Question: For this question, do not round your depreciation rate. However, when necessary, round the depreciation expense to the nearest dollar. Enter all numbers as positive

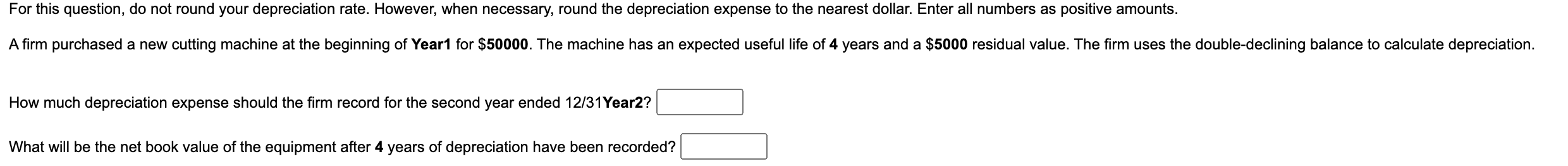

For this question, do not round your depreciation rate. However, when necessary, round the depreciation expense to the nearest dollar. Enter all numbers as positive amounts. A firm purchased a new cutting machine at the beginning of Year1 for $50000. The machine has an expected useful life of 4 years and a $5000 residual value. The firm uses the double-declining balance to calculate depreciation. How much depreciation expense should the firm record for the second year ended 12/31 Year2? What will be the net book value of the equipment after 4 years of depreciation have been recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts