Question: For this question should I use the equipment current Book Value of 32,000 or should I use equipment with a Market Value of 28,000? 1.

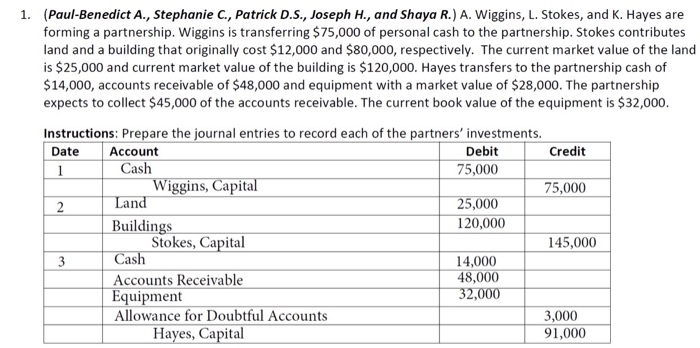

1. (Paul-Benedict A., Stephanie C., Patrick D.S., Joseph H., and Shaya R.) A. Wiggins, L. Stokes, and K. Hayes are forming a partnership. Wiggins is transferring $75,000 of personal cash to the partnership. Stokes contributes land and a building that originally cost $12,000 and $80,000, respectively. The current market value of the land is $25,000 and current market value of the building is $120,000. Hayes transfers to the partnership cash of $14,000, accounts receivable of $48,000 and equipment with a market value of $28,000. The partnership expects to collect $45,000 of the accounts receivable. The current book value of the equipment is $32,000. Instructions: Prepare the journal entries to record each of the partners' investments. Date Account Debit Credit Cash 75,000 Wiggins, Capital 75,000 Land 25,000 Buildings 120,000 Stokes, Capital 145,000 Cash 14,000 Accounts Receivable 48,000 Equipment 32,000 Allowance for Doubtful Accounts 3,000 Hayes, Capital 91,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts