Question: . For this short paper assignment you will explore a very important concept in financial modeling, the time value of money (TVM). TVM allows us

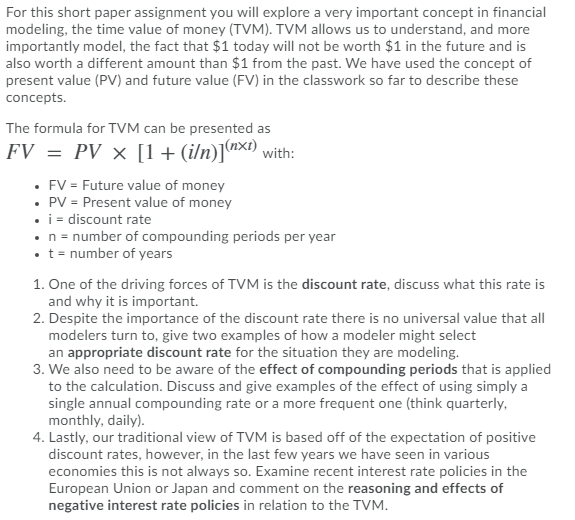

. For this short paper assignment you will explore a very important concept in financial modeling, the time value of money (TVM). TVM allows us to understand, and more importantly model, the fact that $1 today will not be worth $1 in the future and is also worth a different amount than $1 from the past. We have used the concept of present value (PV) and future value (FV) in the classwork so far to describe these concepts. The formula for TVM can be presented as FV = PV x [1 + (iln)](nxi) with: FV = Future value of money PV = Present value of money j = discount rate . n = number of compounding periods per year t = number of years 1. One of the driving forces of TVM is the discount rate, discuss what this rate is and why it is important. 2. Despite the importance of the discount rate there is no universal value that all modelers turn to give two examples of how a modeler might select an appropriate discount rate for the situation they are modeling. 3. We also need to be aware of the effect of compounding periods that is applied to the calculation. Discuss and give examples of the effect of using simply a single annual compounding rate or a more frequent one (think quarterly, monthly, daily). 4. Lastly, our traditional view of TVM is based off of the expectation of positive discount rates, however, in the last few years we have seen in various economies this is not always so. Examine recent interest rate policies in the European Union or Japan and comment on the reasoning and effects of negative interest rate policies in relation to the TVM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts