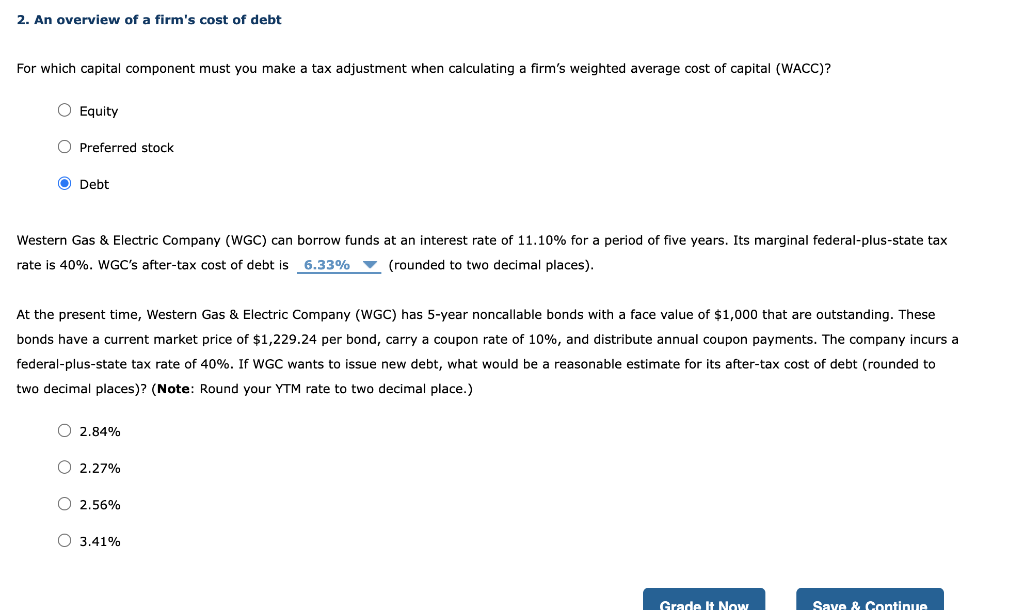

Question: For which capital component must you make a tax adjustment when calculating a firm's weighted average cost of capital (WACC)? Equity Preferred stock Debt Western

For which capital component must you make a tax adjustment when calculating a firm's weighted average cost of capital (WACC)? Equity Preferred stock Debt Western Gas \& Electric Company (WGC) can borrow funds at an interest rate of 11.10% for a period of five years. Its marginal federate rate is 40%. WGC's after-tax cost of debt is (rounded to two decimal places). At the present time, Western Gas \& Electric Company (WGC) has 5-year noncallable bonds with a face value of $1,000 that arese bonds have a current market price of $1,229.24 per bond, carry a coupon rate of 10%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 40%. If WGC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? (Note: Round your YTM rate to two decimal place.) 2.84% 2.27% 2.56% 3.41%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts