Question: Forecast the 2021 cash flow statement. (all is here, do not have Income statement) Question 21 15 pts Consider company TMS Ltd with the following

Forecast the 2021 cash flow statement.

(all is here, do not have Income statement)

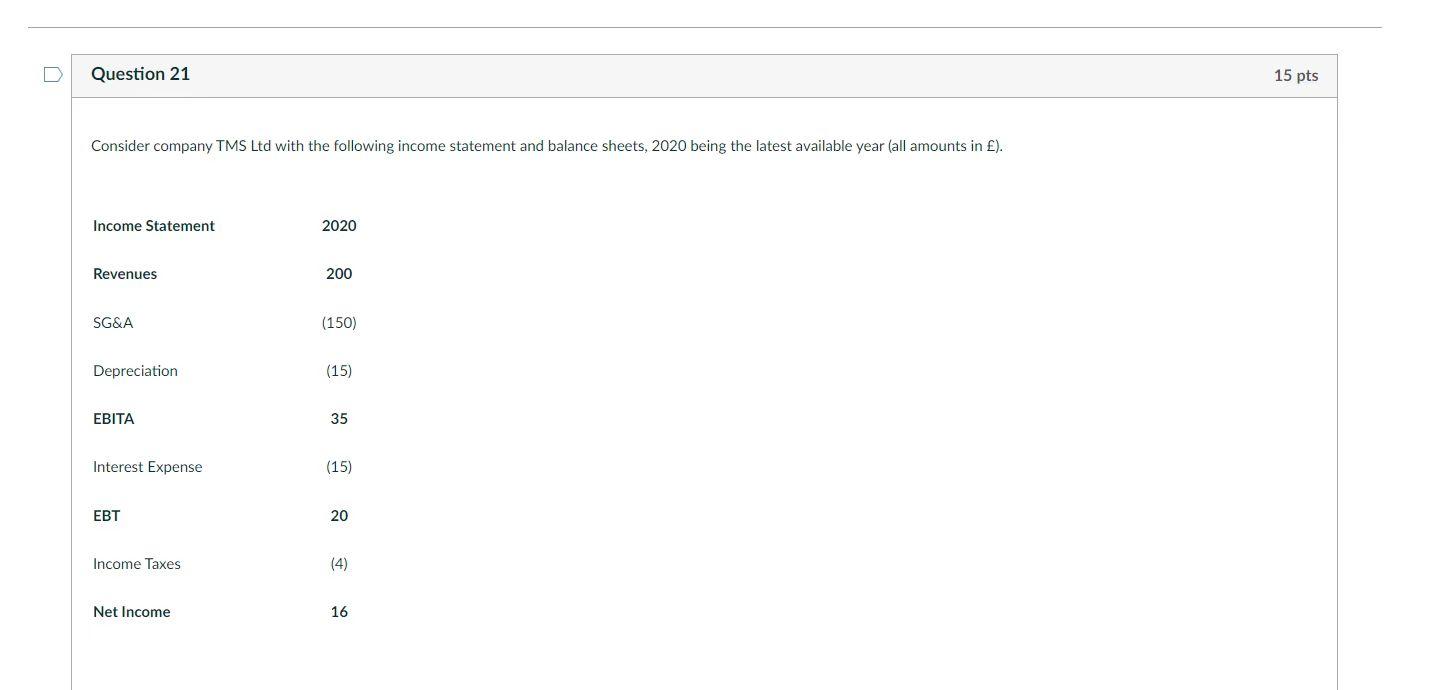

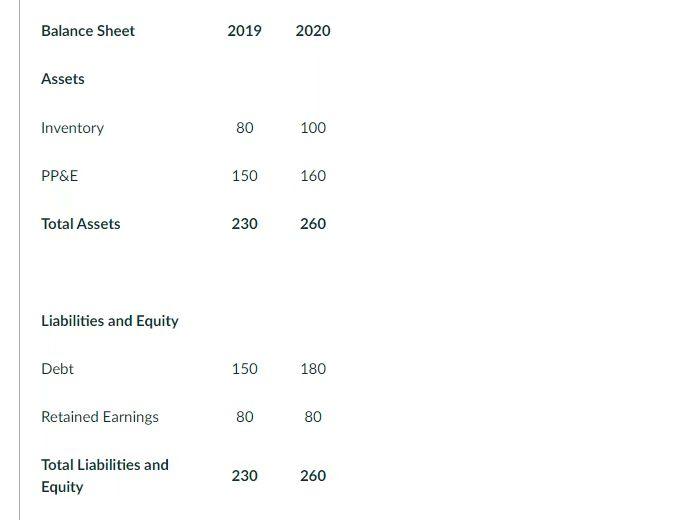

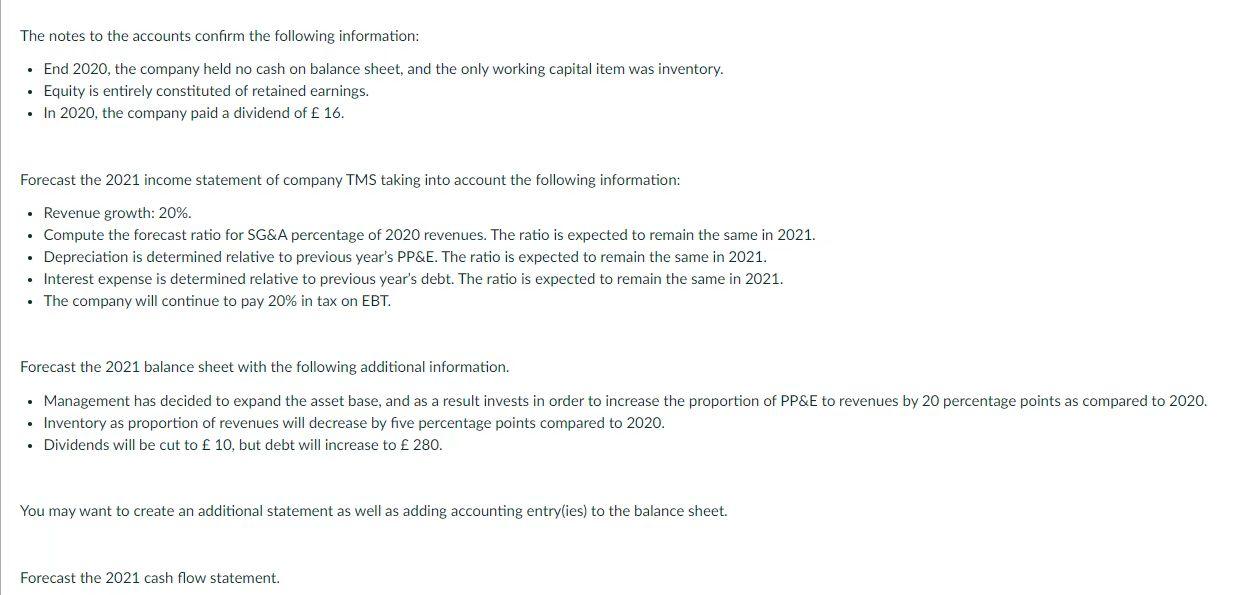

Question 21 15 pts Consider company TMS Ltd with the following income statement and balance sheets, 2020 being the latest available year (all amounts in ). Income Statement 2020 Revenues 200 SG&A (150) Depreciation (15) EBITA 35 Interest Expense (15) 20 Income Taxes (4) Net Income 16 Balance Sheet 2019 2020 Assets Inventory 80 100 PP&E 150 160 Total Assets 230 260 Liabilities and Equity Debt 150 180 Retained Earnings 80 80 Total Liabilities and Equity 230 260 The notes to the accounts confirm the following information: End 2020, the company held no cash on balance sheet, and the only working capital item was inventory. Equity is entirely constituted of retained earnings. In 2020, the company paid a dividend of 16. Forecast the 2021 income statement of company TMS taking into account the following information: Revenue growth: 20%. Compute the forecast ratio for SG&A percentage of 2020 revenues. The ratio is expected to remain the same in 2021. Depreciation is determined relative to previous year's PP&E. The ratio is expected to remain the same in 2021. Interest expense is determined relative to previous year's debt. The ratio is expected to remain the same in 2021. The company will continue to pay 20% in tax on EBT. . Forecast the 2021 balance sheet with the following additional information. Management has decided to expand the asset base, and as a result invests in order to increase the proportion of PP&E to revenues by 20 percentage points as compared to 2020. Inventory as proportion of revenues will decrease by five percentage points compared to 2020. Dividends will be cut to 10, but debt will increase