Question: For this question you will need to do research and then answer your questions in a Word document and upload here. Download daily historical prices

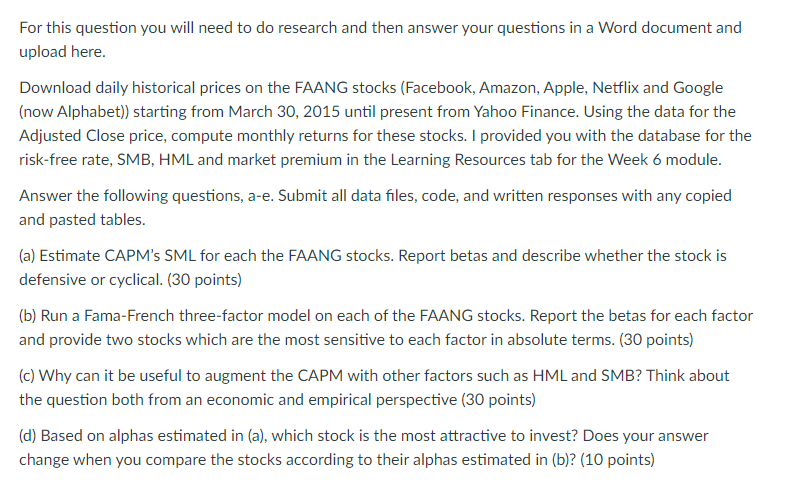

For this question you will need to do research and then answer your questions in a Word document and upload here. Download daily historical prices on the FAANG stocks (Facebook, Amazon, Apple, Netflix and Google (now Alphabet)) starting from March 30, 2015 until present from Yahoo Finance. Using the data for the Adjusted Close price, compute monthly returns for these stocks. I provided you with the database for the risk-free rate, SMB, HML and market premium in the Learning Resources tab for the Week 6 module. Answer the following questions, a-e. Submit all data files, code, and written responses with any copied and pasted tables. (a) Estimate CAPM's SML for each the FAANG stocks. Report betas and describe whether the stock is defensive or cyclical. (30 points) (b) Run a Fama-French three-factor model on each of the FAANG stocks. Report the betas for each factor and provide two stocks which are the most sensitive to each factor in absolute terms. (30 points) (c) Why can it be useful to augment the CAPM with other factors such as HML and SMB? Think about the question both from an economic and empirical perspective (30 points) (d) Based on alphas estimated in (a), which stock is the most attractive to invest? Does your answer change when you compare the stocks according to their alphas estimated in (b)? (10 points) For this question you will need to do research and then answer your questions in a Word document and upload here. Download daily historical prices on the FAANG stocks (Facebook, Amazon, Apple, Netflix and Google (now Alphabet)) starting from March 30, 2015 until present from Yahoo Finance. Using the data for the Adjusted Close price, compute monthly returns for these stocks. I provided you with the database for the risk-free rate, SMB, HML and market premium in the Learning Resources tab for the Week 6 module. Answer the following questions, a-e. Submit all data files, code, and written responses with any copied and pasted tables. (a) Estimate CAPM's SML for each the FAANG stocks. Report betas and describe whether the stock is defensive or cyclical. (30 points) (b) Run a Fama-French three-factor model on each of the FAANG stocks. Report the betas for each factor and provide two stocks which are the most sensitive to each factor in absolute terms. (30 points) (c) Why can it be useful to augment the CAPM with other factors such as HML and SMB? Think about the question both from an economic and empirical perspective (30 points) (d) Based on alphas estimated in (a), which stock is the most attractive to invest? Does your answer change when you compare the stocks according to their alphas estimated in (b)? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts