Question: For this short-answer, please show your work. Actually write the numbers and the formulas here like you are taking a hand-written exam. You will NOT

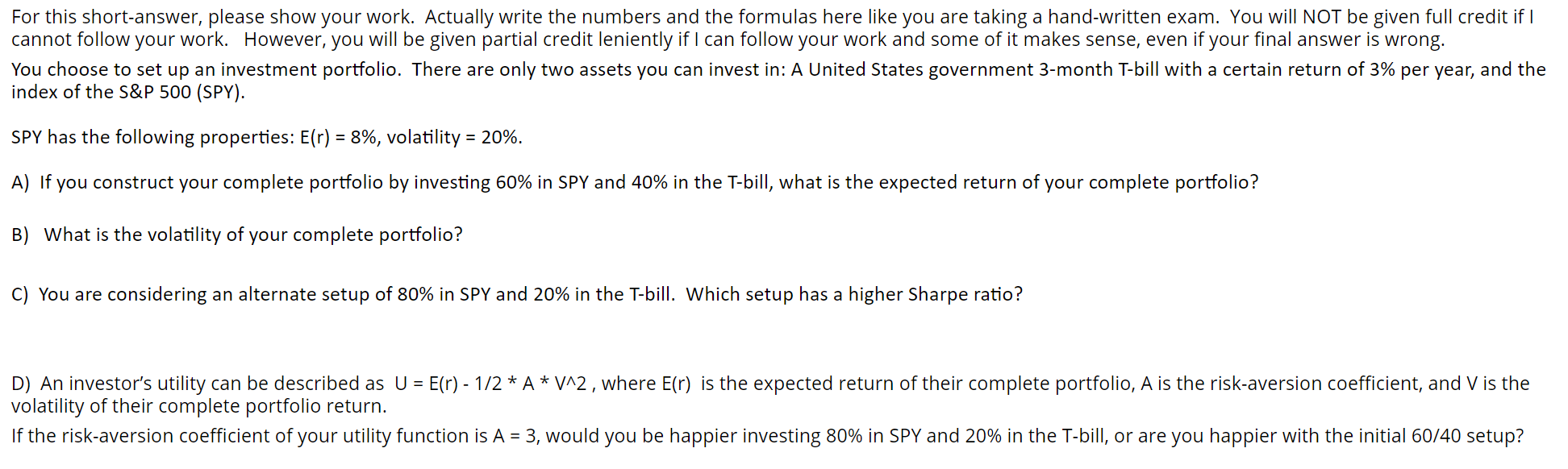

For this short-answer, please show your work. Actually write the numbers and the formulas here like you are taking a hand-written exam. You will NOT be given full credit if I cannot follow your work. However, you will be given partial credit leniently if I can follow your work and some of it makes sense, even if your final answer is wrong. You choose to set up an investment portfolio. There are only two assets you can invest in: A United States government 3-month T-bill with a certain return of 3% per year, and the index of the S&P 500 (SPY). SPY has the following properties: E(r) = 8%, volatility = 20%. A) If you construct your complete portfolio by investing 60% in SPY and 40% in the T-bill, what is the expected return of your complete portfolio? B) What is the volatility of your complete portfolio? C) You are considering an alternate setup of 80% in SPY and 20% in the T-bill. Which setup has a higher Sharpe ratio? D) An investor's utility can be described as U = E(r) - 1/2 * A * V^2, where E(r) is the expected return of their complete portfolio, A is the risk-aversion coefficient, and V is the volatility of their complete portfolio return. If the risk-aversion coefficient of your utility function is A = 3, would you be happier investing 80% in SPY and 20% in the T-bill, or are you happier with the initial 60/40 setup

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts