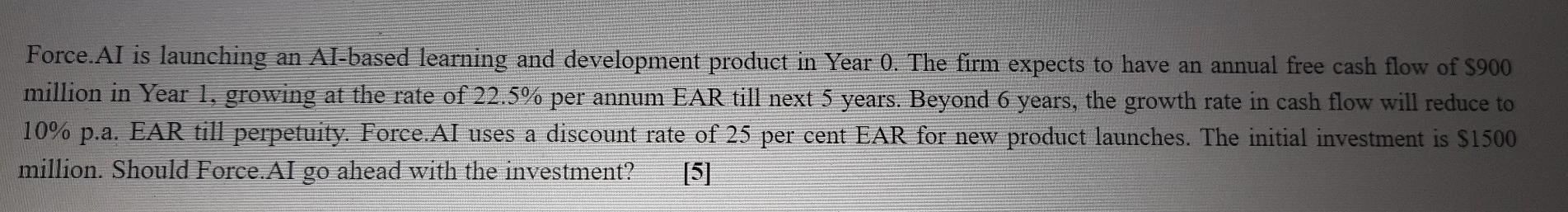

Question: Force.AI is launching an Al-based learning and development product in Year 0. The firm expects to have an annual free cash flow of $900 million

Force.AI is launching an Al-based learning and development product in Year 0. The firm expects to have an annual free cash flow of $900 million in Year 1, growing at the rate of 22.5% per annum EAR till next 5 years. Beyond 6 years, the growth rate in cash flow will reduce to 10% p.a. EAR till perpetuity. Force. Al uses a discount rate of 25 per cent EAR for new product launches. The initial investment is $1500 million. Should Force.Al go ahead with the investment? [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts