Question: For this problem, please answer TRUE or FALSE for each statement concerning the Black-Scholes option pricing theory. The value of a European call option Ce(St)

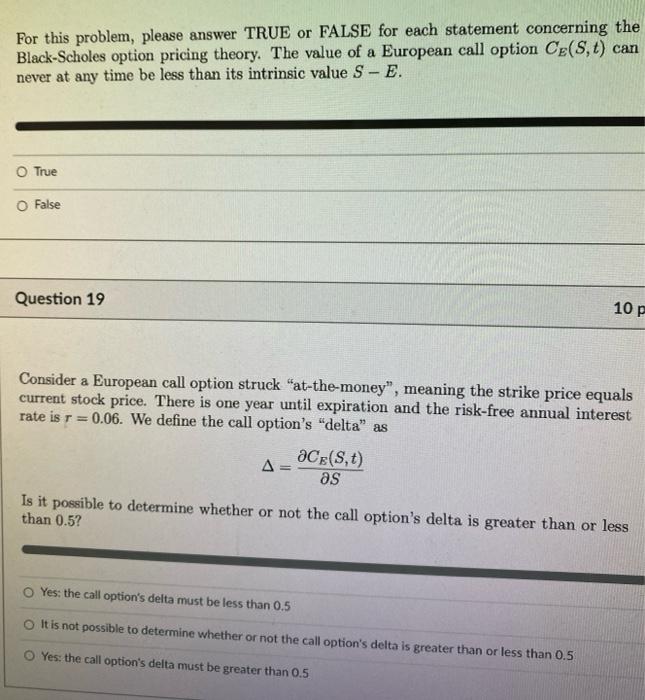

For this problem, please answer TRUE or FALSE for each statement concerning the Black-Scholes option pricing theory. The value of a European call option Ce(St) can never at any time be less than its intrinsic value S-E. O True O False Question 19 10 p Consider a European call option struck at-the-money", meaning the strike price equals current stock price. There is one year until expiration and the risk-free annual interest rate is r = 0.06. We define the call option's "delta" as ace(S,t) as -- Is it possible to determine whether or not the call option's delta is greater than or less than 0.5? Yes: the call option's delta must be less than 0.5 It is not possible to determine whether or not the call option's delta is greater than or less than 0.5 Yes: the call option's delta must be greater than 0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts