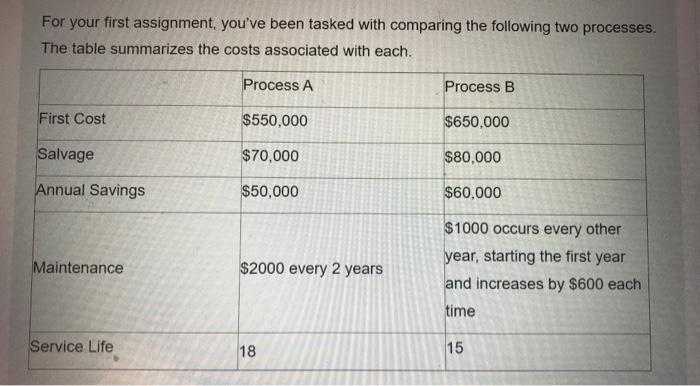

Question: For your first assignment, you've been tasked with comparing the following two processes. The table summarizes the costs associated with each. Process A Process B

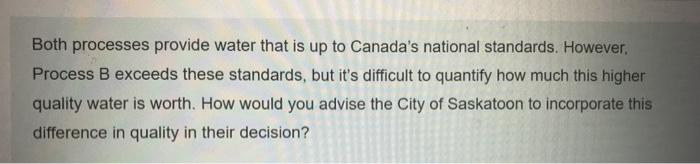

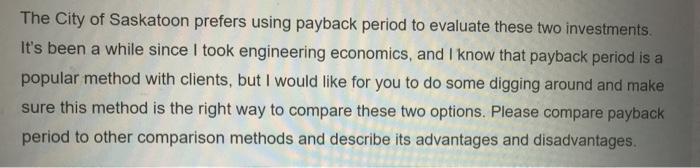

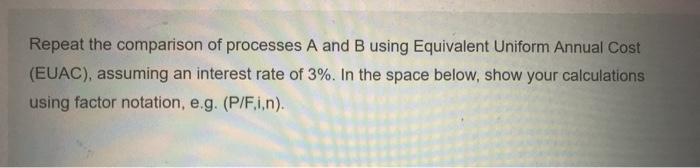

For your first assignment, you've been tasked with comparing the following two processes. The table summarizes the costs associated with each. Process A Process B First Cost $550,000 $650.000 Salvage $70,000 $80,000 Annual Savings $50,000 $60,000 Maintenance $2000 every 2 years $1000 occurs every other year, starting the first year and increases by $600 each time Service Life 18 15 Both processes provide water that is up to Canada's national standards. However, Process B exceeds these standards, but it's difficult to quantify how much this higher quality water is worth. How would you advise the City of Saskatoon to incorporate this difference in quality in their decision? The City of Saskatoon prefers using payback period to evaluate these two investments. It's been a while since I took engineering economics, and I know that payback period is a popular method with clients, but I would like for you to do some digging around and make sure this method is the right way to compare these two options. Please compare payback period to other comparison methods and describe its advantages and disadvantages. Repeat the comparison of processes A and B using Equivalent Uniform Annual Cost (EUAC), assuming an interest rate of 3%. In the space below, show your calculations using factor notation, e.g. (P/F.in). According to the EUAC, which process should they choose? O a. They are equivalent O b. Process B O c. None O d. Process A The City of Saskatoon has applied a real MARR of 5% on similar past projects. Assuming the same rate can be applied here, calculate the minimum feasible salvage value for each of the options. Consider the inflation rate will remain the same as over the last five years, when CPI rose from 124.6 to 137.4. In the space below, show your calculations using factor notation Given the same real MARR of 5%, determine the maximum allowable inflation rate for Process A to still be feasible. In the space below, explain your solution process and show your calculations using factor notation. Now, we need to explain these results to the city in plain language. Here, translate the results of your analysis for a non-engineering audience so that you can describe what you found to the City of Saskatoon. For your first assignment, you've been tasked with comparing the following two processes. The table summarizes the costs associated with each. Process A Process B First Cost $550,000 $650.000 Salvage $70,000 $80,000 Annual Savings $50,000 $60,000 Maintenance $2000 every 2 years $1000 occurs every other year, starting the first year and increases by $600 each time Service Life 18 15 Both processes provide water that is up to Canada's national standards. However, Process B exceeds these standards, but it's difficult to quantify how much this higher quality water is worth. How would you advise the City of Saskatoon to incorporate this difference in quality in their decision? The City of Saskatoon prefers using payback period to evaluate these two investments. It's been a while since I took engineering economics, and I know that payback period is a popular method with clients, but I would like for you to do some digging around and make sure this method is the right way to compare these two options. Please compare payback period to other comparison methods and describe its advantages and disadvantages. Repeat the comparison of processes A and B using Equivalent Uniform Annual Cost (EUAC), assuming an interest rate of 3%. In the space below, show your calculations using factor notation, e.g. (P/F.in). According to the EUAC, which process should they choose? O a. They are equivalent O b. Process B O c. None O d. Process A The City of Saskatoon has applied a real MARR of 5% on similar past projects. Assuming the same rate can be applied here, calculate the minimum feasible salvage value for each of the options. Consider the inflation rate will remain the same as over the last five years, when CPI rose from 124.6 to 137.4. In the space below, show your calculations using factor notation Given the same real MARR of 5%, determine the maximum allowable inflation rate for Process A to still be feasible. In the space below, explain your solution process and show your calculations using factor notation. Now, we need to explain these results to the city in plain language. Here, translate the results of your analysis for a non-engineering audience so that you can describe what you found to the City of Saskatoon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts