Question: For your project this week, complete the following:Create a post answering the following questions about risks your company could encounter:How many days are you willing

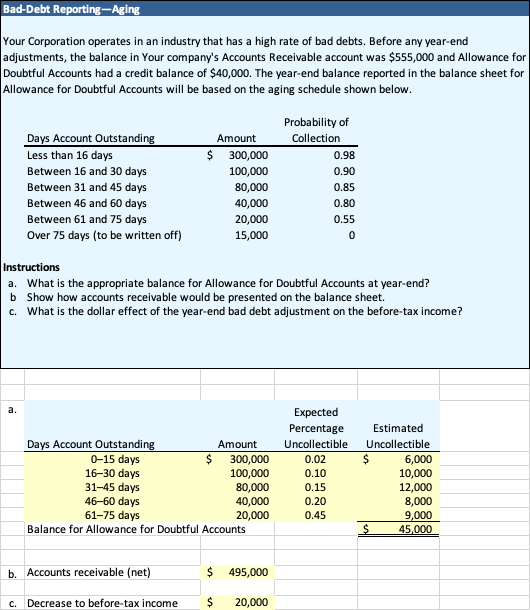

For your project this week, complete the following:Create a post answering the following questions about risks your company could encounter:How many days are you willing to wait to receive payment from your customers? How would you analyze your receivables and inventory turnover? When issuing credit to a customer, what kinds of safeguards would you have? What kinds of red flags would you look for when you sell to someone for the first time? In case of inventory destruction (natural disaster, etc.), what is your risk prevention plan? Download the Account Receivable Aging Schedule spreadsheet.Imagine that you've sold 1000 units of your new product on account, and you expect to receive payment based on your risk analysis. Just when things seem to be going great, 10% of your customers miss the deadline. Based on this scenario, update the Account Receivable Aging Schedule spreadsheet to account for the risk of non-payment of account receivables. How would you account for the write-off of these receivables?Update the following tabs in your Project Journal spreadsheet as needed:Statement of Retained EarningsBalance SheetProfit and LossCreate a post in this forum including the following:Your updated Project Journal spreadsheetYour Account Receivable Aging Schedule spreadsheetAnswers to the questions above about your productHow would you reinstate a customer you wrote off as a bad debt? Bad-Debt Reporting?Aging Your Corporation operates in an industry that

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts