Question: for this Question 7 3 pts Gabby is planning a divorce, the terms of which will be settled in 2020. Under the expected terms of

for this

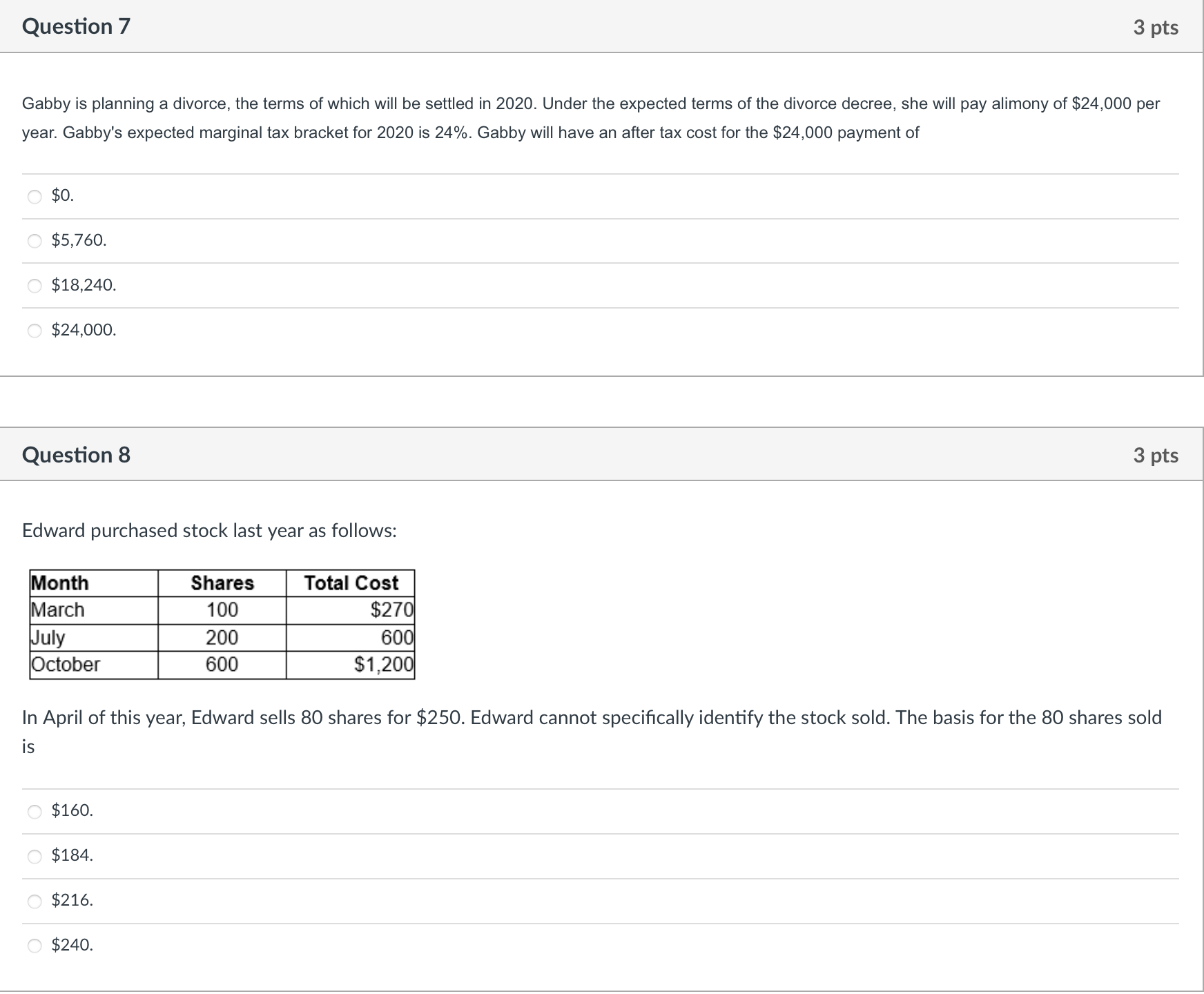

Question 7 3 pts Gabby is planning a divorce, the terms of which will be settled in 2020. Under the expected terms of the divorce decree, she will pay alimony of $24,000 per year. Gabby's expected marginal tax bracket for 2020 is 24%. Gabby will have an after tax cost for the $24,000 payment of ' $0. ' $5,760. " $18,240. " $24,000. Question 8 3 pts Edward purchased stock last year as follows: Total Cost In April of this year, Edward sells 80 shares for $250. Edward cannot specically identify the stock sold. The basis for the 80 shares sold is ' $160. " $184. ' $216. ' $240

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock