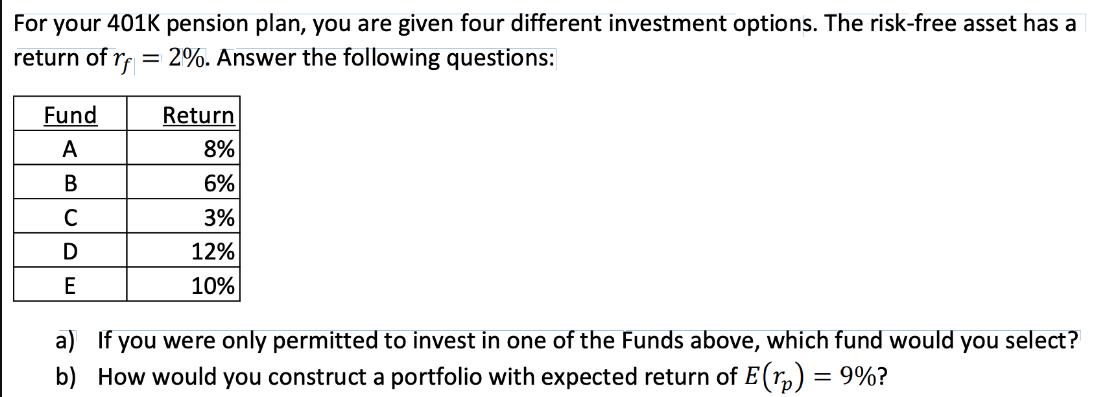

Question: For your 401K pension plan, you are given four different investment options. The risk-free asset has a return of rf = 2%. Answer the

For your 401K pension plan, you are given four different investment options. The risk-free asset has a return of rf = 2%. Answer the following questions: Fund A B D E Return 8% 6% 3% 12% 10% a) If you were only permitted to invest in one of the Funds above, which fund would b) How would you construct a portfolio with expected return of E() = 9%? you select?

Step by Step Solution

There are 3 Steps involved in it

To determine which fund to select we need to compare the expected returns of each fund Given the options and their respective returns Riskfree asset r... View full answer

Get step-by-step solutions from verified subject matter experts