to 280. You may want to create an additional statement as well as adding accounting entry(ies) to the balance sheet. Forecast the 2021 cash flow statement. Question 21 15 pts Consider company TMS Ltd with the following income statement and balance sheets, 2020 being the latest available year (all amounts in ). Income Statement 2020 Revenues 200 SG&A (150) Depreciation (15) EBITA 35 Interest Expense (15) 20 Income Taxes (4) Net Income 16 Balance Sheet 2019 2020 Assets Inventory 80 100 PP&E 150 160 Total Assets 230 260 Liabilities and Equity Debt 150 180 Retained Earnings 80 80 Total Liabilities and Equity 230 260 The notes to the accounts confirm the following information: End 2020, the company held no cash on balance sheet, and the only working capital item was inventory. Equity is entirely constituted of retained earnings. In 2020, the company paid a dividend of 16. Forecast the 2021 income statement of company TMS taking into account the following information: Revenue growth: 20%. Compute the forecast ratio for SG&A percentage of 2020 revenues. The ratio is expected to remain the same in 2021. Depreciation is determined relative to previous year's PP&E. The ratio is expected to remain the same in 2021. Interest expense is determined relative to previous year's debt. The ratio is expected to remain the same in 2021. The company will continue to pay 20% in tax on EBT. . Forecast the 2021 balance sheet with the following additional information. Management has decided to expand the asset base, and as a result invests in order to increase the proportion of PP&E to revenues by 20 percentage points as compared to 2020. Inventory as proportion of revenues will decrease by five percentage points compared to 2020. Dividends will be cut to 10, but debt will increase to 280. You may want to create an additional statement as well as adding accounting entry(ies) to the balance sheet. Forecast the 2021 cash flow statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts