799795 Standard E 1.412733 Observation 13 ANOVA df SS MS F ignificance F Regression 8 116808 14601 7315.807 4.67E-08 Residual 5 9.979077 1.995815 Total 13 116818 Coefficientstandard Erro t Stat P-value Lower 95% Upper 95% ower 95.0upper 95.0% Intercept 0 #N/A #N/A #N/A #N/A #N/A #N/A #N/A X Variable - 0.959785 0.009989 96.08254 2.32E-09 0.934107 0.985463 0.934107 0.985463 X Variable 2 0.939153 0.009924 94.63194 2.5E-09 0.913642 0.964664 0.913642 0.964664 X Variable 3 0.925604 0.0098 94.4467 2.52E-09 0.900411 0.950796 0.900411 0.950796 X Variable 4 0.898716 0.009874 91.0166 3.03E-09 0.873334 0.924099 0.873334 0.924099 X Variable 5 0.884509 0.009852 89.78184 3.25E-09 0.859185 0.909834 0.859185 0.909834 X Variable ( 0.872003 0.013955 62.48477 1.99E-08 0.836129 0.907876 0.836129 0.907876 X Variable 7 0.846753 0.014049 60.2713 2.38E-08 0.810639 0.882867 0.810639 0.882867 X Variable & 0.833223 0.013957 59.69722 2.5E-08 0.797344 0.869102 0.797344 0.869102Z(0,0.5) 0.959785 Z(0, 1) 0.939153 c Z(0, 1.5) 0.925604 Z(0, 2) 0.898716 Z(0, 2.5) 0.884509 Spot Rate Z(0, 3) 0.872003 9.00% 8.38% Z(0,3.5) 0.846753 8.00% Z(0,4) 0.833223 7.00% 6.38% 6.00% 5.22% 5.41% (b) r(0,0.5) 8.38% 0.5 4.97% 4.62% 4.81% 4.61% 5.00% r(0, 1) 6.38% 1 r(0, 1.5) 5.22% 1.5 4.00% r(0,2) 5.41% 2 3.00% r(0,2.5) 4.97% 2.5 2.00% r(0, 3) 4.62% 3 1.00% r(0,3.5) 4.81% 3.5 0.00% r(0,4) 4.61% 4 r(0,0.5) r(0, 1) r(0, 1.5) r(0,2) r(0,2.5) r(0,3) r(0,3.5) r(0,4) d Yes, they are different. Because