Question: for this question please find the correlation between stocks x&z and y&z? 51. The market expected return is 14 percent with a standard deviation of

for this question please find the correlation between stocks x&z and y&z?

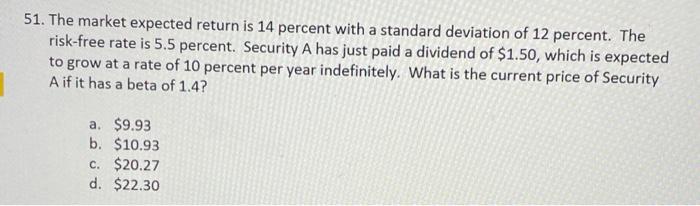

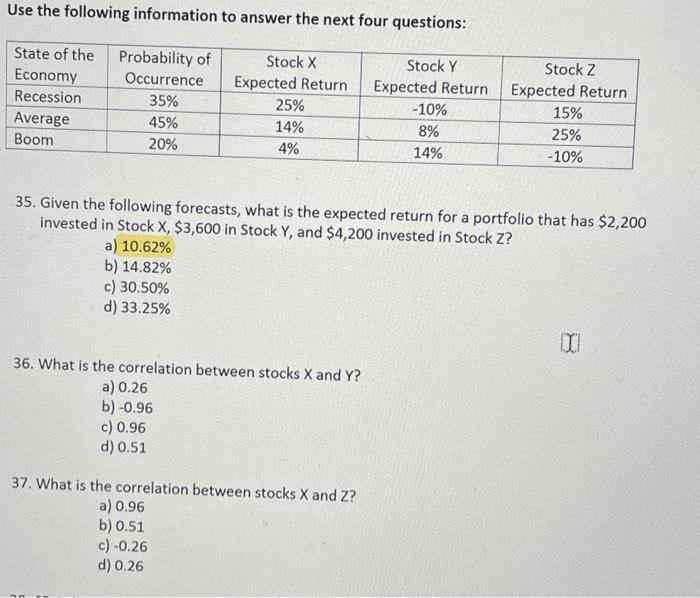

for this question please find the correlation between stocks x&z and y&z?51. The market expected return is 14 percent with a standard deviation of 12 percent. The risk-free rate is 5.5 percent. Security A has just paid a dividend of $1.50, which is expected to grow at a rate of 10 percent per year indefinitely. What is the current price of Security A if it has a beta of 1.4? a. $9.93 b. $10.93 c. $20.27 d. $22.30 Use the following information to answer the next four questions: State of the Economy Recession Average Boom Probability of Occurrence 35% 45% 20% Stock X Expected Return 25% 14% 4% Stock Y Expected Return -10% 8% 14% Stock z Expected Return 15% 25% -10% 35. Given the following forecasts, what is the expected return for a portfolio that has $2,200 invested in Stock X, $3,600 in Stock Y, and $4,200 invested in Stock Z? a) 10.62% b) 14.82% c) 30.50% d) 33.25% 36. What is the correlation between stocks X and Y? a) 0.26 b) -0.96 c) 0.96 d) 0.51 37. What is the correlation between stocks X and Z? a) 0.96 b) 0.51 c) -0.26 d) 0.26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts