Question: For this year, Wilma is a single individual whose taxable income puts her into the 32% bracket. Wilma's taxable income includes so much long-term capital

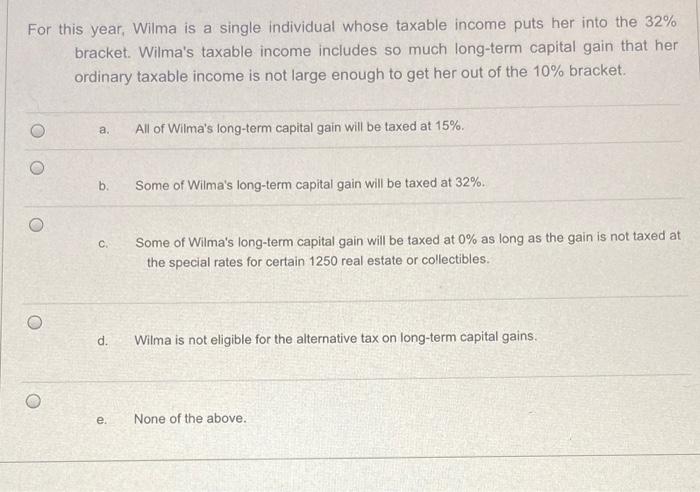

For this year, Wilma is a single individual whose taxable income puts her into the 32% bracket. Wilma's taxable income includes so much long-term capital gain that her ordinary taxable income is not large enough to get her out of the 10% bracket. a. All of Wilma's long-term capital gain will be taxed at 15%. b. Some of Wilma's long-term capital gain will be taxed at 32%. 0 C Some of Wilma's long-term capital gain will be taxed at 0% as long as the gain is not taxed at the special rates for certain 1250 real estate or collectibles 0 d. Wilma is not eligible for the alternative tax on long-term capital gains. O e None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts