Question: For this question please consider a 1 0 y r Fixed rate K deal with 1 bn in underlying loans. All loans are 1 0

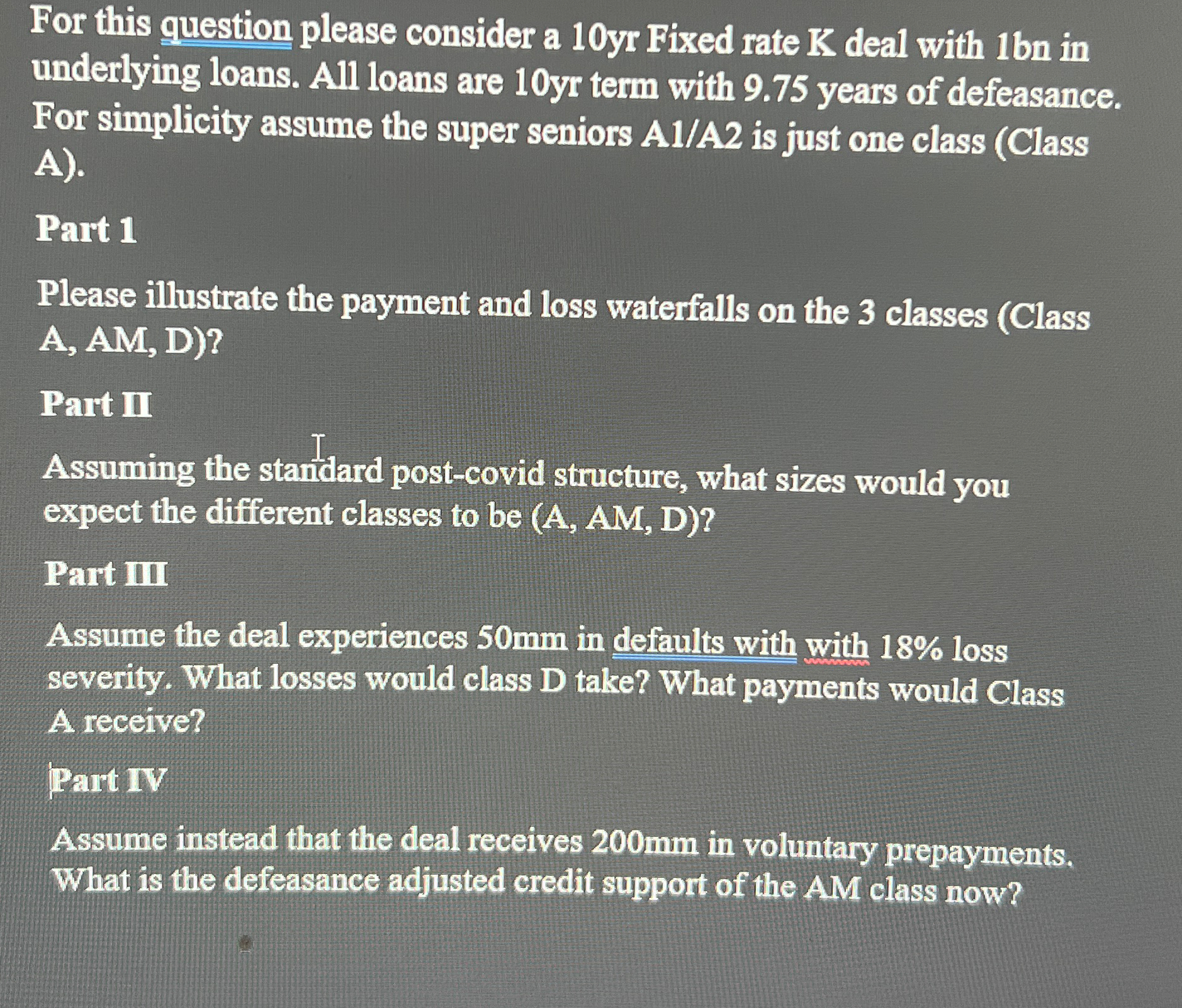

For this question please consider a Fixed rate deal with bn in underlying loans. All loans are term with years of defeasance. For simplicity assume the super seniors AA is just one class Class A

Part

Please illustrate the payment and loss waterfalls on the classes Class

Part III

Assuming the standard postcovid structure, what sizes would you expect the different classes to be

Part III

Assume the deal experiences in defaults with with loss severity. What losses would class D take? What payments would Class A receive?

Part IV

Assume instead that the deal recsives in voluntary prepayments. What is the defeasance adjusted credit support of the AM class now?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock