Question: . For this problem assume that it is possible to borrow and lend risklessly at a rate of 4%. Also assume that the expected return

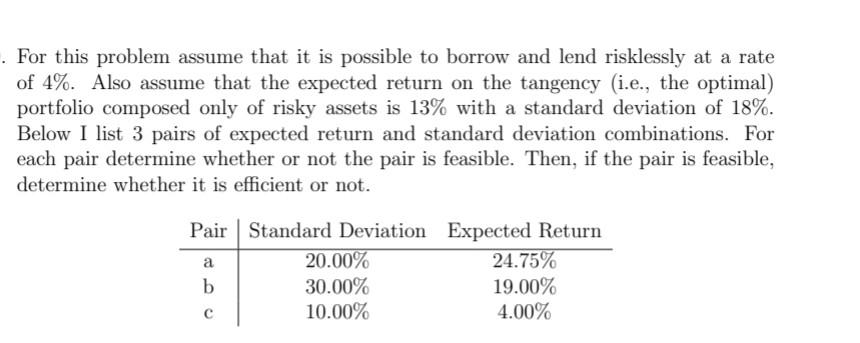

. For this problem assume that it is possible to borrow and lend risklessly at a rate of 4%. Also assume that the expected return on the tangency (i.e., the optimal) portfolio composed only of risky assets is 13% with a standard deviation of 18%. Below I list 3 pairs of expected return and standard deviation combinations. For each pair determine whether or not the pair is feasible. Then, if the pair is feasible, determine whether it is efficient or not. a Pair Standard Deviation Expected Return 20.00% 24.75% b 30.00% 19.00% 10.00% 4.00%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock