Question: [ For this question, you will need to show your calculation with steps ] An investor is considering two bonds with equal maturities and equivalent

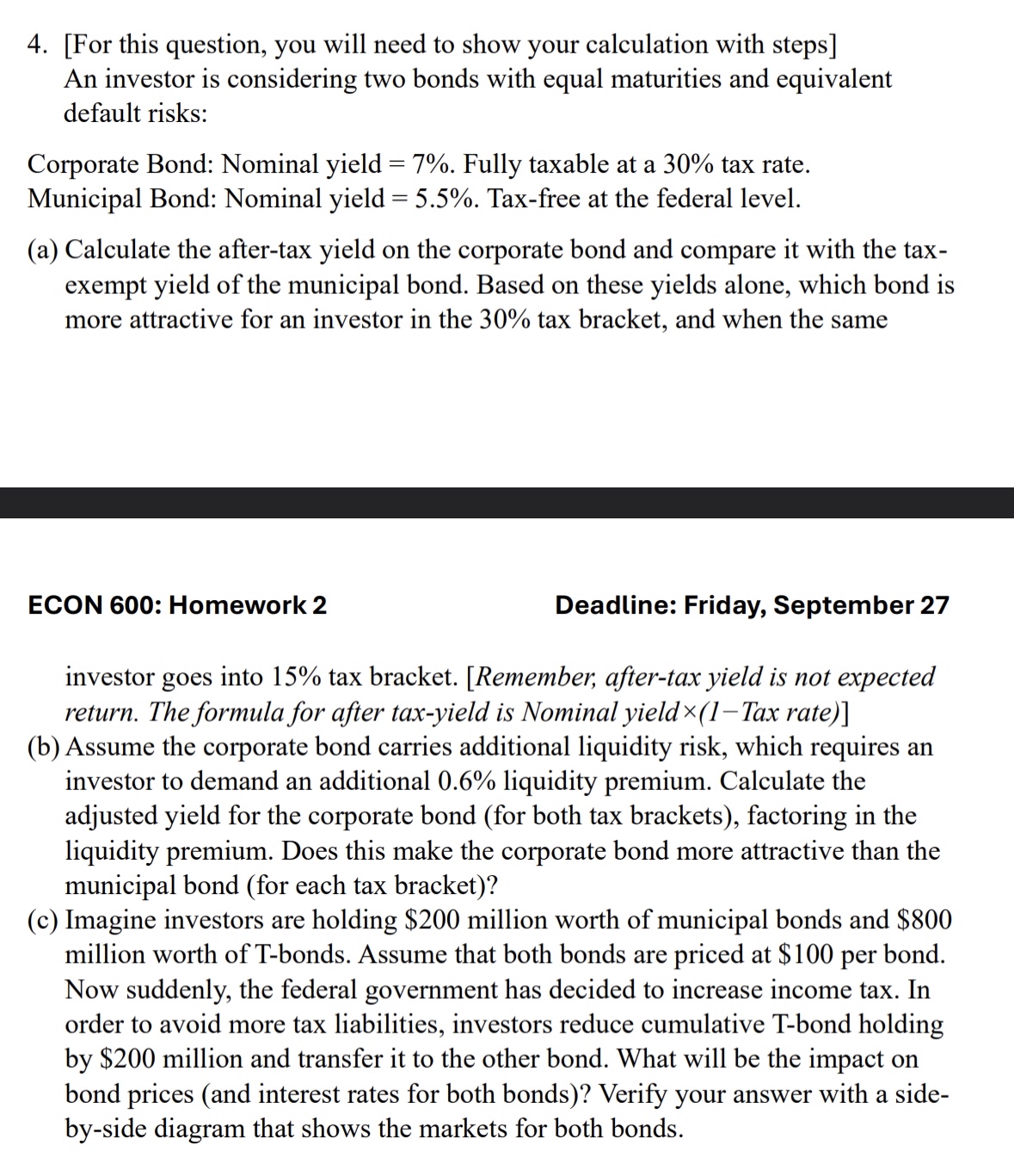

For this question, you will need to show your calculation with steps

An investor is considering two bonds with equal maturities and equivalent

default risks:

Corporate Bond: Nominal yield Fully taxable at a tax rate.

Municipal Bond: Nominal yield Taxfree at the federal level.

a Calculate the aftertax yield on the corporate bond and compare it with the tax

exempt yield of the municipal bond. Based on these yields alone, which bond is

more attractive for an investor in the tax bracket, and when the same

investor goes into tax bracket. Remember aftertax yield is not expected

return. The formula for after taxyield is Nominal yield Tax rate

b Assume the corporate bond carries additional liquidity risk, which requires an

investor to demand an additional liquidity premium. Calculate the

adjusted yield for the corporate bond for both tax brackets factoring in the

liquidity premium. Does this make the corporate bond more attractive than the

municipal bond for each tax bracket

c Imagine investors are holding $ million worth of municipal bonds and $

million worth of Tbonds. Assume that both bonds are priced at $ per bond.

Now suddenly, the federal government has decided to increase income tax. In

order to avoid more tax liabilities, investors reduce cumulative Tbond holding

by $ million and transfer it to the other bond. What will be the impact on

bond prices and interest rates for both bonds Verify your answer with a side

byside diagram that shows the markets for both bonds.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock