Question: For this question (answer provided) can someone explain to me what fA stands for and exactly how 1,040,105 was calculated for PV of future cash

For this question (answer provided) can someone explain to me what "fA" stands for and exactly how 1,040,105 was calculated for PV of future cash flows (equation in steps)

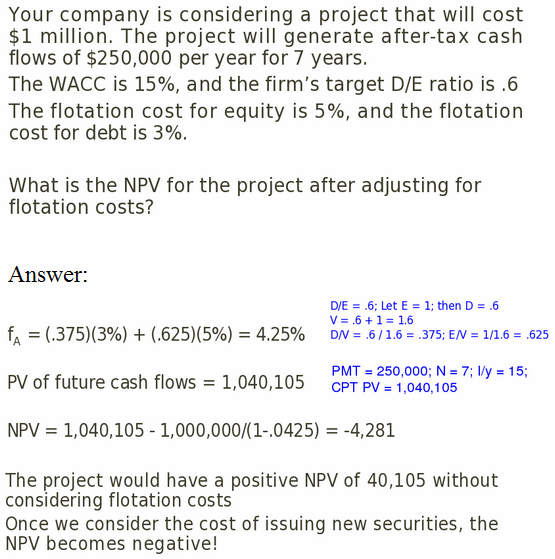

Your company is considering a project that will cost $1 million. The project will generate after-tax cash flows of $250,000 per year for 7 years. The WACC is 15%, and the firm's target D/E ratio is .6 The flotation cost for equity is 5%, and the flotation cost for debt is 3%. What is the NPV for the project after adjusting for flotation costs? Answer: D/E = .6; Let E = 1; then D = .6 fA = (375)(3%) + (.625)(5%) = 4.25% DN= .6/1.62 .375; EN= 1/1.6 = .625 PV of future cash flows = 1,040,105 CPT PV = 1,040,105 NPV = 1,040,105-1,000,000/(1-.0425) =-4,281 PMT 250,000; N-7; Vy = 15; The project would have a positive NPV of 40,105 without considering flotation costs Once we consider the cost of issuing new securities, the NPV becomes negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts