Question: For this problem I used the approximate YTM formula and put the following into my calculator: (70+(1000-1050)/20)/(.4(1000)+.6(1050)) and gor 6.55% however the answer is 6.54%

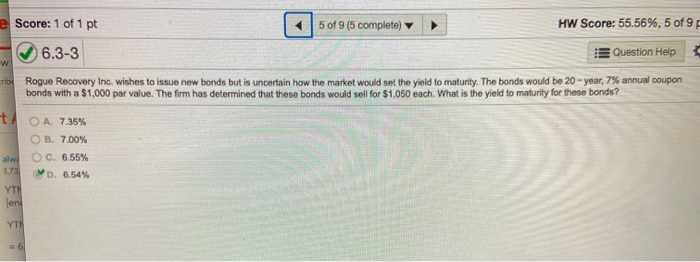

Score: 1 of 1 pt so1915 comments HW Score: 55.56%, 5 of 9 6.3-3 E Question Help Rogue Recovery Inc. wishes to issue new bonds but is uncertain how the market would set the yield to maturity. The bonds would be 20-year, 7% annual coupon bonds with a $1.000 par value. The firm has determined that these bonds would sell for $1.050 each. What is the yield to maturity for these bonds? O A. 7.35% OB. 7.00% alw0 6.55% 173 . 6.54% YTH len YTA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts