Question: For this question you have to preare a journal entry and record these transactions and events Problem 10-48 Computing and revising depreciation, revenue and capital

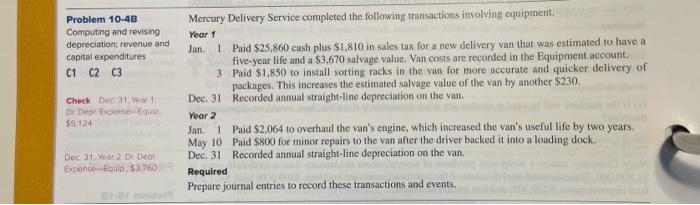

Problem 10-48 Computing and revising depreciation, revenue and capital expenditures C1 C2 C3 Check Dec 31 Wort Di DepExpense que Mercury Delivery Service completed the following transactions involving equipment Year 1 Jan. 1 Paid $25.860 cash plus 1.810 in sales tax for a new delivery van that was estimated to have a five-year life and a $3,670 salvage value. Van costs are recorded in the Equipment account. 3 Paid $1,850 to install sorting racks in the van for more accurate and quicker delivery of packages. This increases the estimated salvage value of the van by another $230. Dec. 31 Recorded annual straight-line depreciation on the van. Year 2 Jan. 1 Paid $2,064 to overhaul the van's engine, which increased the van's useful life by two years, May 10 Paid S800 for minor repairs to the van after the driver backed it into a loading dock. Dec 31 Recorded annual straight-line depreciation on the van Required Prepare journal entries to record these transactions and events. Dec. 31. Year 2: Dr Door Expence-Equin. 53.760

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts