Question: For this problem do not round any intermediate computations round your answer to the nearest dollar. Please and thanks = Question 19 of 25 (1

For this problem do not round any intermediate computations round your answer to the nearest dollar. Please and thanks

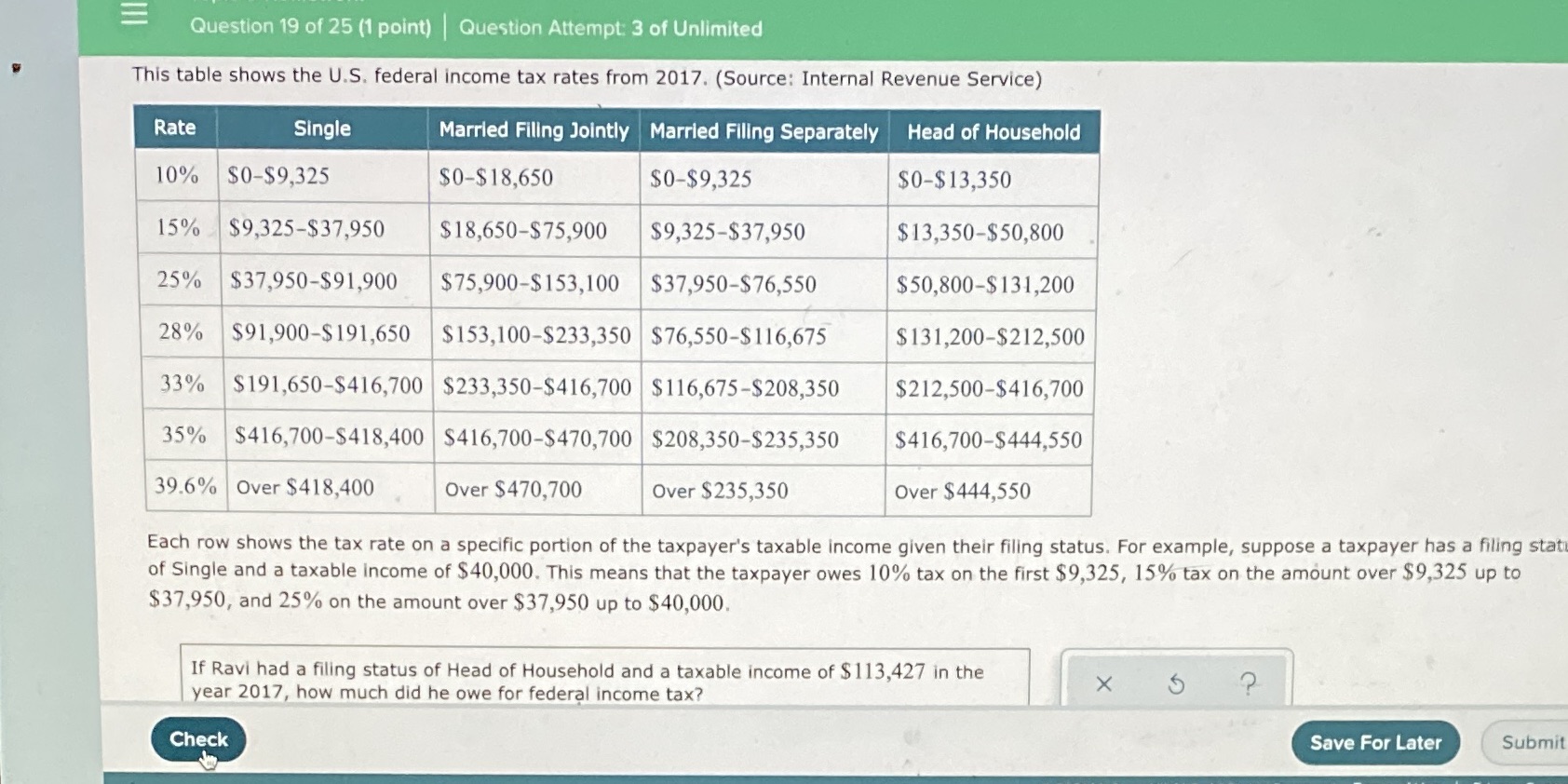

= Question 19 of 25 (1 point) | Question Attempt: 3 of Unlimited This table shows the U.S. federal income tax rates from 2017. (Source: Internal Revenue Service) Rate Single Married Filing Jointly Married Filing Separately Head of Household 10% $0-$9,325 $0-$18,650 $0-$9,325 $0-$13,350 15% $9,325-$37,950 $18,650-$75,900 $9,325-$37,950 $13,350-$50,800 25% $37,950-$91,900 $75,900-$153,100 $37,950-$76,550 $50,800-$131,200 28% $91,900-$191,650 $153,100-$233,350 $76,550-$116,675 $131,200-$212,500 33% $191,650-$416,700 $233,350-$416,700 $116,675-$208,350 $212,500-$416,700 35% $416,700-$418,400 $416,700-$470,700 $208,350-$235,350 $416,700-$444,550 39.6% Over $418,400 Over $470,700 Over $235,350 Over $444,550 Each row shows the tax rate on a specific portion of the taxpayer's taxable income given their filing status. For example, suppose a taxpayer has a filing stat of Single and a taxable income of $40,000. This means that the taxpayer owes 10% tax on the first $9,325, 15% tax on the amount over $9,325 up to $37,950, and 25% on the amount over $37,950 up to $40,000. If Ravi had a filing status of Head of Household and a taxable income of $113,427 in the year 2017, how much did he owe for federal income tax? X 5 Check Save For Later Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts