Question: For this question, please use the data found in this fle: IS GHC Assumptions. Assuming 2021 Unievered Free Cash Flow of $200,000, and using the

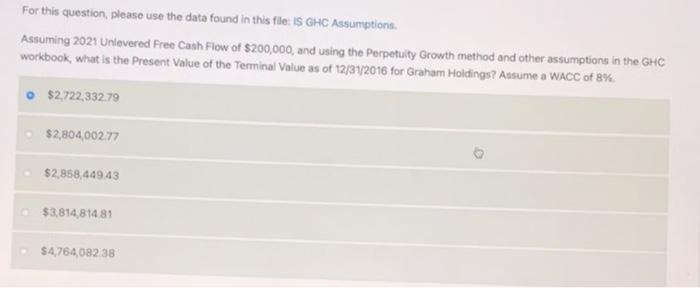

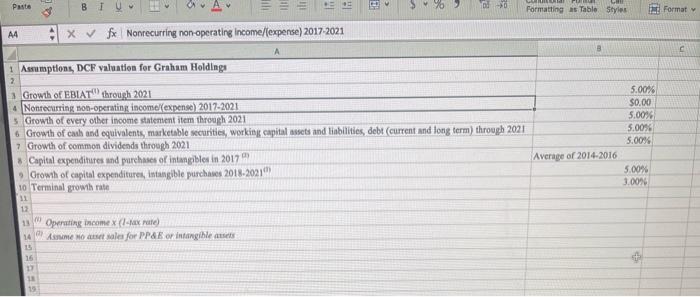

For this question, please use the data found in this fle: IS GHC Assumptions. Assuming 2021 Unievered Free Cash Flow of $200,000, and using the Perpetuity Growth method and other assumptions in the GHC workbook, what is the Present Value of the Terminal Value as of 12/31/2016 for Graham Holdings? Assume a WACC of 8%. $2,722,332.79 $2,804,00277 $2,858,449.43 $3,814,814.81 $4,764,082.38 For this question, please use the data found in this fle: IS GHC Assumptions. Assuming 2021 Unievered Free Cash Flow of $200,000, and using the Perpetuity Growth method and other assumptions in the GHC workbook, what is the Present Value of the Terminal Value as of 12/31/2016 for Graham Holdings? Assume a WACC of 8%. $2,722,332.79 $2,804,00277 $2,858,449.43 $3,814,814.81 $4,764,082.38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts