Question: For this question, you are asked to evaluate the LOOP benchmark and then explore the profitable investment opportunity when it does not hold exactly

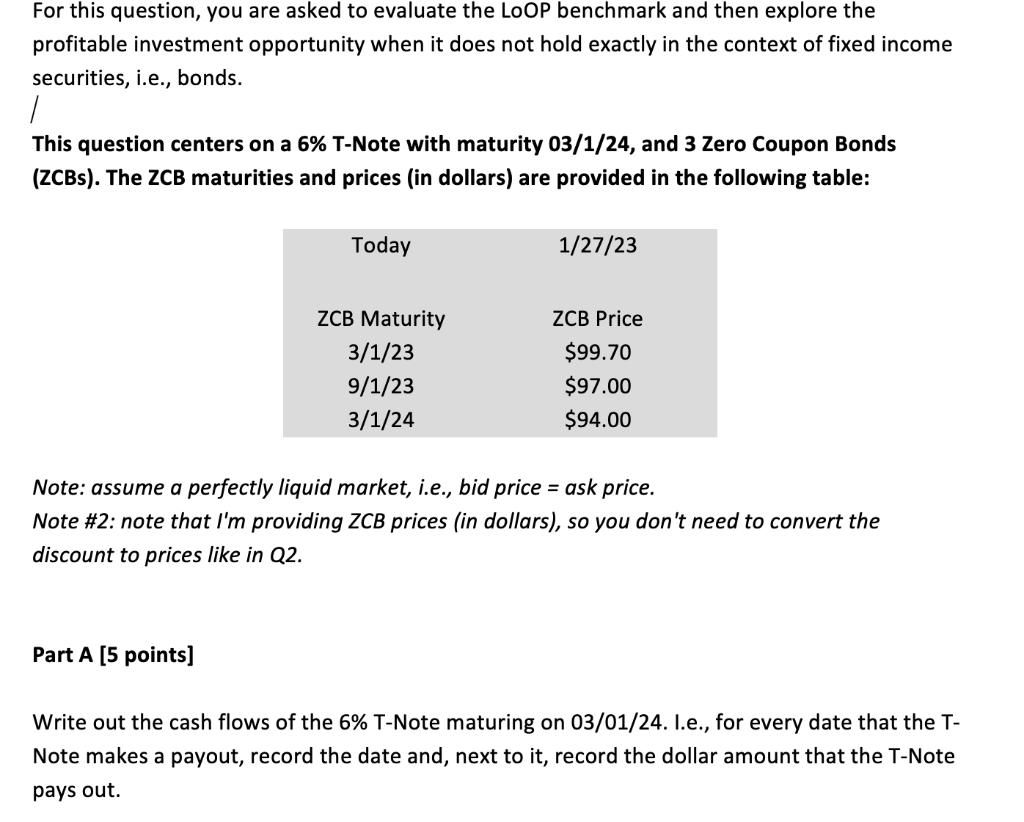

For this question, you are asked to evaluate the LOOP benchmark and then explore the profitable investment opportunity when it does not hold exactly in the context of fixed income securities, i.e., bonds. 1 This question centers on a 6% T-Note with maturity 03/1/24, and 3 Zero Coupon Bonds (ZCBS). The ZCB maturities and prices (in dollars) are provided in the following table: Today Part A [5 points] ZCB Maturity 3/1/23 9/1/23 3/1/24 1/27/23 ZCB Price $99.70 $97.00 $94.00 Note: assume a perfectly liquid market, i.e., bid price = ask price. Note #2: note that I'm providing ZCB prices (in dollars), so you don't need to convert the discount to prices like in Q2. Write out the cash flows of the 6% T-Note maturing on 03/01/24. I.e., for every date that the T- Note makes a payout, record the date and, next to it, record the dollar amount that the T-Note pays out. Part B [5 points] For each date when the 6% T-Note above makes a payment, indicate how many T-Bills and of what maturity do you need to replicate that particular cash flow. Hint: i.e., figure out how to replicate individual cash flows of the T-Note. Part C [5 points] Suppose the Law of One Price holds. Based on the ZCB prices in the table above, what should be the price of the 6% T-Note? Part D [15 points] Suppose the price of the T-Note is $102, i.e., not the same obtained in Part C. This implies that the market is at an imbalance and the Law of One Price does not hold. Is there a profitable investment opportunity that does not carry over any risk that involves trading the T-Note, and the ZCBs? Hint: sell expensive, buy cheap. Make sure the long-short strategy is nothing but positive cash flows.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Part A The cash flows of the 6 TNote maturing on 030124 are as follows 030123 No cash flow coupon payment is made annually 030124 Principal payment of ... View full answer

Get step-by-step solutions from verified subject matter experts